This is a strange market lately. The majority of the 9 market leaders I track are below their 30 day averages and far from their 52 week highs. Two are at new highs (PCLN and BIDU). Perhaps the leaders have completed their bull market run and have topped, while others will rise for a while and top. I do know that the Dow 30 (ETF, DIA) was strong on Thursday. For now, it looks like tech stocks are trailing the large caps. The QQQ completed the 13th day of its short term down-trend on Thursday. A few more up days could turn the trend around. Meanwhile, IBD continues to call the market in a correction. This rebound from the March lows has come on insufficient volume to convince IBD editors that the correction is over.

All Posts

GMI: 2; 12th day of QQQ short term down-trend

I remain cautious. The QQQ is still in a short term down-trend, but the DIA is showing some strength. The tech stocks are simply weak right now. Some of the growth leaders I track are showing strength: BIDU, NFLX, PCLN, AZO. The longer term trend of the market remains up, and I am waiting for signs that the current short term down-trend is ending.

11th day of QQQQ short term down-trend; in cash and short; submarine stocks

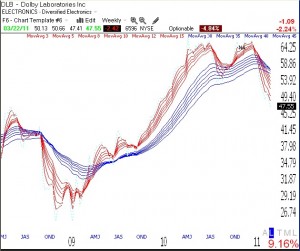

The down-trend continues and the market remains in a correction, according to IBD. I ran my submarine scan to look for possible weak stocks to short. Among the stocks I found are: MICC, AKAM, PVH, SAN, HSP, VCI, CTRP, CREE, DLB. I short stocks in my IRA by buying deep in the money puts. Once the stock falls I often buy shares to lock in the gain and ultimately put them to the option seller at the strike price. Note that DLB now has a BWR pattern, with all of its shorter term averages (red) below its longer term averages (blue). Click on weekly chart to enlarge. BWR is a submarine pattern.