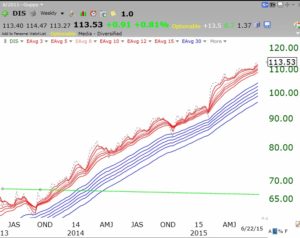

I meant to post this table on Monday. By the way, Judy reminded me that she also likes DIS as a Star Wars play.

I meant to post this table on Monday. By the way, Judy reminded me that she also likes DIS as a Star Wars play.

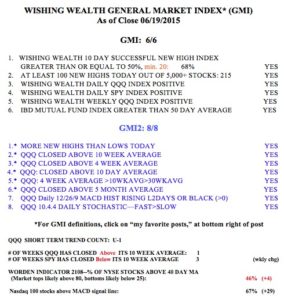

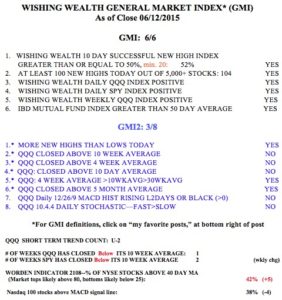

General Market Index (GMI) table

All GMI components are positive; Betting on Star Wars–$IMAX, $HAS, $EA

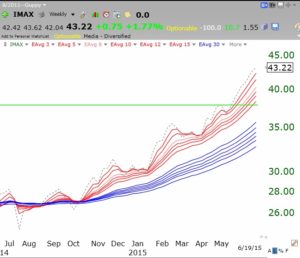

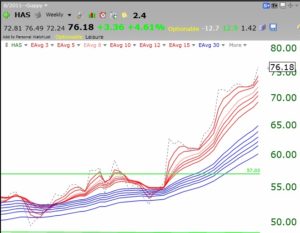

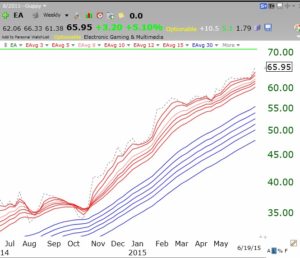

My stock buddy, Judy, has been talking to me about IMAX for years, but recently she urged me again to consider IMAX along with HAS and EA, all companies that might do well with the coming release of of the Star Wars movie in December. So I own all three companies. I am posting their weekly modified GMMA charts below to show they are all in RWB up-trends. I will hold all three until December, unless the market weakens greatly. IMAX and HAS are also above recent green line tops, at all-time highs. EA is heading towards its last green line top.

Market on the edge; watching $LOGM and $SYNA

The $QQQ short term up-trend could reverse down Monday with a weak day–after only 2 days of an up-trend! The prior short term down-trend lasted only 3 days. This is a schizoid market. The GMI is at 6 (of 6) but the more sensitive GMI2 is at 3 (of 8). This week may tell the story of whether we will have the June swoon. I have reduced my long positions in my trading accounts. I remain a chicken…..

But I am always looking for strong stocks in case the market strengthens. I am keeping an eye on LOGM, which may have finished consolidating Friday after its big gap up on 4/29. LOGM is another stock that Judy has talked to me about.

But I am always looking for strong stocks in case the market strengthens. I am keeping an eye on LOGM, which may have finished consolidating Friday after its big gap up on 4/29. LOGM is another stock that Judy has talked to me about.

SYNA is another stock I am watching after its recent green line break-out to an all-time high.

SYNA is another stock I am watching after its recent green line break-out to an all-time high.