Here are weekly charts of two stocks that are recent GLB that hit new all-time highs last week.

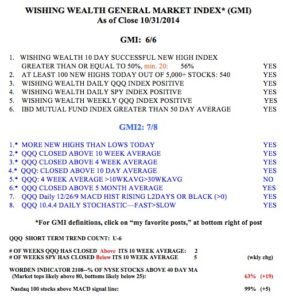

General Market Index (GMI) table

Stocks at new highs and with good fundamentals; $MNST, $NKE

I ran my TC2000 scan for stocks with good earnings that hit a 52 week high on Friday. The list is posted to the right.  There were 15 stocks. Five have a flag to the left, indicating they appear in one of my IBD watch lists. All of these but DTSI and FARM, are trading above a recent green line break-out (GLB) at an all-time high. I own several of these. One stock, MNST, had a huge volume break-out, consolidated, and is now moving up. Check out its weekly chart below.

There were 15 stocks. Five have a flag to the left, indicating they appear in one of my IBD watch lists. All of these but DTSI and FARM, are trading above a recent green line break-out (GLB) at an all-time high. I own several of these. One stock, MNST, had a huge volume break-out, consolidated, and is now moving up. Check out its weekly chart below.

Some strong stocks do not meet all of this scan’s criteria. For example, NKE looks good but has not doubled in the past year. NKE recently had a nice GLB, as shown in this weekly chart…….

Some strong stocks do not meet all of this scan’s criteria. For example, NKE looks good but has not doubled in the past year. NKE recently had a nice GLB, as shown in this weekly chart…….

Friday was the 6th day of the new QQQ short term up-trend. QQQ short term up-trends can often last for several months. Given that we are in the strong seasonal period for the market, I would not be surprised if this up-trend lasts into January. Eventually, higher interest rates will kill this market. So I am watching rates very carefully. The GMI is at 6 (of 6) and all but one of the GMI-2 components are positive.

GMI performance since 2006; GMI flashes a Buy; GLB $RCPT takes off; GLB: $EW

In response to a comment left by a reader who questioned the value of the GMI, I am posting a visual of how the QQQ behaved since 2006 while the GMI was on a Sell (red) or Buy (green) signal. You will see that the GMI got me out of the major declines. The cost was that sometimes the GMI gave a false signal and got me out at the end of a short decline. It then got me back in. I think this is a fine trade-off to make in order to avoid the pain of a serious decline. I am a chicken when it comes to trading. (Click on chart to enlarge.) The GMI is now back to a Buy signal as of Monday’s close. Two consecutive closes above 3 yield a Buy signal. Monday was also the second day of the new QQQ short term up-trend.

The GMI is now back to a Buy signal as of Monday’s close. Two consecutive closes above 3 yield a Buy signal. Monday was also the second day of the new QQQ short term up-trend.

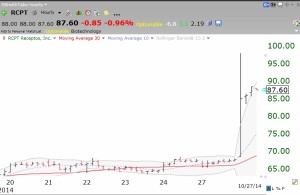

On September 10, I wrote that RCPT had had a green line break-out (GLB). The stock exploded up after hours on Monday and is trading up about 25%. Check it out on Tuesday. After the close RCPT announced good results on their colitis treatment. This is why technical analysis has value. Somebody apparently anticipated this news and bought into the company huge over a month ago! Their buying was evident in the chart. Here is its hourly chart after Monday’s close. Expect RCPT to open way up on Tuesday.

Speaking of GLB stocks, EW had a huge break-out last week. Check out this daily chart of EW.

Speaking of GLB stocks, EW had a huge break-out last week. Check out this daily chart of EW.