Still expecting a strong last week of month as second quarter comes to an end.

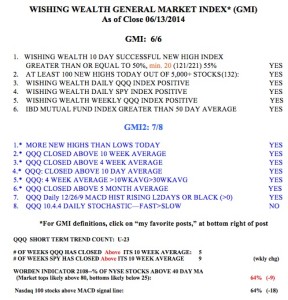

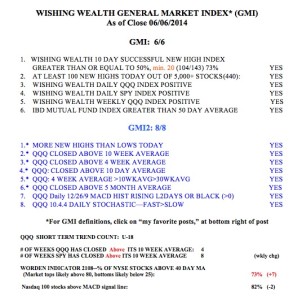

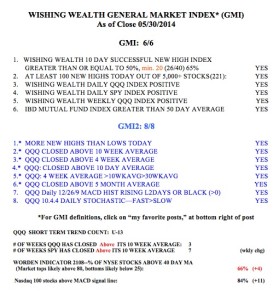

General Market Index (GMI) table

What a market top looks like

I teach my students to let the action of the market reveal its true nature. Ignore the interpretations of the media pundits, who are typically most interested in selling their advice. Many of these pundits have been warning of an imminent market top. They have their many logical scenarios and use fundamentals and statisitcs to back up their prophesies.

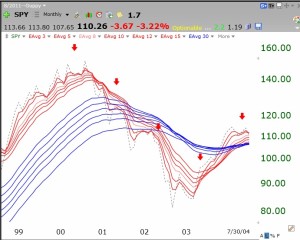

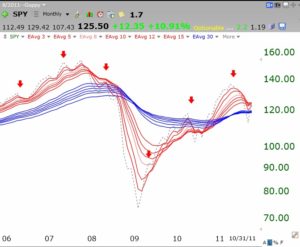

I prefer to use my technical tools to characterize market tops and to compare them to the current market. Below are some GMMA monthly charts of the SPY (S&P500 index ETF) at the 2000 and 2008 market tops. These monthly charts display 12 exponential moving averages plus the monthly close of the index (dotted line). The red lines are shorter term averages and the blue lines are longer term averages. As long as the red lines are rising above the blue lines so that there is a white space between them, we have the powerful RWB (red white and blue) pattern and the market is advancing. When the red lines converge with and fall below the blue lines leaving a white space between them we have the BWR pattern and the potential for a significant decline.

Market tops take months to develop, leaving plenty of time for the watchful investor to exit the market. Note the pattern of the SPY as it formed a top in 2000-1:

And again in 2007-8:

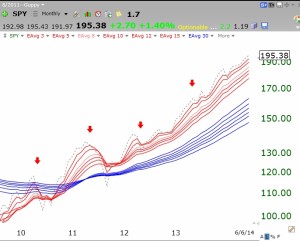

Compare these patterns to the current pattern of the SPY:

I see nothing resembling a topping pattern. Do you????? (The red arrows show the month of May from a prior Sell in May analysis.) To the contrary, the market looks like full speed ahead……

And the GMI, with all components positive, is still on the Buy signal flashed on April 22nd. Since April 22nd, SPY is up +3.9%, the QQQ is up +6.0%, and the DIA is up +2.6%. In addition, the 3x leveraged ETF, TQQQ is up +18.3%, AAPL is up 21.4% and GMCR is up +23.7%. I see again proof that if I do not want to spend time searching for the rare individual stock that will greatly out perform the indexes, the best bet is for me to wade into the TQQQ during an up-trend. That is what I have been doing…..