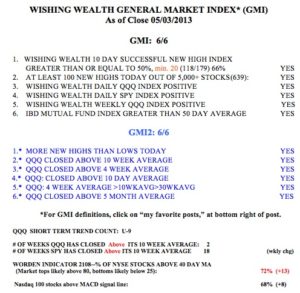

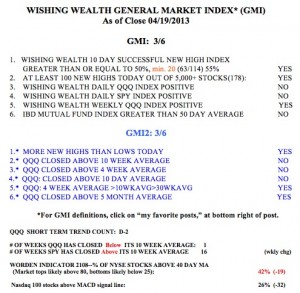

The GMI and GMI-2 are each at 6 (of 6). Stock indexes look a little extended to me. I was away all weekend and could not prepare a more detailed post.

General Market Index (GMI) table

Sell in May? SYNA: green line break-out

First, thanks to all who encouraged me to continue posting scans. Please keep in mind I do this as an educational exercise and not to provide specific recommendations. One should review my results, research the companies and make a decision whether any company fits your trading model and risk tolerance level…..

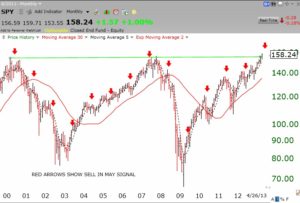

As you May know (pun intended!), there have been analyses done with markets around the world showing that for some reason, markets are weaker in the period from May through October than in the rest of the year. One could get most of the gains with less risk by being in the market only from Halloween through April each year. Hence the mantra, Sell in May and Go Away. These sayings may have utility in timing the market merely if many people follow them. The monthly chart below of the SPY shows how the market performed after the month of May each year since 2000. There are 13 signals, not including the coming May. In all but two years, the market showed weakness in the period after May. The exceptions, in 2003 and 2009, came after large bear market declines. So it may be that this year we will get weakness from May on since we are not coming back from a steep recent decline. To the contrary, the SPY has had a recent green line break-out to an all-time high.

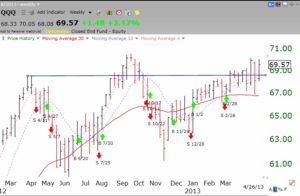

Meanwhile, IBD says the market is still in a correction while the GMI remains a strong 6 (of 6). The Naadaq 100 Index, as this weekly chart of the QQQ ETF shows, has now rebounded, yet again, above its 10 week average. It looks to me like we are either putting in a double top or setting up for a substantial break-out. The GMI buy signal from late February remains in effect (see GMI table below). Stay tuned…

SYNA came up in one of my scans. It released terrific earnings on Thursday and gapped open to an all-time high on Friday, as evidenced by the green line break out on its weekly chart below. It broke a high reached in November, 2007 on the highest weekly volume since 2009. It remains to be seen whether this is the start of a substantial move up.

Two other recent green line break-outs also came up in my scan: CERN and TRIP. Check them out!

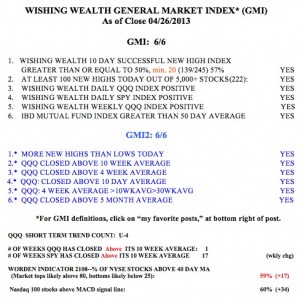

Market weak; I am again cautious

IBD sees the market in a correction and the GMI could flash a sell signal this week. We normally see strength as earnings come out, followed by a post-earnings lull. But look what happened to IBM on Friday after it announced earnings.

The only technical tip off I might have noticed (I did not own IBM) is that it failed its recent green line break-out several times. When a stock bursts through a multi-month green line base to an all-time high, it should not look back much. IBM closed below its green line top on several occasions. If the market is weak during earnings season, what will happen during the following, typically weak period?

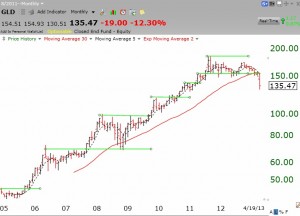

A reader asked me if gold or silver are good buys now. As you know, I only buy stocks or ETF’s that are near or above their green line tops. I do not buy stocks that have been much higher and declined. There are so many people waiting to sell as the stock comes back, and one never knows if the decline will resume. A failed come back rally can lead to a quick, vicious decline. GLD is now below 2 of its green line tops. It is not my game to buy it or silver, which has a similar pattern. Look at this monthly chart of GLD. Would it not be better to buy it, or any stock, when it is breaking above a green line top? A failed green line break-out is a major sign of weakness.

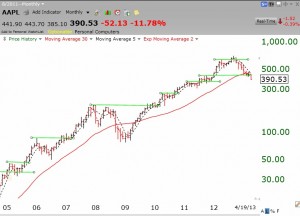

AAPL had a green line break-out failure last September and just penetrated a former green line base.

Meanwhile, the GMI strengthened to 3 on Friday and remains on a buy signal since late February. Nevertheless, this market has been very difficult for me to trade profitably. I am largely in cash in my trading accounts. I am prohibited from market timing with the mutual funds in my university pension but will consider transferring a portion to money market funds if a serious down-trend looks imminent. I am unwilling to take large risks with my retirement assets.

Note that the QQQ is back below its 10 week average and the IBD Mutual Fund Index is now below its 50 day average. When these technical events occurred in the past, I was unlikely to make money trading growth stocks. If the fund pros can’t do well trading growth stocks, neither can I. Friday was day 2 (D-2) of the new QQQ short term down-trend. I trust short term trend changes more after they reach day 5. Only 26% of Nasdaq 100 stocks closed with their daily MACD above its signal line, a sign of near term weakness.

For those of you who are brave and/or foolhardy, there were 7 stocks that came up in my TC2000 scan for stocks at new highs with good recent earnings.  ACOR just broke its green line top and several of these recently broke through their green line tops. Any stock that can come through the recent market volatility at an all-time high is a good company to start researching. Many such stocks are extended and probably should be monitored for a pull-back to support. When I search for stocks to buy, I always start with the new high list.

ACOR just broke its green line top and several of these recently broke through their green line tops. Any stock that can come through the recent market volatility at an all-time high is a good company to start researching. Many such stocks are extended and probably should be monitored for a pull-back to support. When I search for stocks to buy, I always start with the new high list.