My 10:30 weekly chart shows that QQQ has regained strength and is riding above its 10 and 30 week averages.

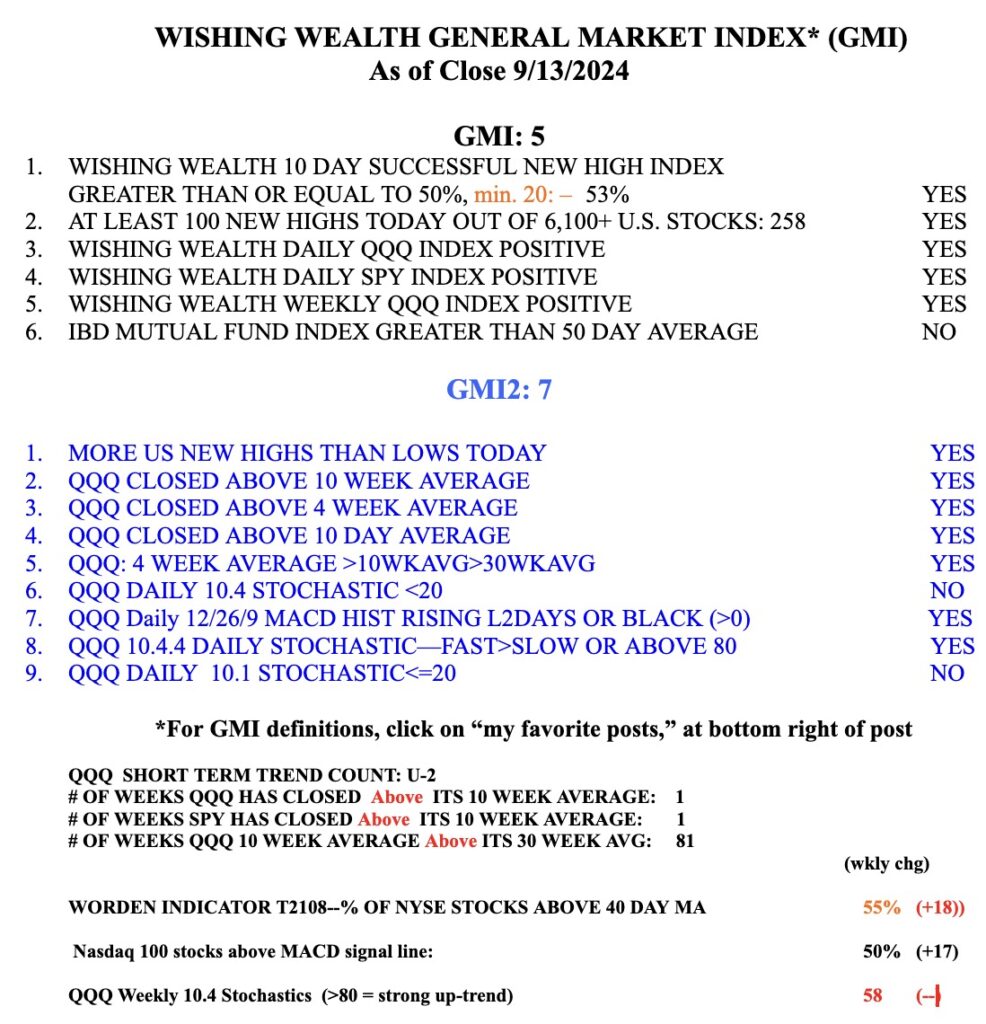

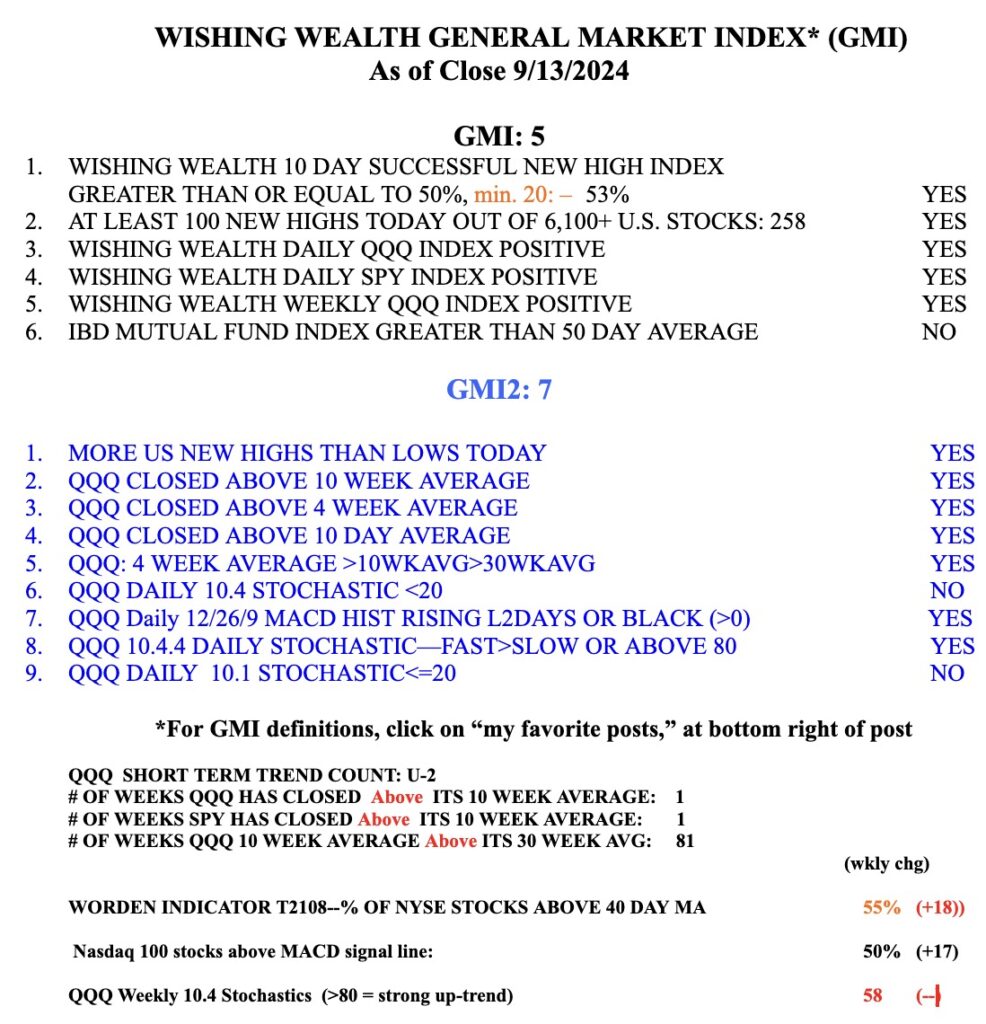

Stock Market Technical Indicators & Analysis

My 10:30 weekly chart shows that QQQ has regained strength and is riding above its 10 and 30 week averages.

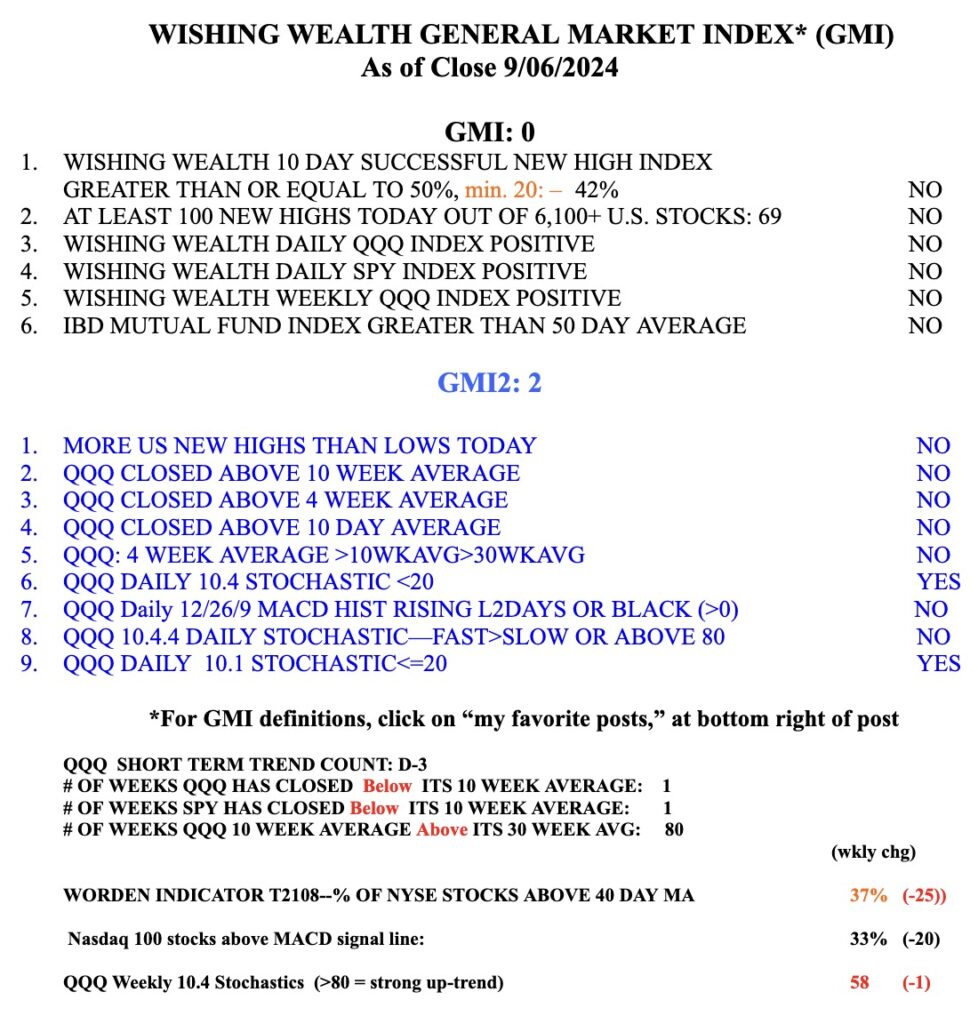

I cannot remember a time when the GMI declined so quickly. When it turns RED at Monday’s close, both of my short and longer term indicators for QQQ will be indicating a decline. While QQQ is now below its 10 week, 30 day and 30 week averages, it is still in a Weinstein Stage 2 up-trend, for now. The 10/30 weekly chart below shows this. If the 10 week average closes below the 30 week average and the 30 week average curves down, I will begin to exit the mutual funds in my conservative university pension accounts. In 2000, 2008 and 2022, a declining 30 week average helped me to exit the market BEFORE the real decline began. In the past, a reading below 10% in T2108 has been where markets have often bottomed.

In this 10/30 weekly chart, the gray line tracks the weekly close, the dotted line is the 10 week average and the red line is the 30 week average.

The daily modified Guppy chart shows that the QQQ RWB up-trend remains intact. QQQ is also in a longer term weekly RWB up-trend. RWB means that the shorter term averages (red) are all rising above the longer term averages (blue) with a white space between them. The dotted line is the closing price for the selected period. ATH=all-time high. I am still holding some TQQQ.