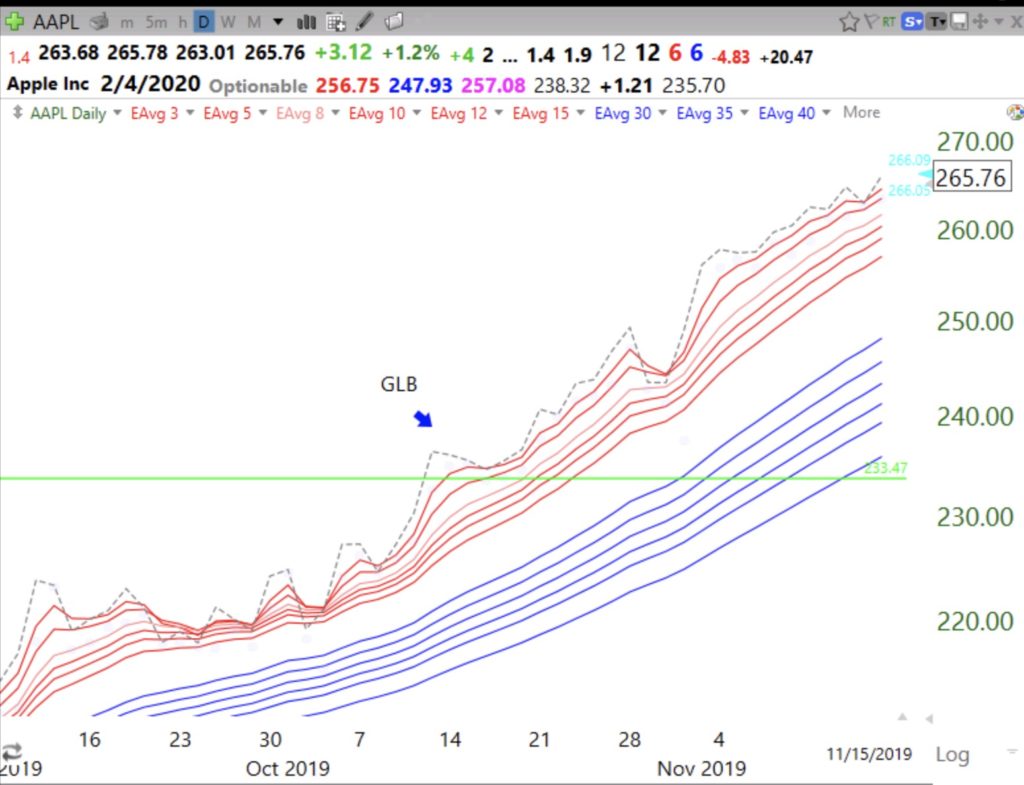

LK is a recent IPO that had a GLB 2 weeks ago (green line break-out to an all-time high). This stock is extended, but may be a large buy for me if/when it falls back to support. (I already have a small position.) Right now LK is extended, floating way above its 4 week average (pink dotted line). Note the huge volume on the break-out in this weekly chart. While LK has no earnings, its sales have been rising triple digit. According to MarketSmith, next earnings come out on January 28 and it has an accumulation rating of A+ and an RS rating of 96. Not too shabby. LK will soon have more coffee shops in China than Starbucks. And maybe the trade war will induce Chinese consumers to abandon Starbucks? (Thanks to Judy for alerting me to this stock.) Remember to check out my list of selected GLB stocks on this page.

