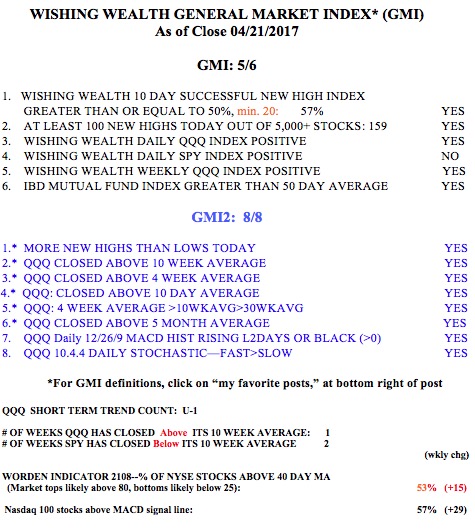

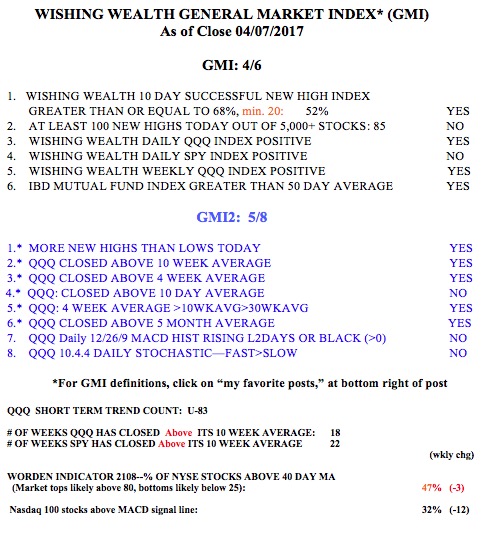

The bifurcated market is clearly evident in the fact that the QQQ is above its 10 week average while the SPY and DIA remain below. So the GMI which is heavily oriented towards the QQQ has now gone to Green, 4 days after it turned Red. The QQQ short term trend has also changed to up. I usually wait for 5 days of a new QQQ short term trend to trade it aggressively. I did nibble at TQQQ on Friday. Time will tell.

General Market Index (GMI) table

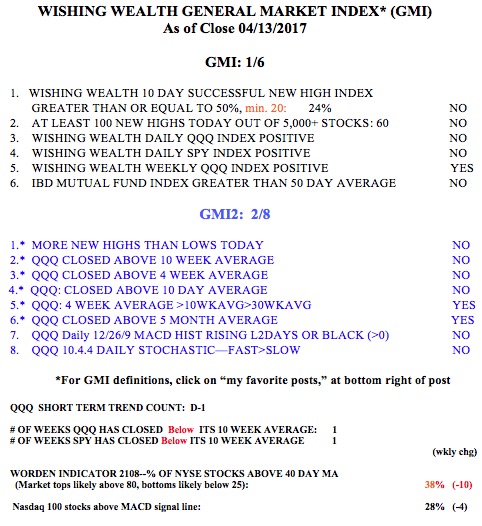

GMI may turn RED on Monday; $QQQ short term up-trend ends at 86th day; In cash and $GLD; GLB: $TWOU

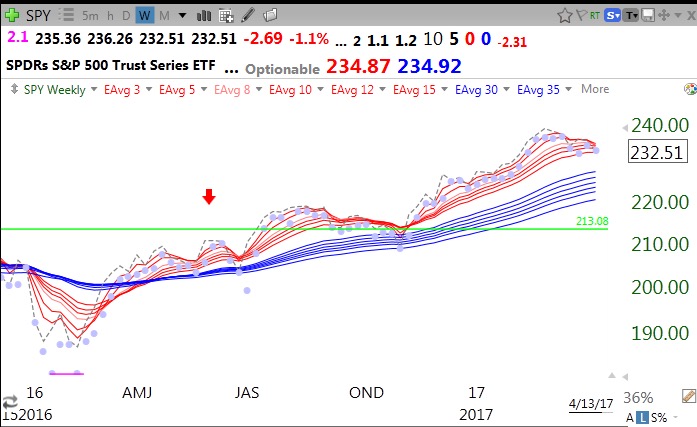

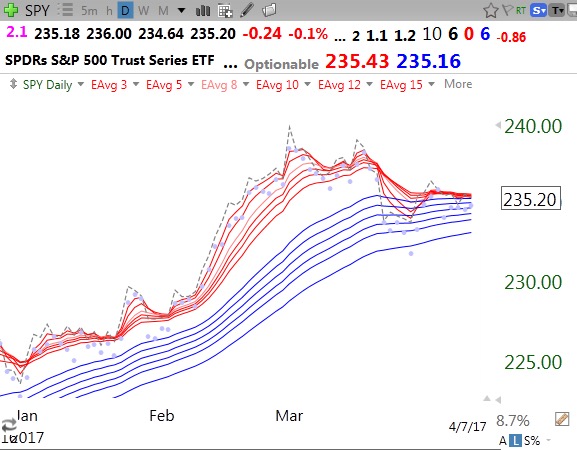

The GMI turned Green on November 10. Since then the QQQ has advanced + 12.7% through last Thursday. Another GMI reading below 3 on Monday will turn it to Red. The SPY/DIA/QQQ all closed below their 10 week averages, an ominous sign of weakness. My separate but somewhat correlated and more sensitive QQQ short term trend indicator has already just turned down (D-1). About 40% of the new QQQ short term down-trends since 2006 lasted under 5 days. I therefore do not trade much on the short side with a 3X inverse ETF like SQQQ until the new down-trend exceeds 5 days. The longer term trends remain up and I must respect that. Most of the indexes are no longer in daily RWB up-trends but their weekly RWB patterns remain intact. Below are the daily and weekly RWB charts for SPY.

