According to IBD, Thursday was a distribution day and when that occurs within 2 days of a follow-through day, the up-trend fails “95% of the time.” My indicators show that the QQQ short term down-trend completed its 17th day on Thursday. This market remains treacherous and it is good to be on the sidelines in cash. It will be interesting to see if Uncle Ben can rescue this market on Friday. Irene may have something to say about that too.

All Posts

16th day of QQQ short term down-trend; Best Wishes to Steve Jobs

Still waiting to see if this base will hold. I hope Steve Jobs recovers.

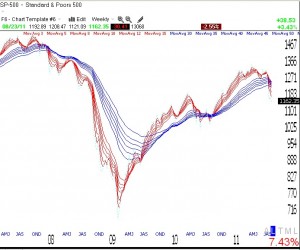

IBD says market in confirmed up-trend; GMMA weekly chart of S&P 500 ominous; still in cash

With IBD calling Tuesday’s rise on higher volume a follow-through day since the recent bottom, they now designate the markets as being in a confirmed up-trend. My indicators are still a long way from saying that, as Tuesday was the 15th day of the current QQQ short term down-trend. IBD has been quite good at calling the trend change, so I will have to wait to see if they are correct this time. However, they always caution that while all up-trends begin with a follow-through day, not all follow-through days lead to a solid up-trend.

Only time will tell if this new base will hold. I remain almost 100% in cash. This weekly GMMA chart of the S&P 500 index still looks pretty ominous, with the shorter term averages (red) descending below the longer term averages (blue). Click on chart to enlarge.