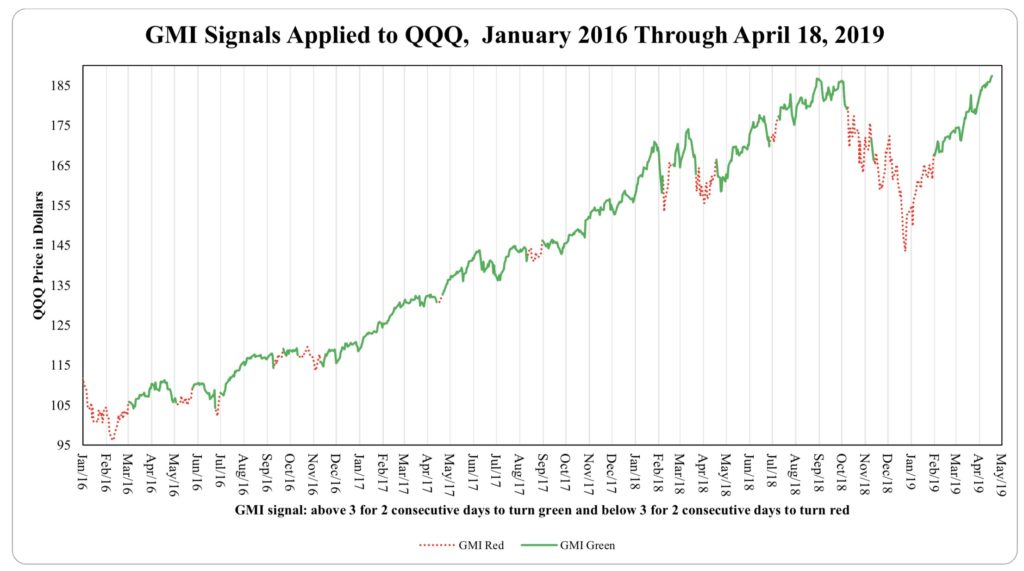

Since January 9, the first day of the current QQQ short term up-trend, the following has occurred:

QQQ +18.55%, DIA +11.06%, SPY +13.74%, TQQQ +61.77%

None of the Nasdaq100 and S&P500 stocks beat TQQQ

Only 2.2% (9/412) of stocks on my watchlist of IBD type growth stocks beat TQQQ.

The moral of the story, once again, is for me to hold the 3X QQQ leveraged ETF (TQQQ) rather than trying to find the extremely rare stock that will beat it. It takes a lot of courage to buy TQQQ at the beginning of a new up-trend, after stocks have been falling for a long time. I suspect that programming a machine to pull the trigger might work better…..