Daily SPY: Note the 0/0 pattern, reflecting that the SPY has now closed (blue dotted line) below all 12 daily moving averages. A return to 6/6, signifying a close above all 12 averages, would be a new buy signal for me.

And the weekly RWB: The 10 shows that 10 (10/5/0/0) of the 12 weekly averages line up properly with each above the next longer average.

My interpretation of these patterns is that the SPY is in a short term pause within a longer term up-trend. Should the weekly chart turn BWR I would consider transferring my university pension from equity mutual funds into money market funds, something I do very rarely. The DIA and QQQ show similar patterns– a vanishing RWB daily pattern and a continuing RWB weekly pattern. It is so much more safe and profitable to trade on the long side when the daily and weekly charts both form RWB patterns…

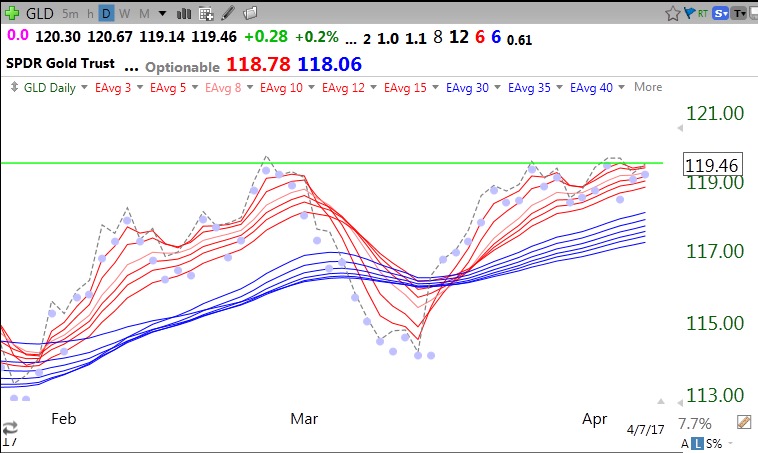

On the other hand, GLD (gold) remains in a strong daily RWB pattern, 12/6/6. (The green line is from a prior top/base.)

I like market declines because it is easier for me to find potential leaders in a dwindling new high list. There were only 60 new 52 week highs on Thursday in my US stock universe of 4800 companies. I looked through them to see if there were any green line break-outs (GLB) going to all time highs. That is how I found TWOU. I found that TWOU is signing up the most prestigious universities in 10 year contracts to offer their graduate degrees using their innovative online digital platform. While this may not be the time to buy anything, I think it is worth putting TWOU on my watchlist. This weekly chart shows that TWOU came public at $13 in 2014 and has now tripled in price. Some Fidelity funds are reported to have positions. They must see something good here…..

Note the daily RWB pattern (11/5/6) and the above average green volume spikes on up days. Some institutions are buying….

The GMI is now at 1 (of 6) and still on a GREEN signal. One more day below 3 will change it to RED.

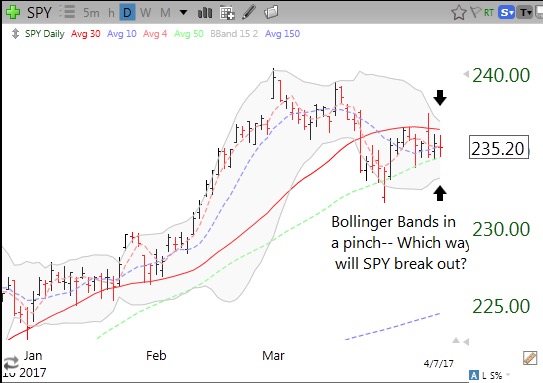

How will $SPY break out of BB pinch? $GLD = RWB 12/6/6 at resistance

The QQQ short term up-trend is now 83 days old, not far from the longest (88) since 2006. Meanwhile the DIA and SPY are weaker than the QQQ. DIA and SPY are in a Bollinger Band (15.2 daily) pinch. That means there is a contraction in price movement, reflected in the bands’ approaching each other. Eventually the index will break outside one of the bands. Low volatility leads to higher volatility. Too bad, however— price can move in either direction. We just have to monitor the situation and get ready to act. Note the SPY is finding repeated support at its 50 day average (green dotted line). A close below the 50 day average (234.51) may be a good clue that the market is breaking down.

This daily RWB chart shows more clearly the tightening of the prices, with all of the short term averages (red lines) constricted. SPY has a 6/0/6 pattern, closing below all of its 6 red lines but just above all of the blue lines (longer moving averages). Note the RWB pattern is gone. Note also how long (January to mid-March) the SPY was in a RWB pattern (see my glossary for definitions) and a good time to be long the SPY.

GLD remains in a 12/6/6 RWB pattern, up against resistance. A close (dotted line) below the lowest red line (118.78) would be a possible sign of weakening of the RWB pattern, as last occurred in early March.

The GMI is at 4 (of 6).