Still waiting to see if this base will hold. I hope Steve Jobs recovers.

All Posts

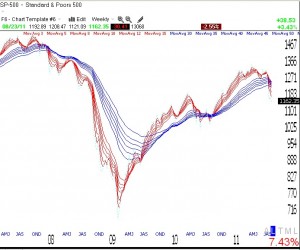

IBD says market in confirmed up-trend; GMMA weekly chart of S&P 500 ominous; still in cash

With IBD calling Tuesday’s rise on higher volume a follow-through day since the recent bottom, they now designate the markets as being in a confirmed up-trend. My indicators are still a long way from saying that, as Tuesday was the 15th day of the current QQQ short term down-trend. IBD has been quite good at calling the trend change, so I will have to wait to see if they are correct this time. However, they always caution that while all up-trends begin with a follow-through day, not all follow-through days lead to a solid up-trend.

Only time will tell if this new base will hold. I remain almost 100% in cash. This weekly GMMA chart of the S&P 500 index still looks pretty ominous, with the shorter term averages (red) descending below the longer term averages (blue). Click on chart to enlarge.

14th day of QQQ short term down-trend; Huge premium on AG calls

The QQQ short term down-trend completed its 14th day on Monday.

I spoke with my stock buddy, Judy, on Monday. She bought some AG shares and is selling calls on them. Check out the huge premium (8%, 13%) you can get on Sept or Oct 22.50 calls. I would not normally write covered calls in a Stage 4 declining market, but if anything is rising it is gold and silver–for now.