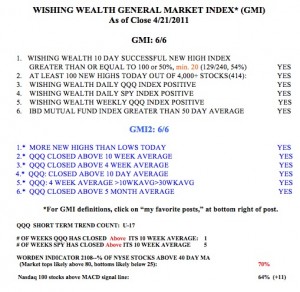

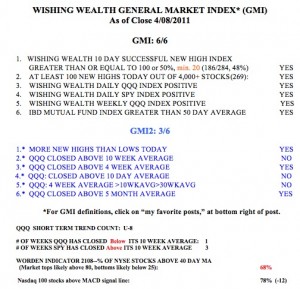

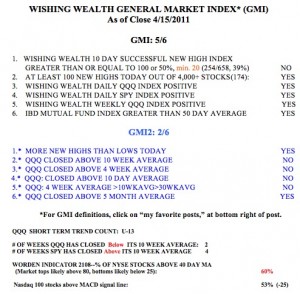

General Market Index (GMI) table

AAPL on long term support–critical test of up-trend imminent

This week, after Wednesday’s earnings release, we will probably get more clarity on AAPL’s trend. AAPL has been a market leader and it has been weakening lately. I have traded AAPL profitably many times by just owning it when it remains above its rising 10 week average and getting out when it declines below it. AAPL had a nice up-trend, staying above its 10 week average from last September through mid-March. AAPL has now closed below its 10 week average (blue dotted line) for 4 of the past 5 weeks. In addition, since January, the 3 weeks with the highest weekly volume of trading in AAPL were down weeks, suggesting institutional selling. Maybe all of this weakness is the result of AAPL’s soon-to-be reduction in its weight in the Nasdaq 100 index, and maybe it is not. Most important to me, AAPL is just above its critical 30 week average (red line). In times like this I sit on the sidelines and wait for a definitive signal of a rebound or a serious decline. IF AAPL does not hold up, it may be telling us something about the strength of this market, or at least tech stocks. Click on chart to enlarge.

Meanwhile, the GMI remains strong, at 5 of 6 but the GMI2 is 2 of 6. The GMI2 is more sensitive to sudden changes in the markets.  By my count, Friday was the 13th day (U-13) of the current QQQ short term up-trend. While the QQQ has closed below its critical 10 week average for 2 weeks, the SPY has closed above it for 4 weeks. This is an unusual divergence in the two indexes. The Worden T2108 indicator is in neutral territory, at 60%. 53% of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength.

By my count, Friday was the 13th day (U-13) of the current QQQ short term up-trend. While the QQQ has closed below its critical 10 week average for 2 weeks, the SPY has closed above it for 4 weeks. This is an unusual divergence in the two indexes. The Worden T2108 indicator is in neutral territory, at 60%. 53% of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength.

With the QQQ below its 10 week average, I remain largely in cash in my trading IRA account. My university pension remains 100% invested in mutual funds until the longer term trends turn down.

8th day of QQQ short term up-trend

All of my GMI indicators remain positive. This week, first quarter earnings announcements begin and on Friday we have option expiration. I am still concerned about the weakness in AAPL and the QQQ. Note that the QQQ closed back below its 10 week average. Nevertheless, I must ride the up-trend for now. Click on table to enlarge.