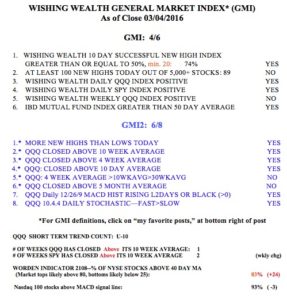

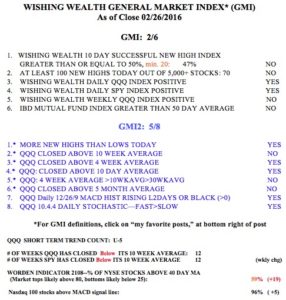

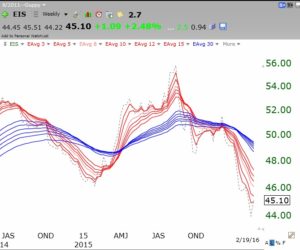

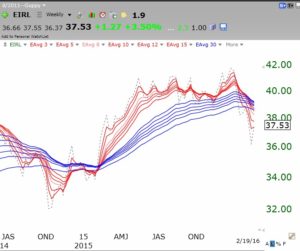

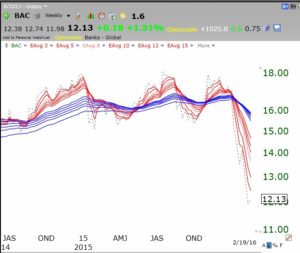

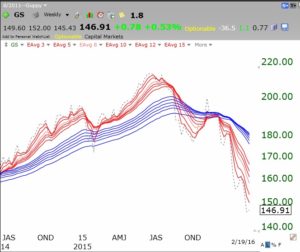

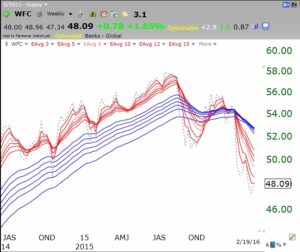

With the GMI on a buy, IBD on a confirmed up-trend and my QQQ short term up-trend in its 10th day, I have been tip-toeing back into this market in my trading IRA. However, the longer term trend is not up, so I am not ready to reinvest my university pension funds. I do think it is okay to talk about some stocks that appear to be showing technical strength. The stocks below all had a recent green line break-out (GLB). This means they have formed a 3 month or longer top at an all-time high and have just broken through that top to a new all-time high. Such strength can sometimes signify the start of a large multi-month move. I am showing these GLB stocks as a way of explaining how I find promising stocks. When I do buy a GLB, I always exit if the stock comes back below the green line. This is a sign of a false break-out and technical weakness. When a stock breaks through its all-time top, I want to see an increase in volume as others rush in to buy. I often buy a stock back if it then closes back above the green line. Here are some weekly charts of stocks that hit a new yearly high on Friday and that have had a recent GLB. I have not researched them for a possible buy. Some of them had unusually large trading volume last week and there may have been an important announcement that would need to be reviewed and weighed before purchase. Before buying, I always review the fundamentals of the company, its next earnings date, and other technical indicators. I am putting these GLB stocks in a watch list to monitor over the coming days. Let me know if you find such posts useful. These are weekly charts.

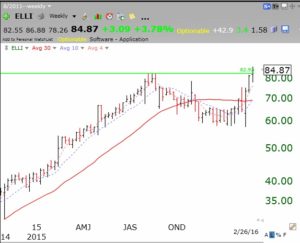

ELLI

ALGN:

SYY: