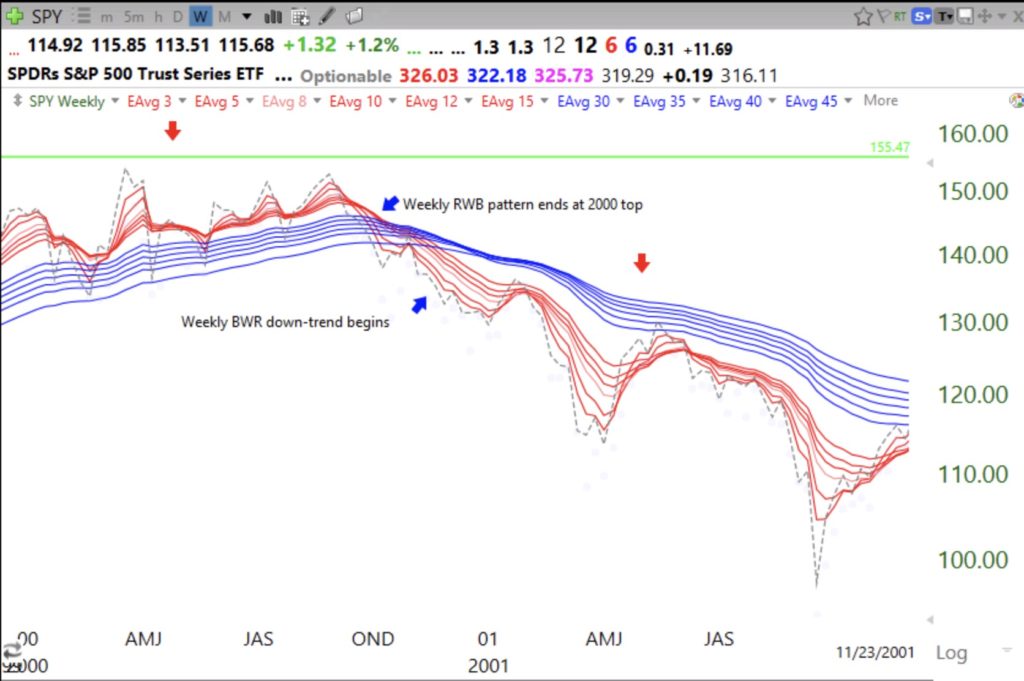

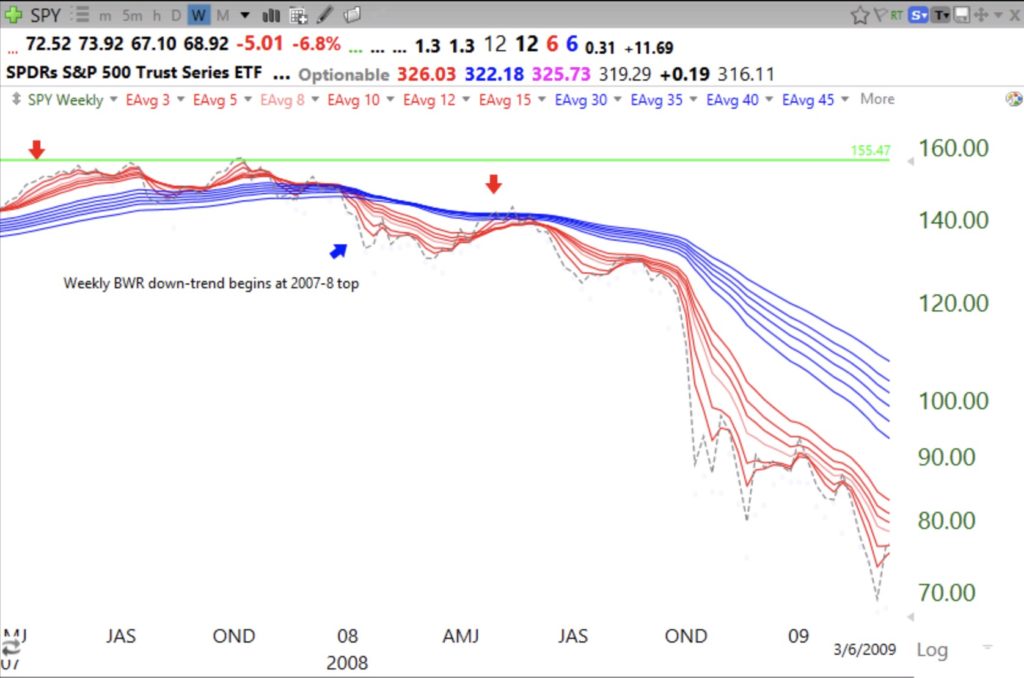

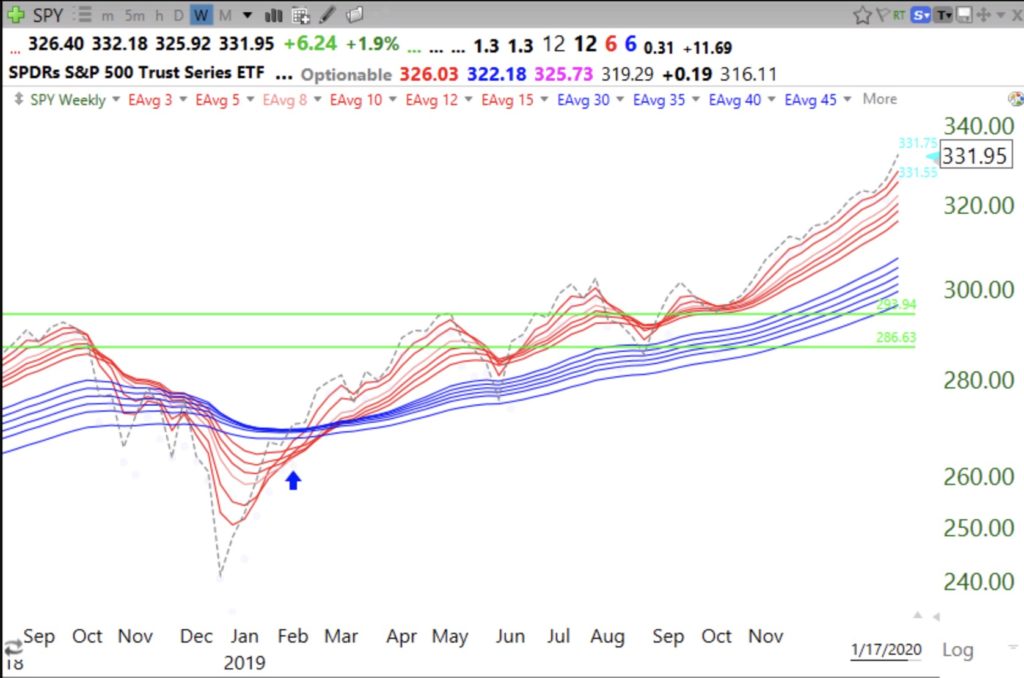

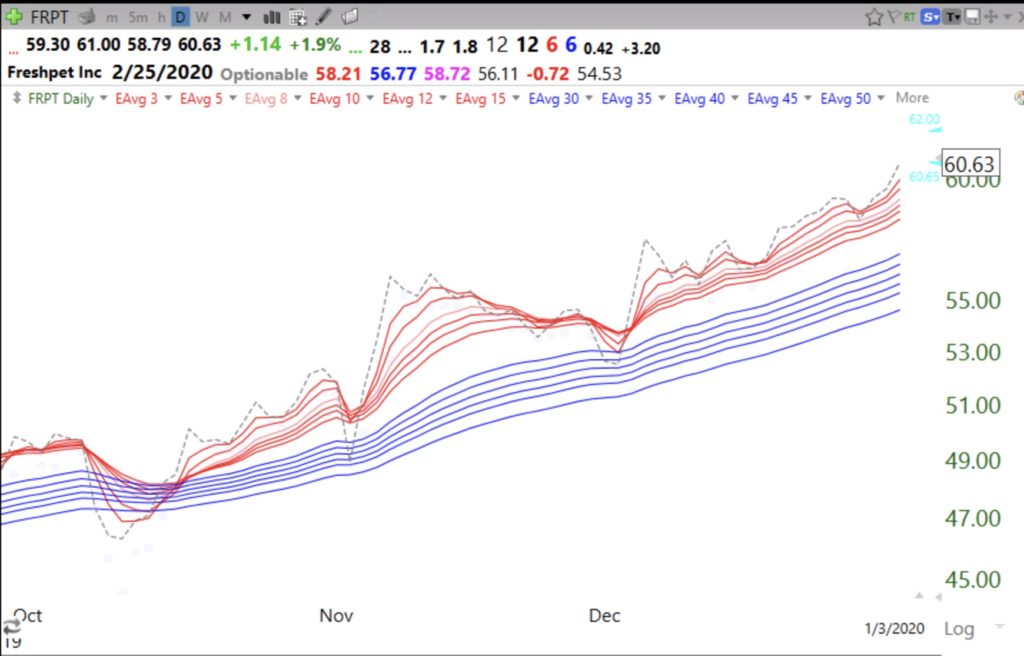

So many media pundits are claiming that the market is too extended and overbought. Ignore the gossip. The truth is no one knows when an up-trend will end until after it has ended. That is what trend followers try to discern. We hop on, after a defined bottom, and off, after