These 13 stocks on my list of 559 promising stocks reached an all-time high, ATH, on Friday. They are ranked in descending order of the last column, close today divided by close 250 days ago. Only one of them, CCB, is more than twice its price a year ago. The fact that 5 of them, PLMR, AXS, PGR, BRO, AJG are in the insurance business is noteworthy. As we all know, insurance costs have skyrocketed, thus growing profits for the industry. PLMR held its green line on above average volume after having a GLB after recently releasing its earnings. During a weak market, stocks that can reach an ATH are showing incredible strength. See PLMR’s daily chart below.

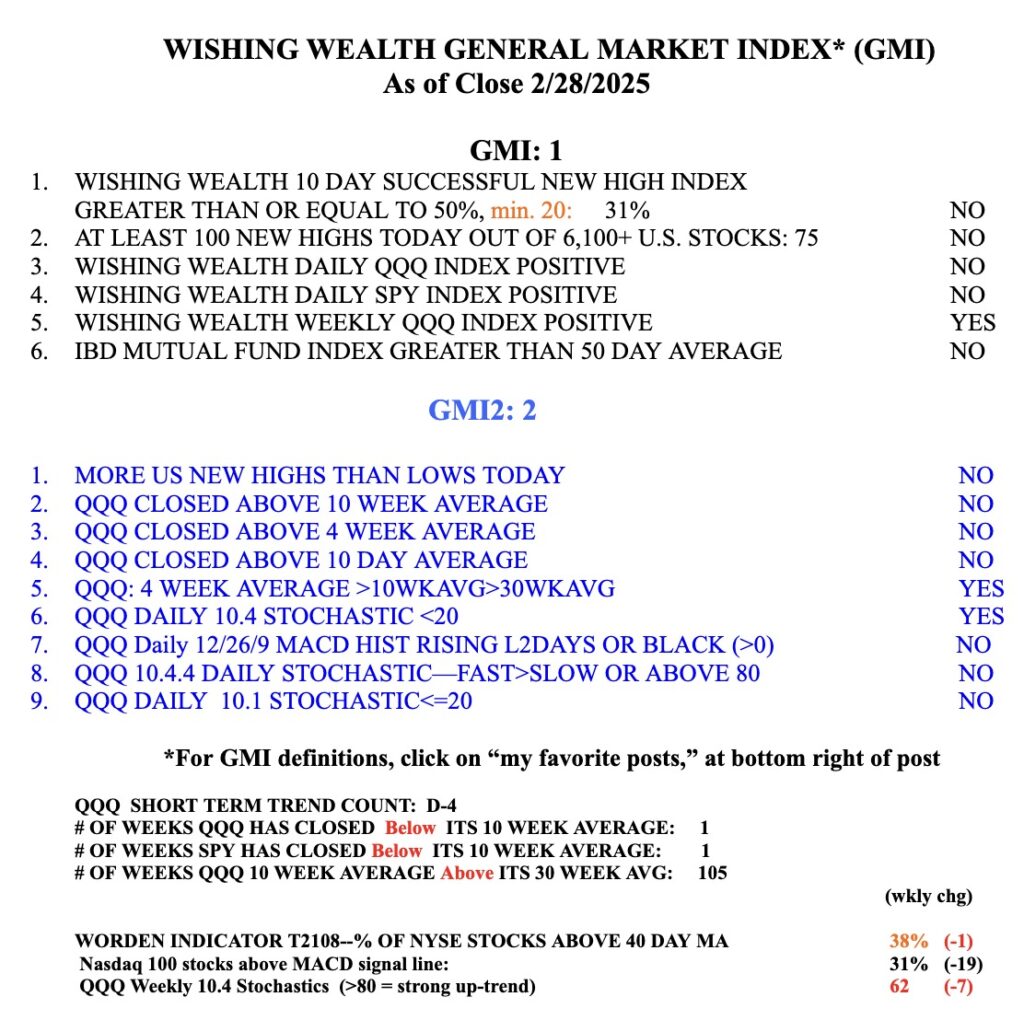

The GMI is RED and both QQQ and SPY have closed below their 10 week averages. Time for me to be in cash and/or very risk adverse with close stops in my trading accounts. I may nibble at a stock for insurance, however, ha ha. It is so much easier to be profitable trading long when the GMI is Green and registers 5 or more.