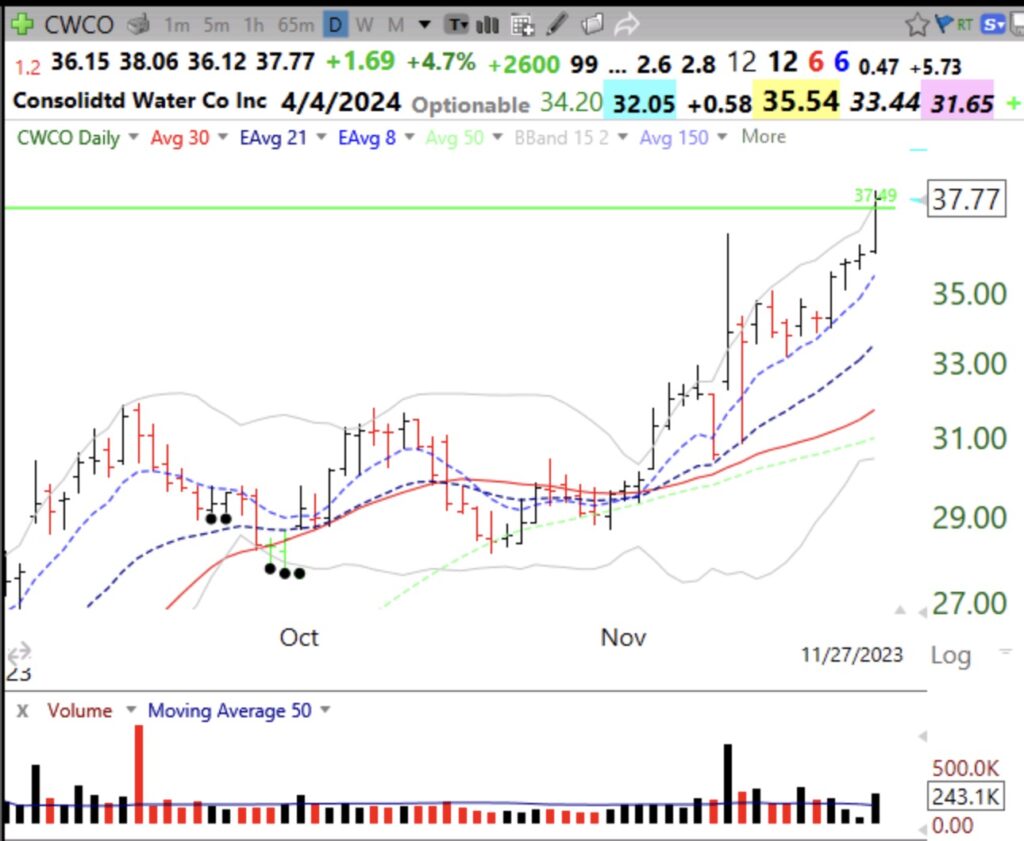

In addition to its GLB today, CWCO caught my eye because it is expected to have earnings in 2023 up +220%. It has also almost tripled its yearly low. MS Accum/Dist rating=A+. Someone is accumulating this stock. Maybe there is a future in seawater desalination? It must not close back below the green line, at 37.49. If it does, that would be a failed GLB and I would sell immediately. If that happens I would buy it back if it closes back above its green line. Note the above average volume up days (black bars) recently on the daily chart.

All Posts

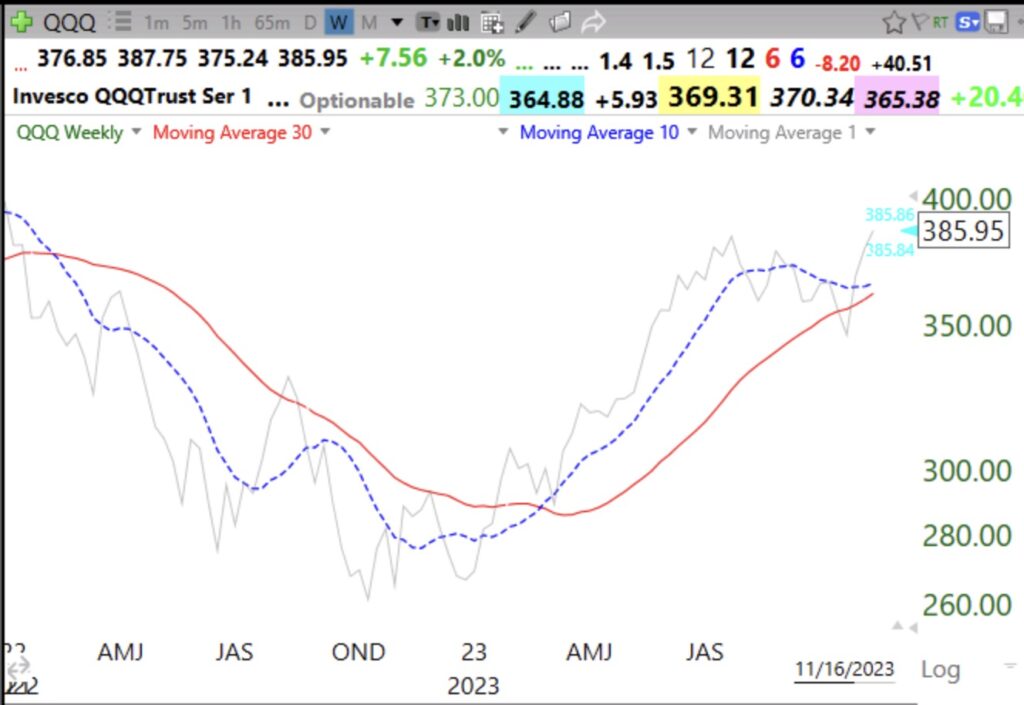

Blog Post: Day 10 of $QQQ short term up-trend; 10:30 weekly chart shows that $QQQ remains in a Stage 2 up-trend after a brief head fake, see chart and a confession

QQQ dipped below the 30 week average and then climbed back above it and the 10 week average (dotted line). I got scared out, instead of waiting for the 30 week average to curve down. That is the signal I waited for before successfully exiting at the beginning of large declines. Nearing retirement, I get spooked more easily these days. QQQ remains in a Stage 2 up-trend. Gray solid line is the weekly close.