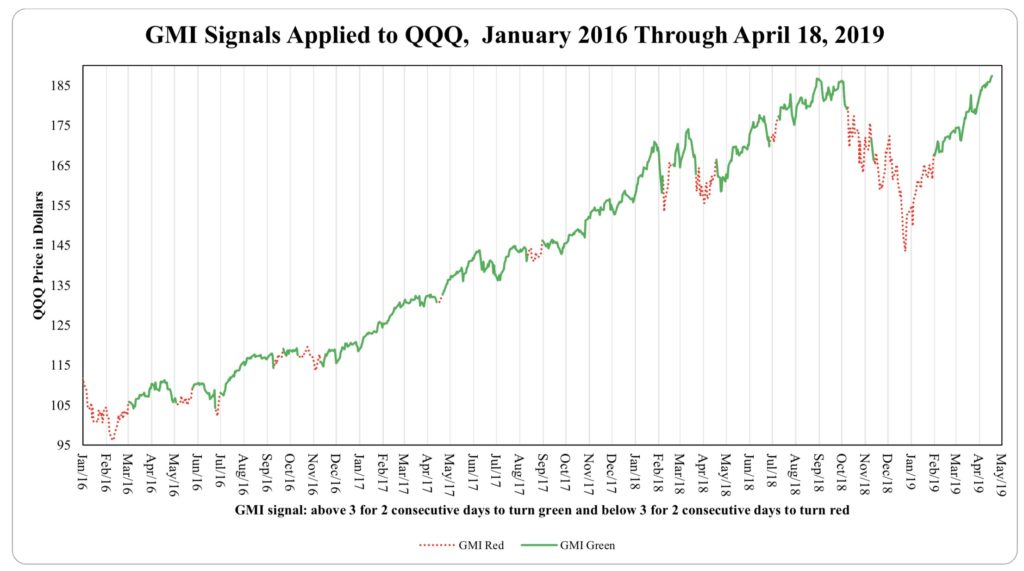

Between Sell in May and the 80th day of the current QQQ short term up-trend, we may see some weakness shortly. Or is it just caused by the President’s tweets about the China talk? It will be a major sign of technical weakness if the recent GLB (187.52) does not hold.

The recent pet care ETF IPO, PAWZ, had a GLB last week. Having inherited a wonderful mini labradoodle from my late sister, I now know personally how much people spend on their pets.

