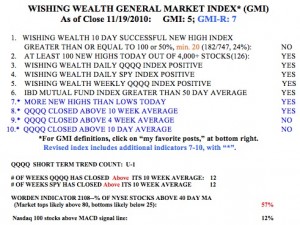

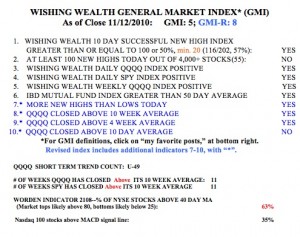

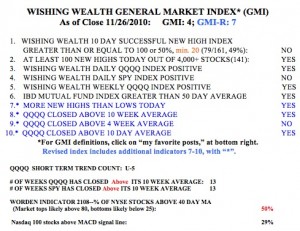

On Friday, the new QQQQ short term up-trend completed its 5th day. Usually, once an up-trend turns 5, it lasts quite a bit longer. But the GMI is only 4, reflecting some weakness in the S&P500 (SPY) stocks. I am also a little concerned by the fact that the Investor’s Intelligence Survey on last Tuesday showed 55.7% of advisers being bullish on the market. This is a good contrary indicator, and in the past when the bullish percentage approached 60%, the market was near a top. So, we need to watch this survey and the market very closely.  The QQQQ and SPY have closed above their 10 week averages for 13 straight weeks. I have found that as long as the QQQQ closes above its 10 week average, I can trade the tech stocks profitably. So, this is another indicator I monitor. The Worden T2108 indicator is at 50%, in neutral territory. The percentage of Nasdaq100 (QQQQ) stocks closing with their MACD above its signal line more than doubled last week, to 29%. This is a sign of short term strength. The GMI is now at 4 (of 6), and the more sensitive GMI-R is at 7 (of 10, click on Table to enlarge).

The QQQQ and SPY have closed above their 10 week averages for 13 straight weeks. I have found that as long as the QQQQ closes above its 10 week average, I can trade the tech stocks profitably. So, this is another indicator I monitor. The Worden T2108 indicator is at 50%, in neutral territory. The percentage of Nasdaq100 (QQQQ) stocks closing with their MACD above its signal line more than doubled last week, to 29%. This is a sign of short term strength. The GMI is now at 4 (of 6), and the more sensitive GMI-R is at 7 (of 10, click on Table to enlarge).

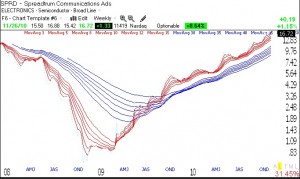

Below is a weekly GMMA chart of another RWB rocket stock, SPRD. All of the short term averages (red) are well above the rising longer term averages (blue). SPRD is close to its all-time high of $17 reached in November, 2007. A close above $17 would be a sign of strength for me and a potential buy signal, if I were interested in acquiring it.