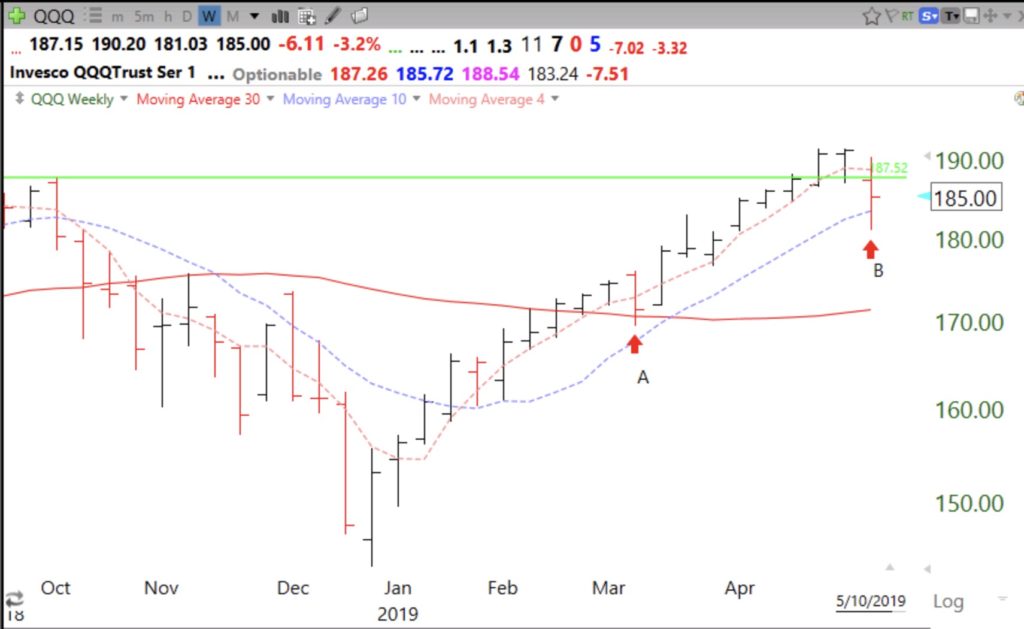

Since the first week in January after the market bottom, the QQQ has closed above its rising 4 week average every week except once in early March (A) and last week (B). Closing above the rising 4 week average is a sign of a strong advance. This week the market will reveal its short term direction by whether the QQQ can regain and close above its 4 week average (red dotted line). A close below the 10 week average (purple dotted line) would indicate a significant decline. Failure of the recent GLB is another major sign of weakness.

Some stocks are still hitting all-time highs. OLLI had a GLB last week. It has closed above its 4 week moving average the past 7 weeks.

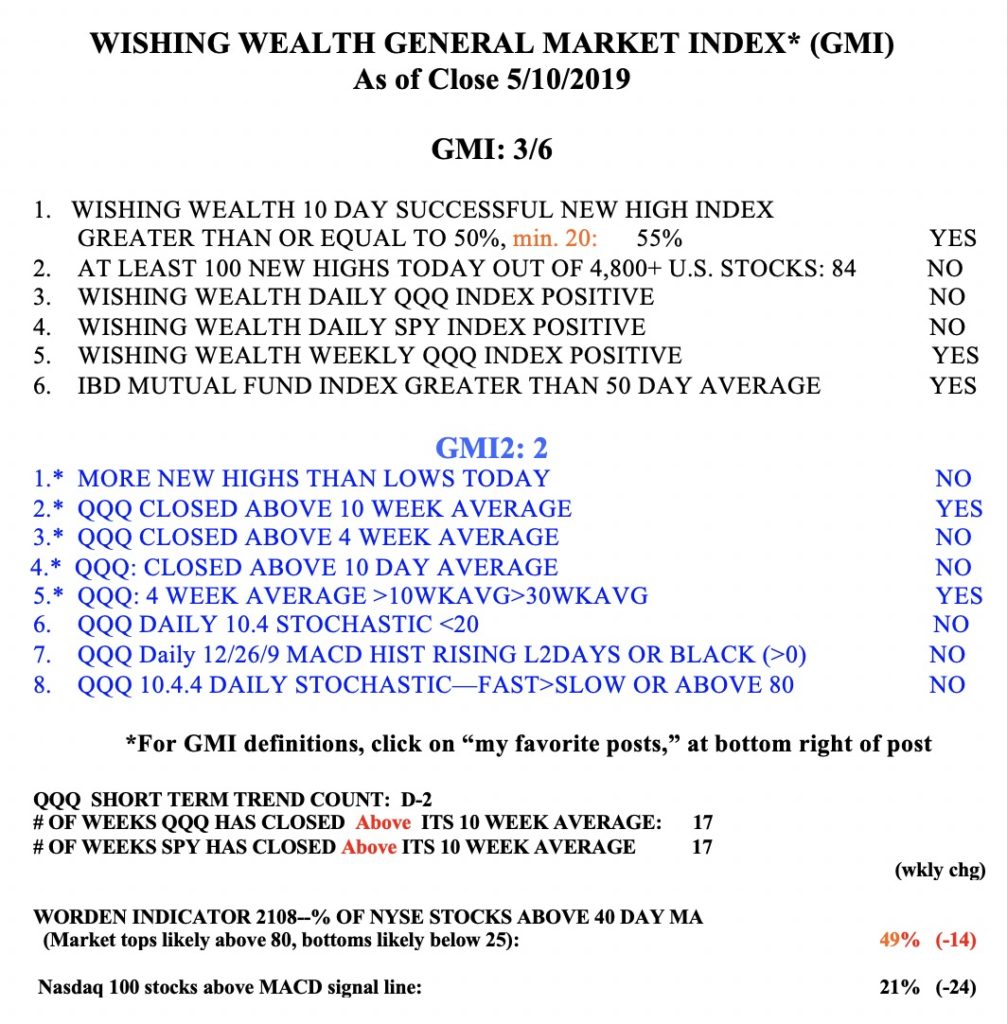

The GMI is 3 (of 6) and remains Green.