My indicators weakened on Friday and so the GMI Sell signal remains in place. My more sensitive measure of the short term trend of the QQQ also remains down, now having reached 6 days. I am holding mainly biotech stocks which have been miraculously bucking any market weakness, some SQQQ as a hedge, and a lot of cash in my trading accounts. I am about 40% cash in my more conservative university pension accounts. I am very cautious now. The market will become very volatile now as 4th quarter earnings are released and everyone focuses mainly on estimating the impact of lower oil prices on the future profits of many companies.

Meanwhile interest rates continue to drop as government bonds strengthen. Note that TLT (20 yr treasury bond ETF) broke above the possible double top I wrote about around December 23rd. Check out this daily chart that I have now updated. I guess the entire world is seeking the relative safety and better yield of U.S. long term bonds! This pattern looks like a powerful cup and handle break-out. Bonds will probably continue to be bid up until the eventual bubble bursts!

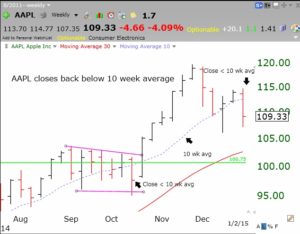

Here are the GMI stats. Note that SPY has now closed below its critical 10 week average.

I will be unable to post on Monday night, as I will be far from my computer and my statistical software. I will post again Tuesday night.