a defined top. I like to use my adapted GMMA weekly charts to tell me when a major trend has changed. My modified weekly GMMA has 12 exponential weekly moving averages plus a one period average which indicates each weekly close. The six shorter term averages are red and the the six longer averages are blue. The 13th one period average is a gray dotted line. All averages are drawn on a white background with the actual prices in white and therefore invisible. A strong up-trend is defined as one in which all of the red averages are rising above the rising blue averages such that there is a white space between them. This pattern I call a weekly RWB up-trend pattern. A down-trend is the reverse and is called a BWR pattern. A trend is in jeopardy when the white space between the red and blue lines disappears. Below are the weekly GMMA charts from the 2000 and 2007-8 market tops of the SPY. Look how easy it is to see the change in the market’s trend from up to down. Now compare these two market tops with the current weekly GMMA chart of the SPY. A BWR pattern began in 2018 but it quickly ended. Does it look like a top is imminent now? One of the best early warning signs of a down-trend occurs when the index’s dotted line closes below all of the red and blue lines. A possible sign of a new up-trend occurs when the dotted line closes back above all of the red and blue lines. I prefer to ignore the pundits and let the market show me its intent…….

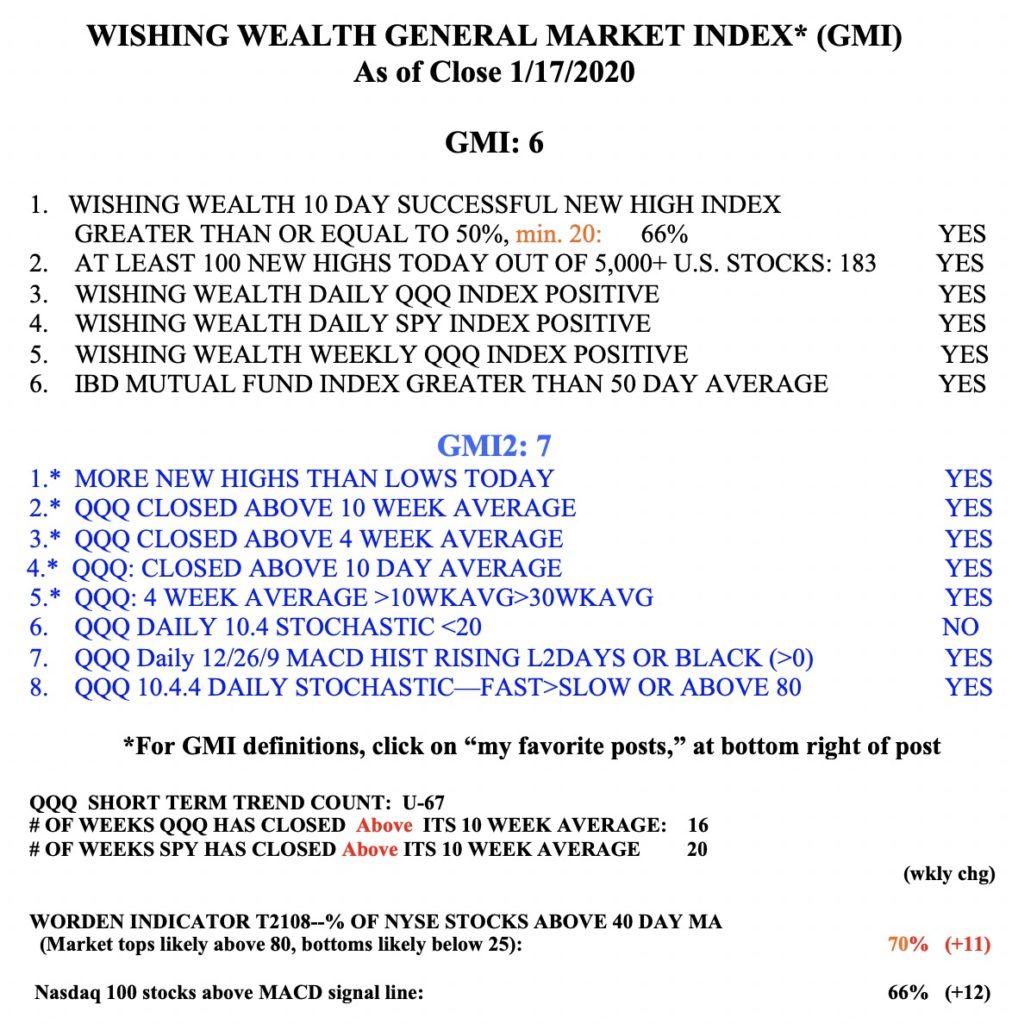

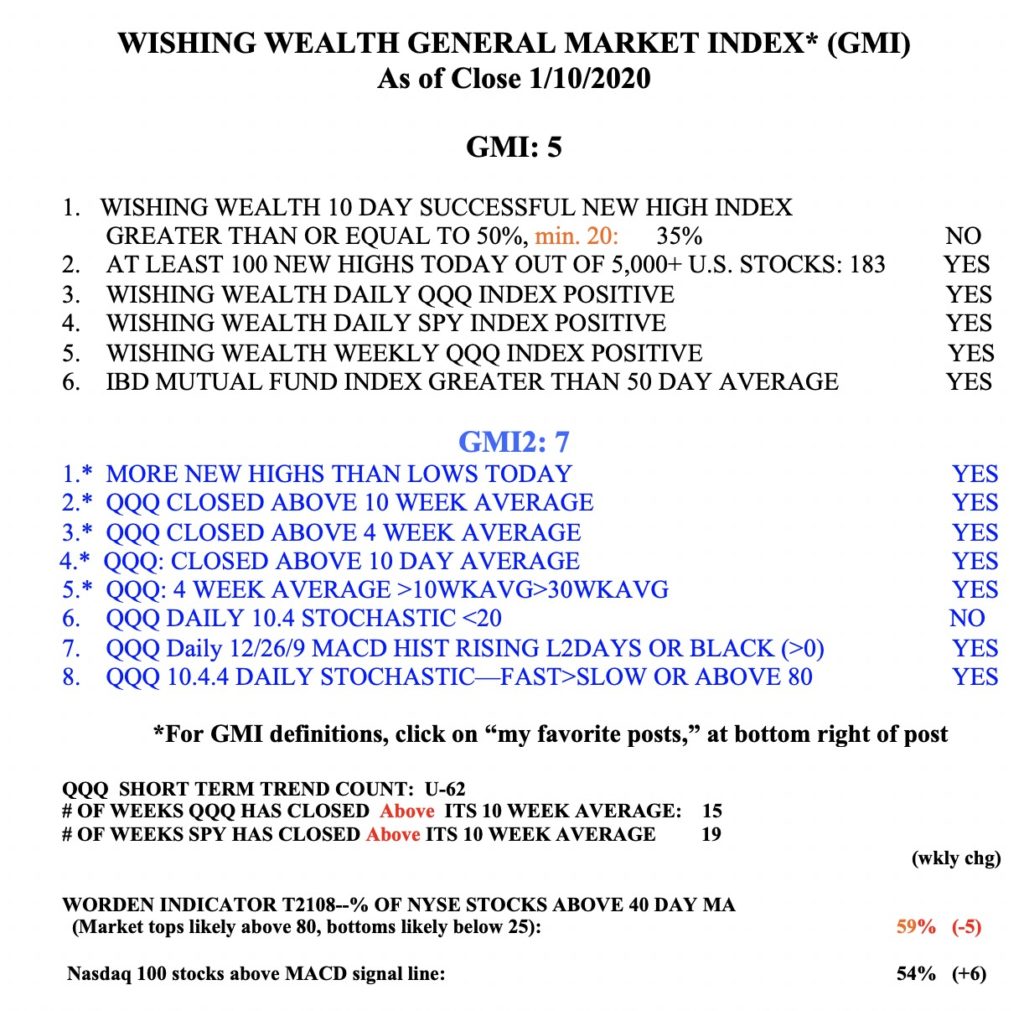

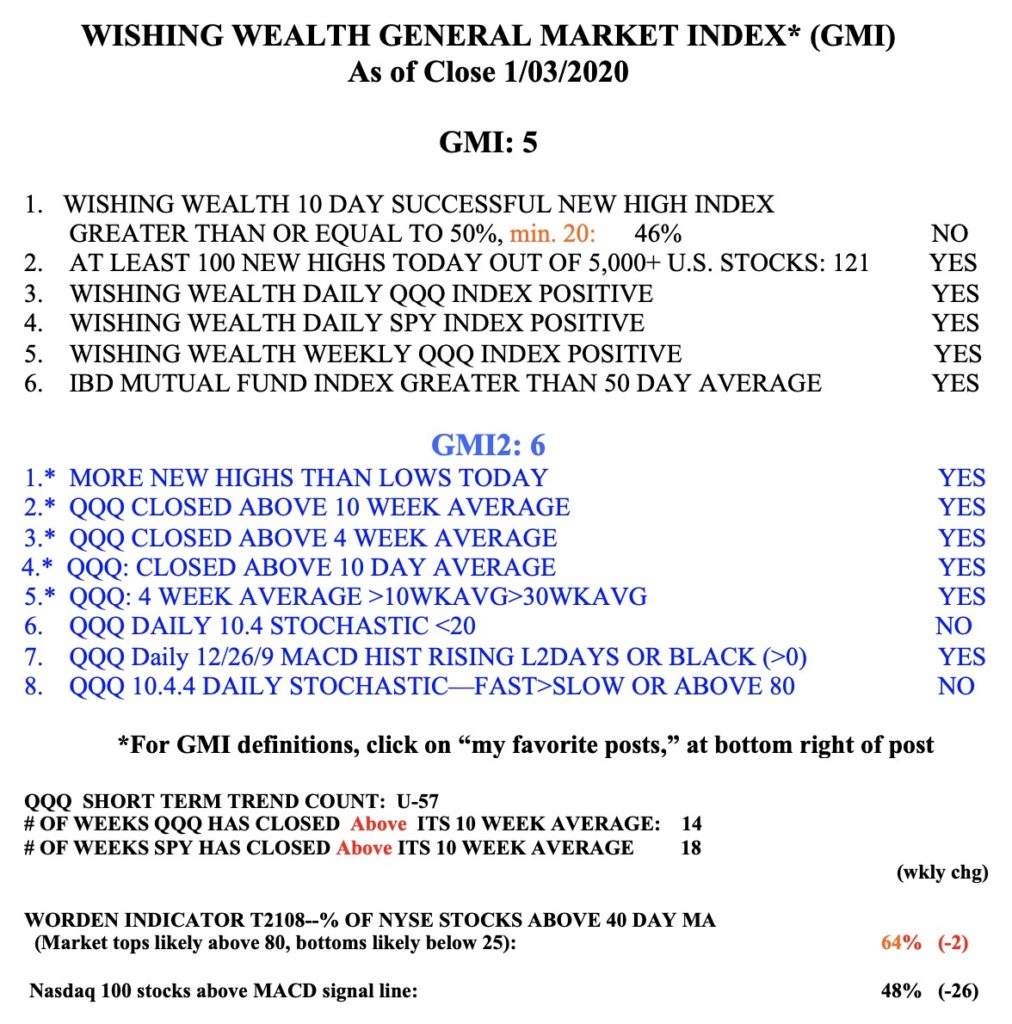

The GMI remains Green and registers 6 (of 6). Friday was the 67th day (U-67) of the current QQQ short term up-trend. The longest QQQ short term up-trend since 2006 was 88 days.