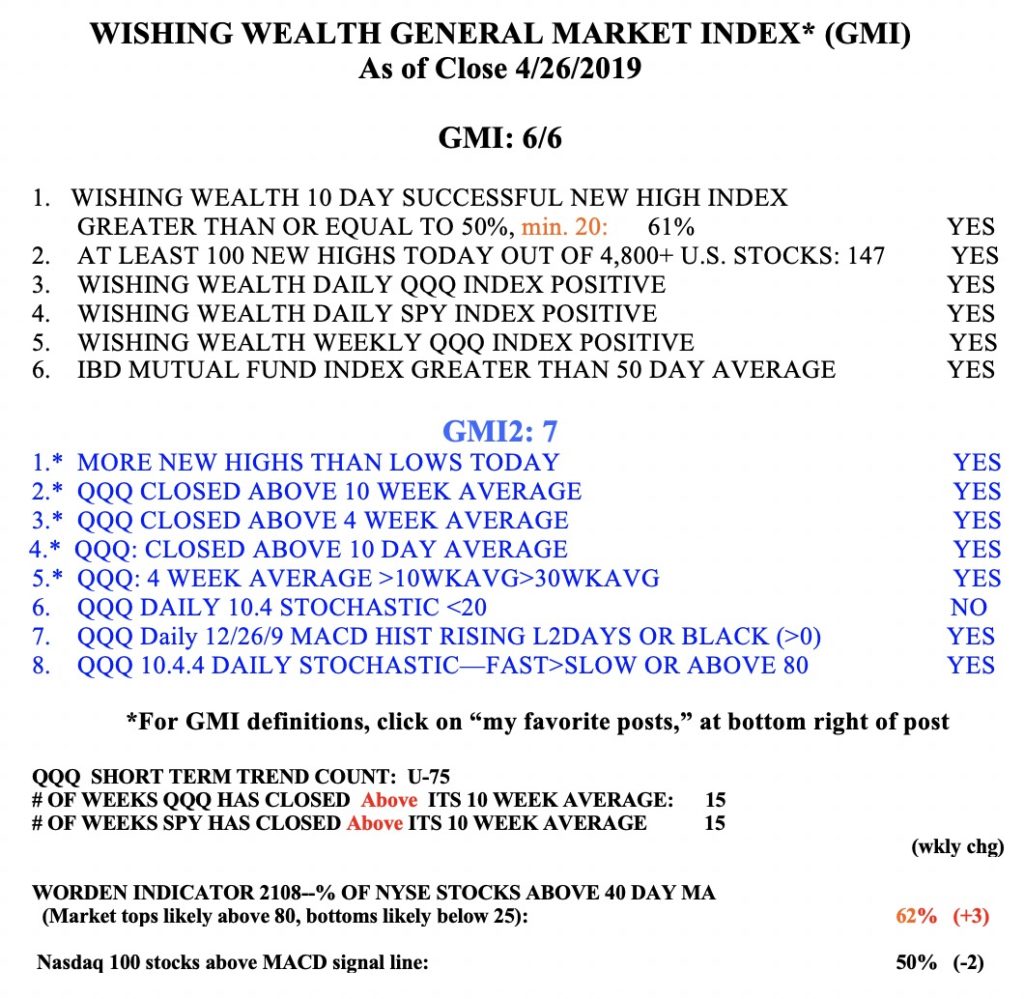

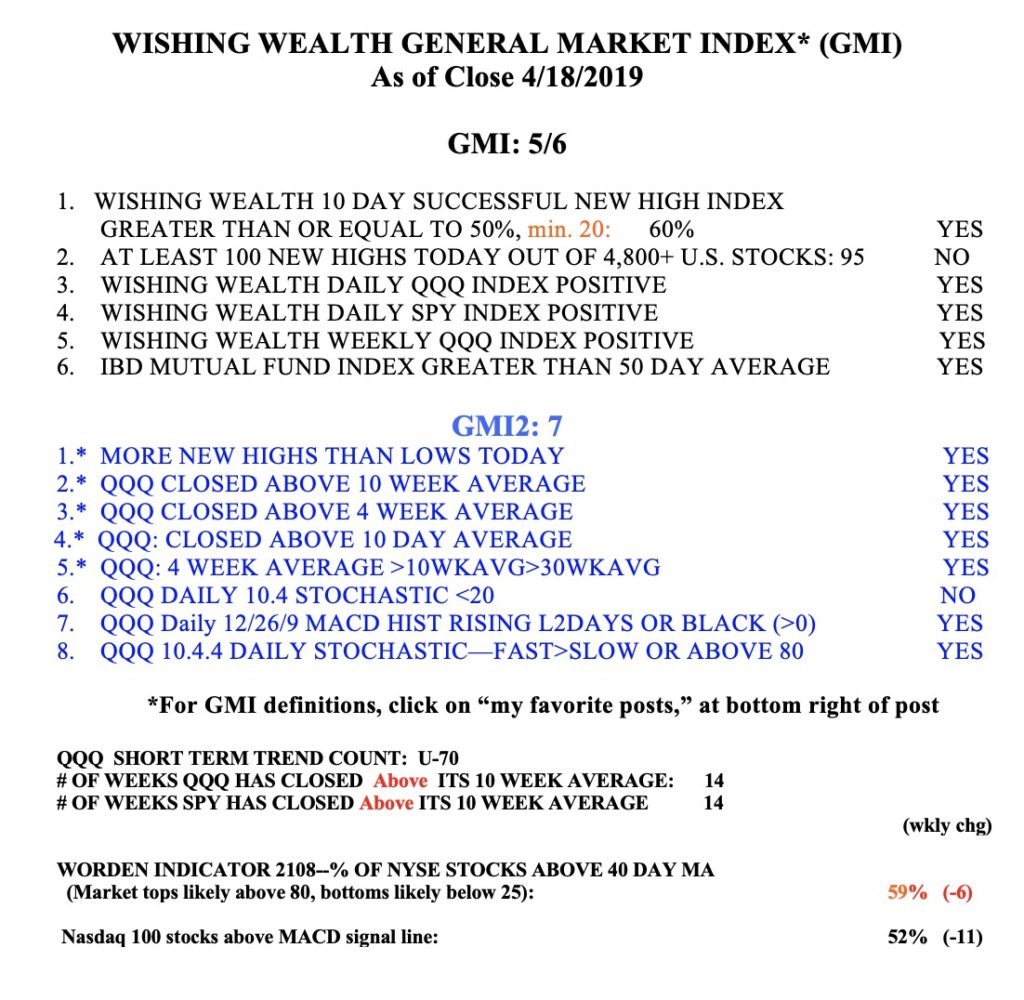

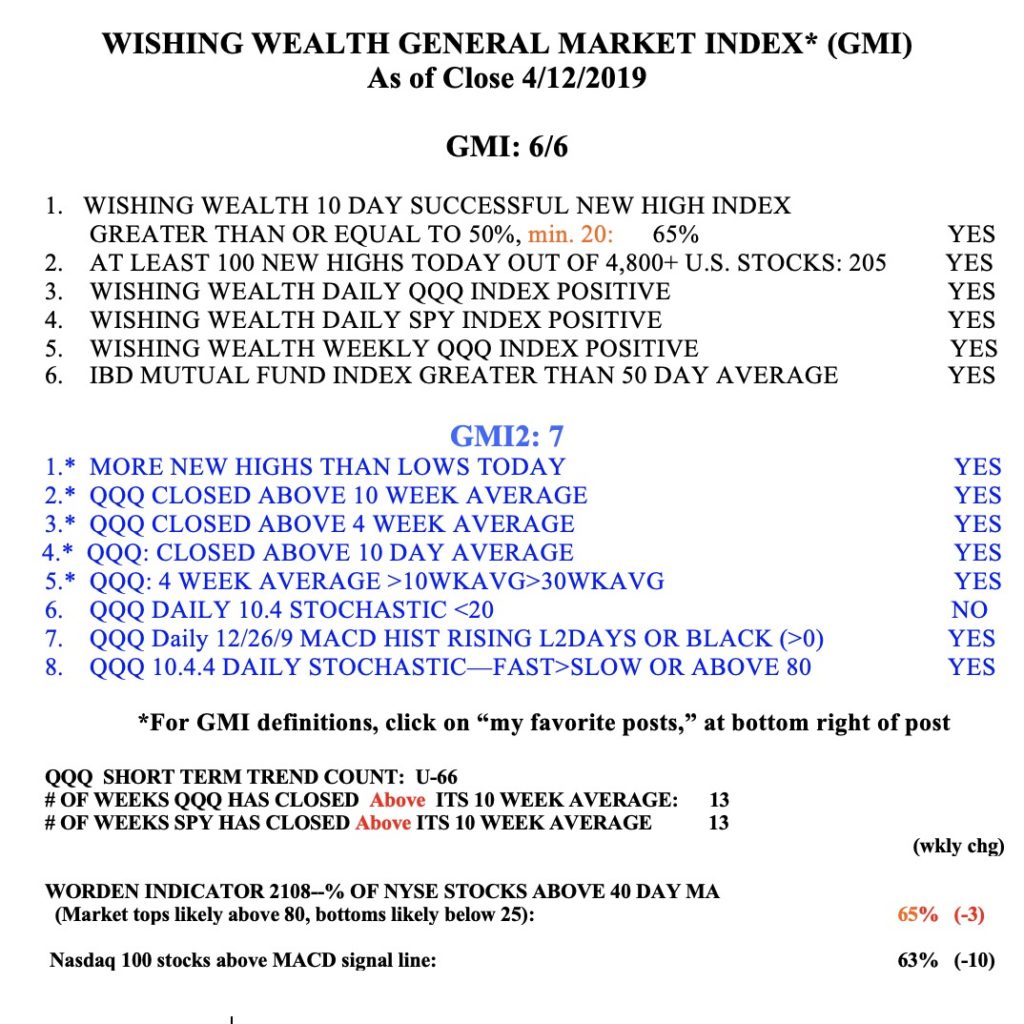

The GMI is a longer term trend indicator than my QQQ short term trend indicator. The GMI is 6 (of 6) and remains on a Green signal, since January 31.