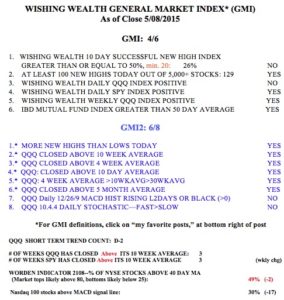

IBD still sees the market in a correction, the GMI is on a Sell signal and the QQQ has completed the second day of its new short term down-trend. BUT, both the QQQ and SPY closed above their 10 week averages and the QQQ closed above its recent channel again. Bottom line— time to be extra cautious and see if the market short term up-trend will re-assert itself. A strong day on Monday could signal a new GMI Buy signal and new short term up-trend.

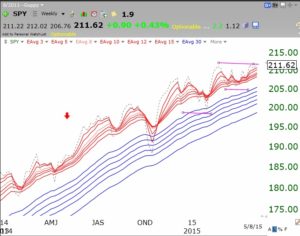

This weekly GMMA chart of the SPY shows it to remain in a strong RWB up-trend. The QQQ and DIA have similar RWB patterns.

The GMI is back to 4 (of 6).