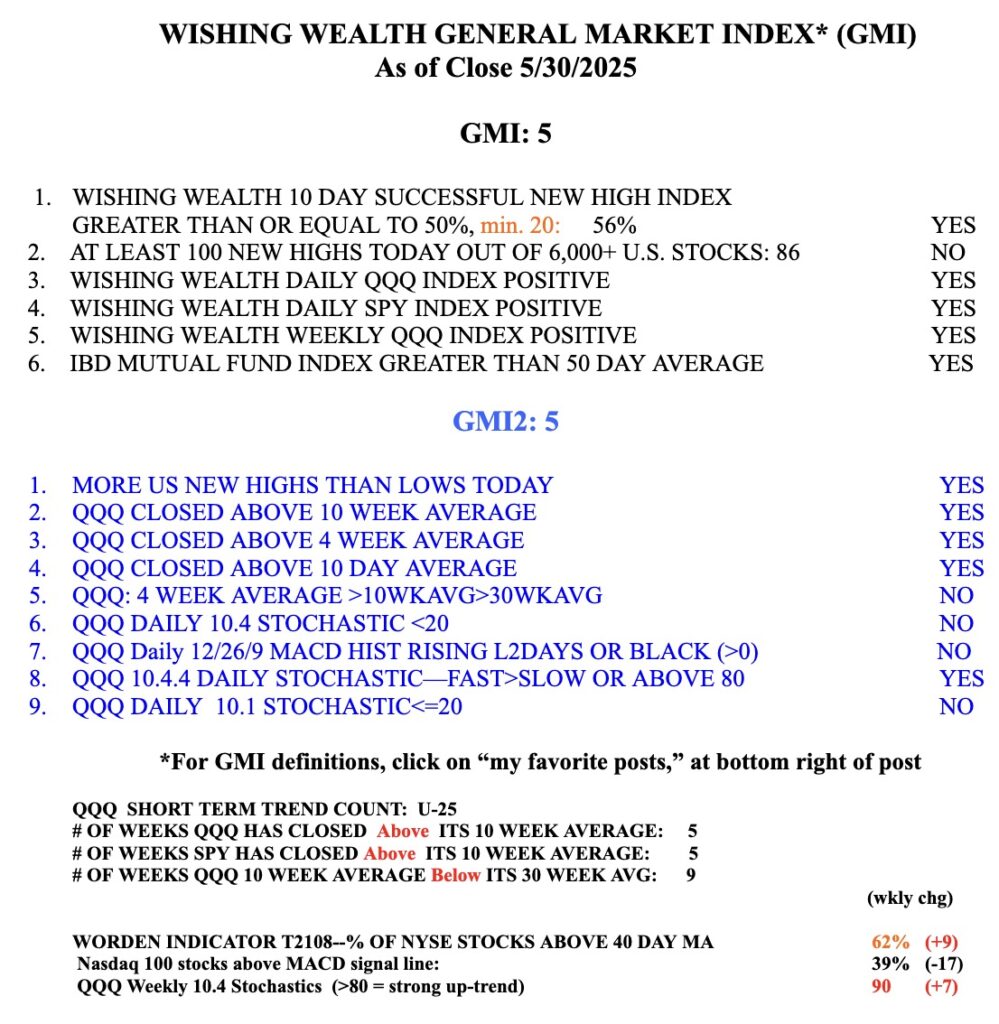

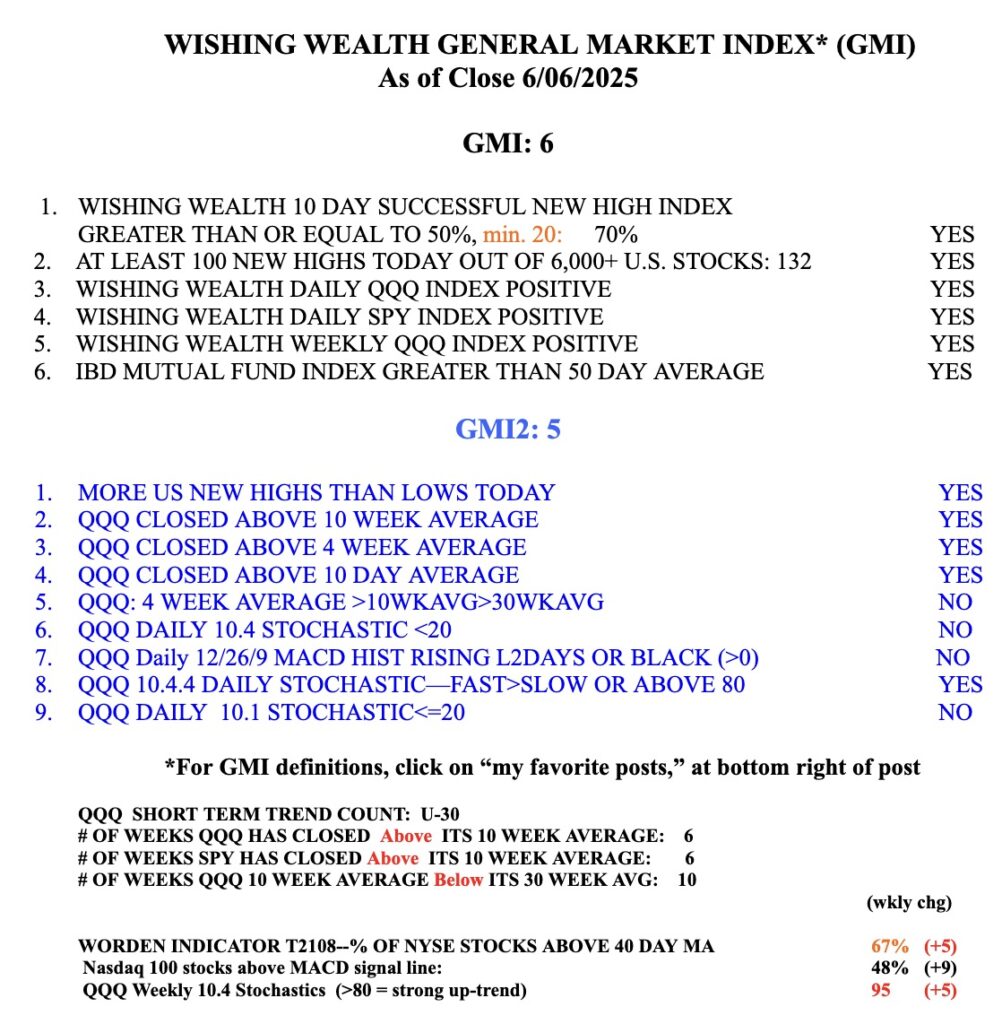

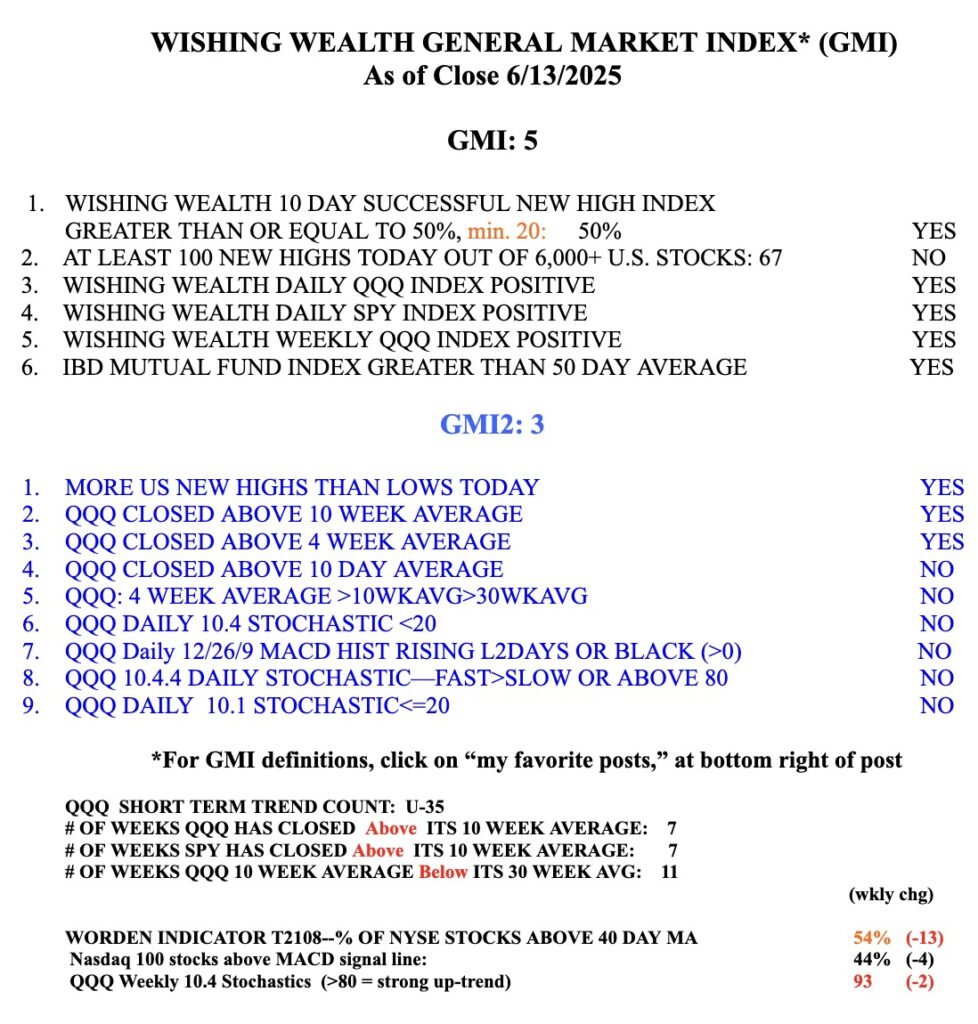

General Market Index (GMI) table

Blog Post: Day 25 of $QQQ short term up-trend; 5 Stocks with my Blue Dot setup on Friday, $PM and $VRNA are examples of prior successful blue dot setups, see daily charts.

In my presentation to the Boston IBD Meetup on 5/21, I described my Blue Dot setup. Here is a list of 5 stocks that met that setup on Friday. They are worth investigating. No one knows if any of them will be successful. It often depends on the market’s action. But if I I bought one of these, I would immediately place a sell stop below the low of the bounce. The Blue Dot setup finds strong stocks that recently reached an ATH and just bounced from being oversold. Below are the 5. The last column shows each close Friday divided by its close 250 days ago. DUOL has almost tripled and LRN has more than doubled. I described how I program the blue dot setup in TC2000 in a recent post.

PM and VRNA are examples of stocks that performed beautifully after a blue dot.The blue dot occurred 6 days after PM had reached an ATH. Note PM also bounced off of its lower 15.2 daily BB, a confirming bullish indicator. VRNA had a similar pattern.

The GMi remains Green at 5 (of 6). So far the up-trend is holding.