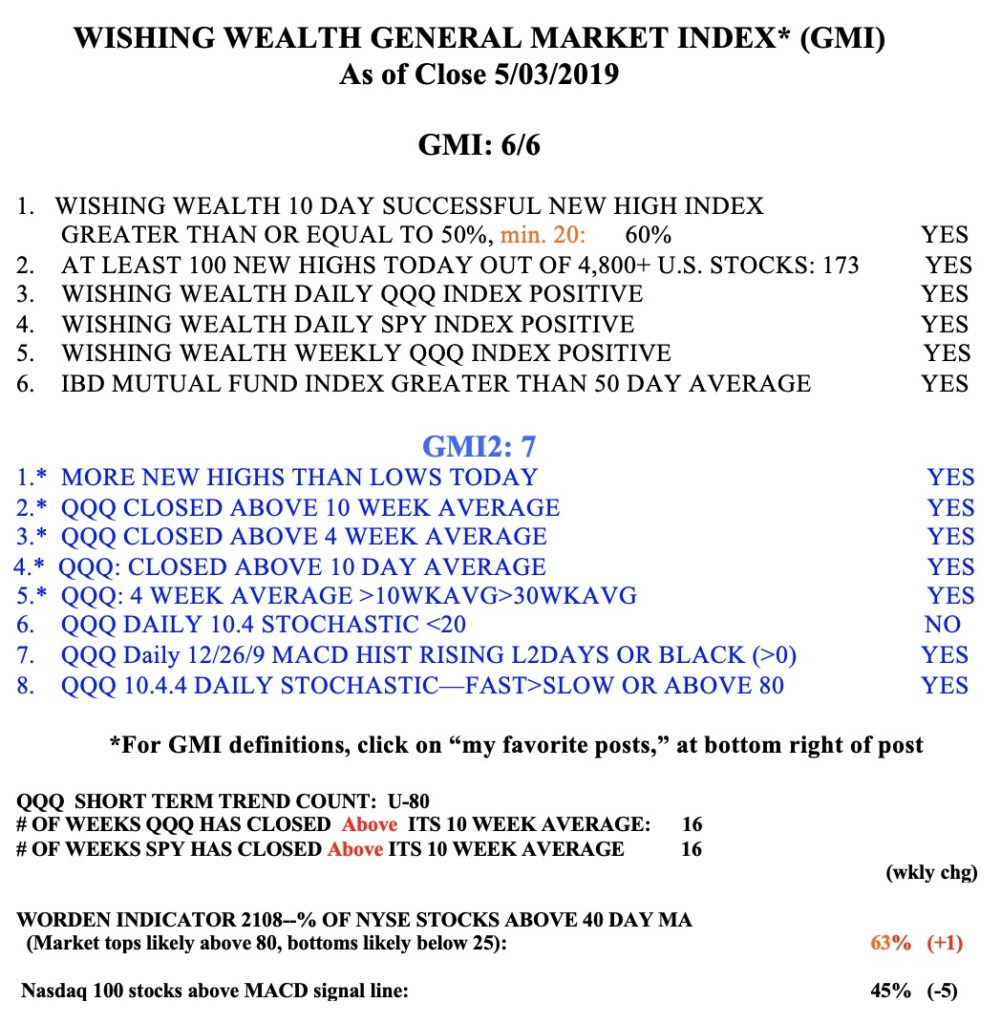

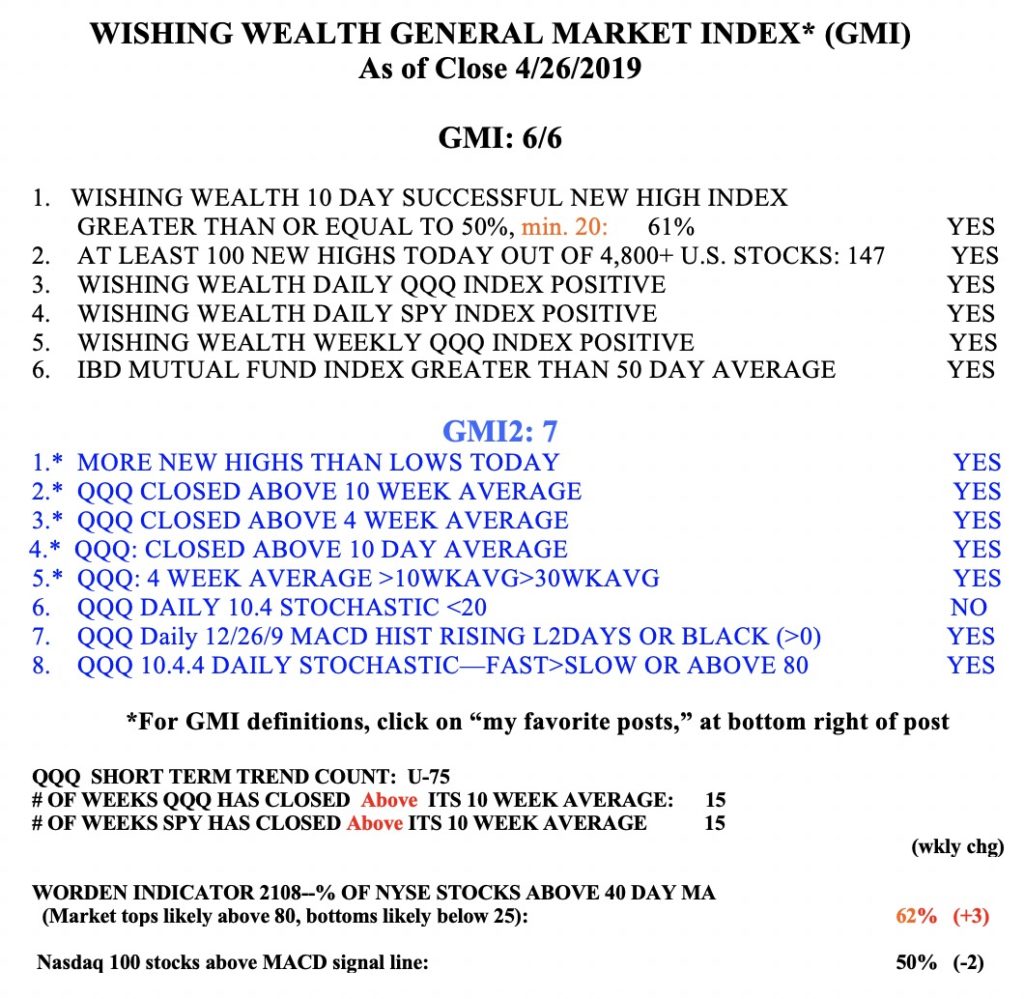