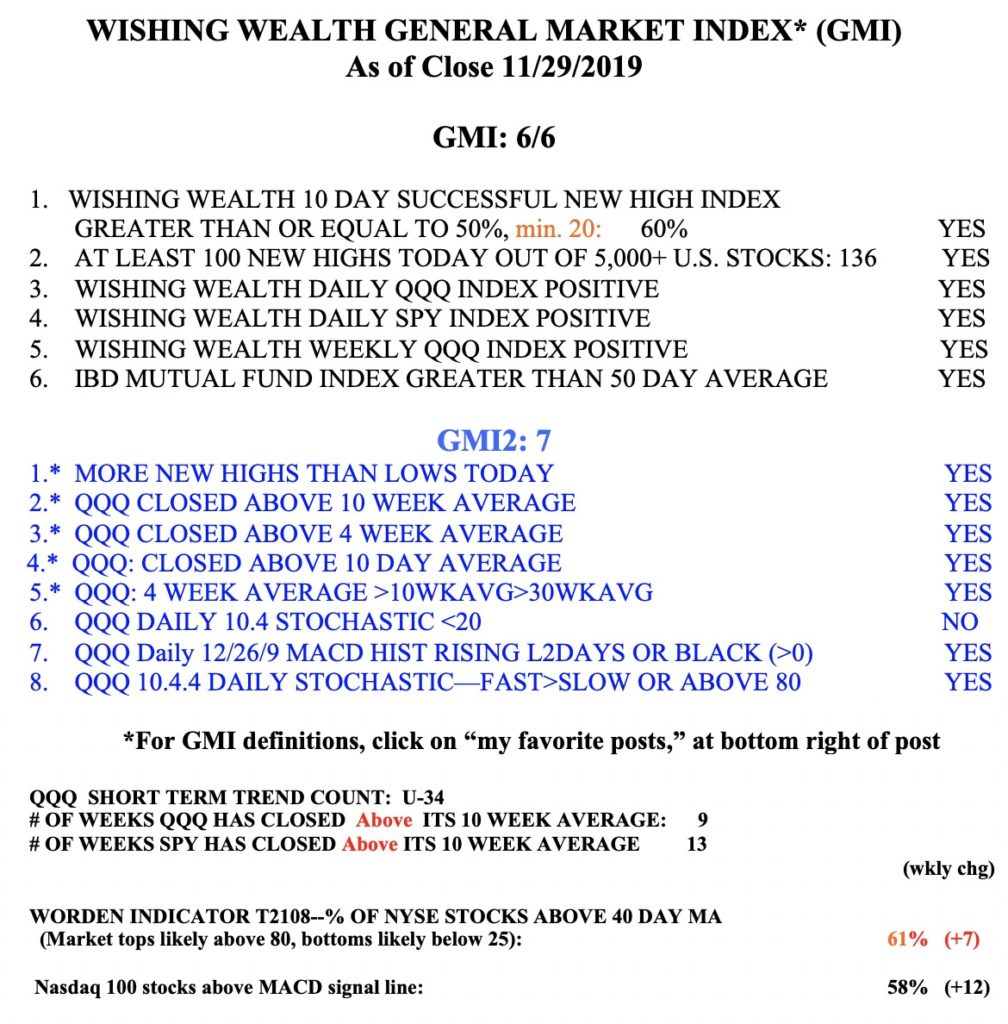

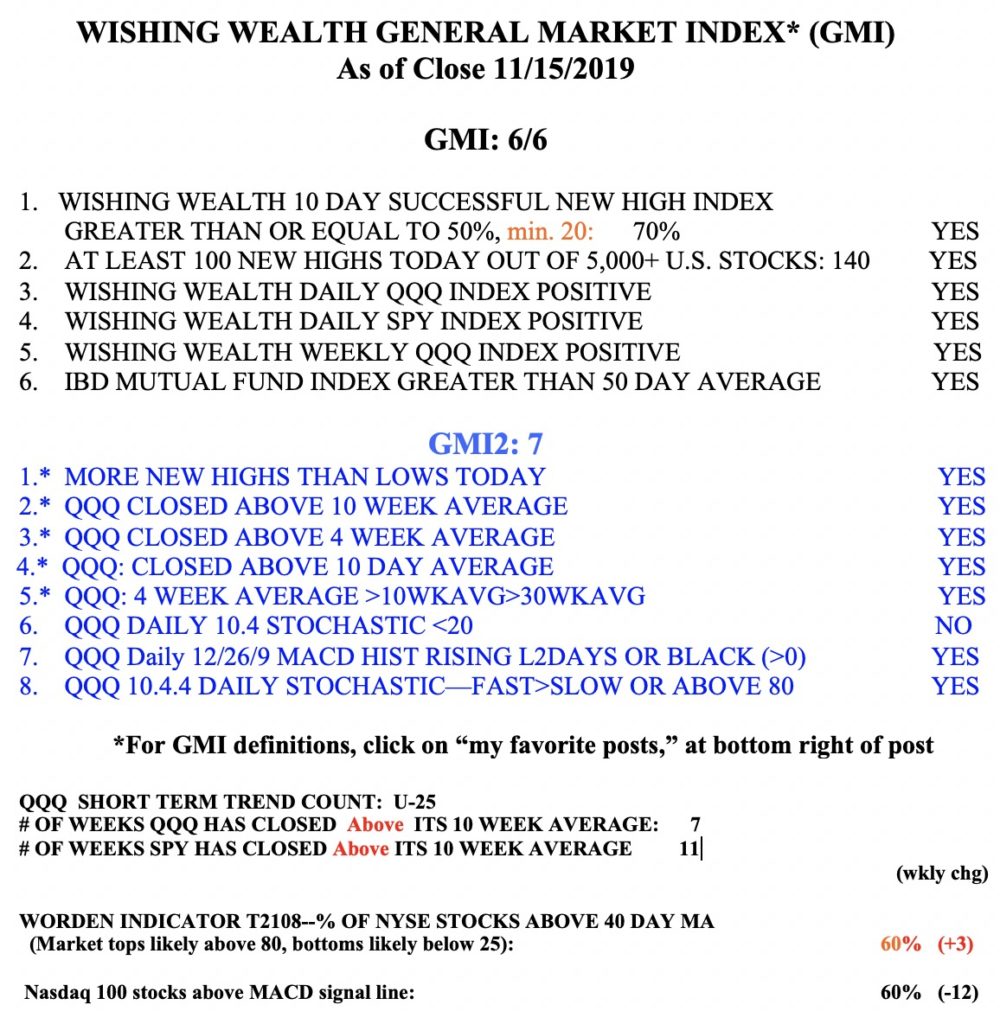

The GMI remains Green, at 6 (of 6).