I was planning to write that, for the first time since last October, AAPL appear to be back in a Stage 2 up-trend. Last week AAPL closed above its critical 30 week average. A fully developed Stage 2 requires a rising 30 week average (red line in chart). AAPL’s is still declining, but it is time to watch for it to curve up. If one exited AAPL last October when the stock closed below its 30 week average, one would have gotten out at around $600. I would begin buying AAPL as long as it closes above its 30 week average (red line). Most of the hype about AAPL is over and probably so is most of the selling. It is appropriate that AAPL would start rising just as everyone has given up on it. This weekly chart of AAPL shows where AAPL failed a green line break-out last October and then found support near its prior green line top. AAPL will probably find resistance back around its last green line top near $650.

Until I saw this weekend’s announcement about the Obama administration’s decision to protect AAPL’s right to sell products banned by the ITC decision, the above is all I would have written about AAPL. However, I examined the one minute chart of AAPL from Friday and found an enormous amount of buying occurring in the last two minutes of the day. The SEC might want to examine whether someone who learned of the imminent decision used inside information to buy AAPL late Friday. Or maybe it was just someone’s lucky trade!? Anyone who bought late Friday may profit handsomely if AAPL pops on Monday morning. Check out the minute by minute chart below and come to your own conclusions. (Click on chart to enlarge.) If you buy on Monday these hypothetical insiders may be selling to you!

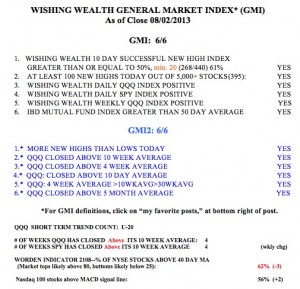

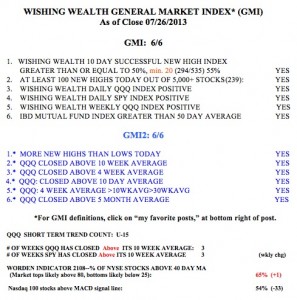

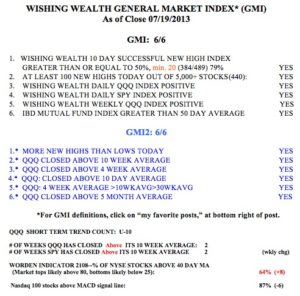

The GMI remains at the maximum 6 (of 6). Oh that I had the discipline to stay invested in TQQQ since the last GMI Buy signal on July 5. If I had bought TQQQ at the close on July 5, my account would be up 18.9%, compared to the QQQ, +6% and the SPY, +4.9%. Maybe one of my readers did this well? Please let me know.

Below is the daily chart of TQQQ, with a green arrow showing the GMI Buy signal.