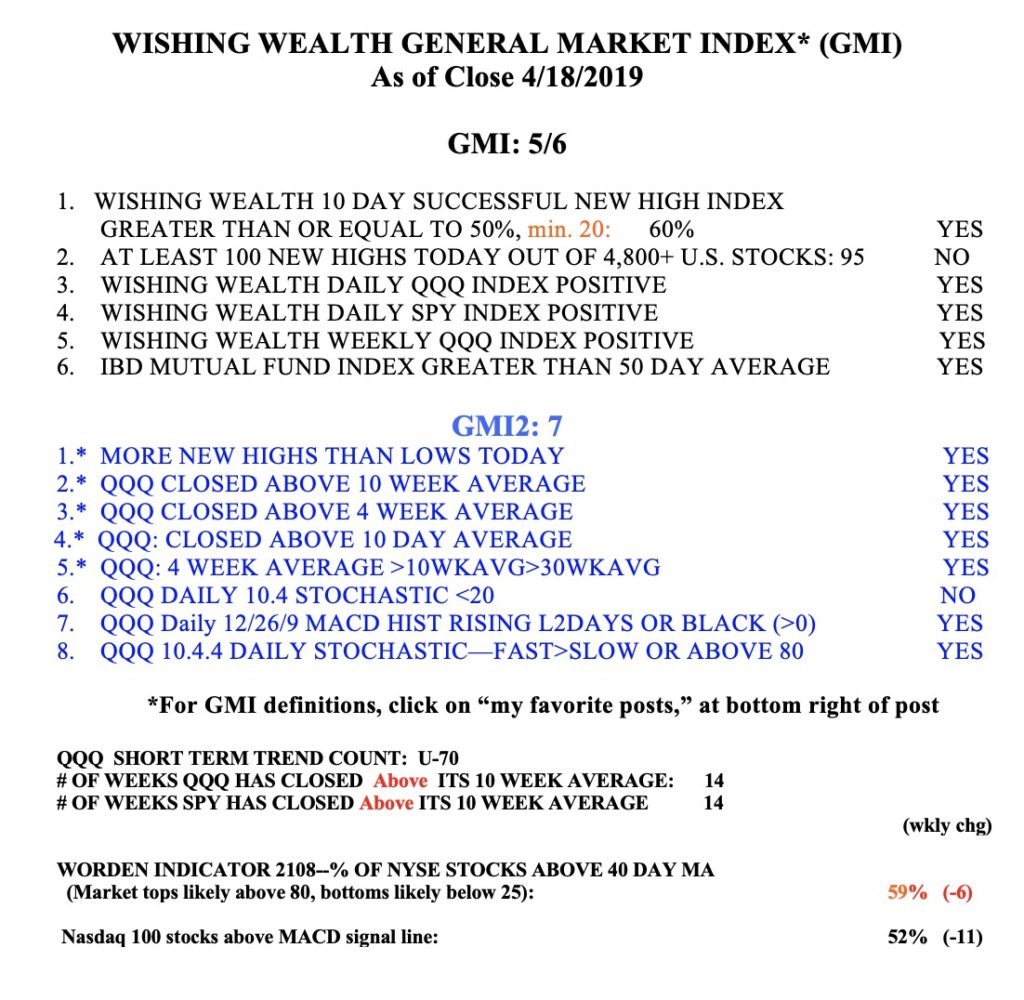

The GMI remains strong at 6 (of 6).