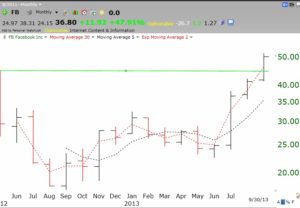

I am very interested in stocks that come public, form a base and then break to new highs. CYBR is getting close to breaking out. It is close to a green line break-out. It may even be completing a cup and handle base, as seen in this weekly chart. With so many hacking events hitting the news, it may mean good business for cyber-security firms. Judy has been talking about CYBR for some time.

As an alternative to single stocks, there is a new ETF for cyber-security firms, HACK. HACK had a strong week last week.

As an alternative to single stocks, there is a new ETF for cyber-security firms, HACK. HACK had a strong week last week.

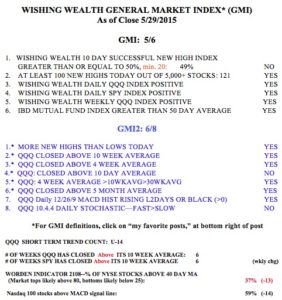

The GMI remains strong and the longer term up-trend remains intact. But note that the SPY has closed below its 10 week average. Tech stocks are outperforming. Will SPY or QQQ lead the market?