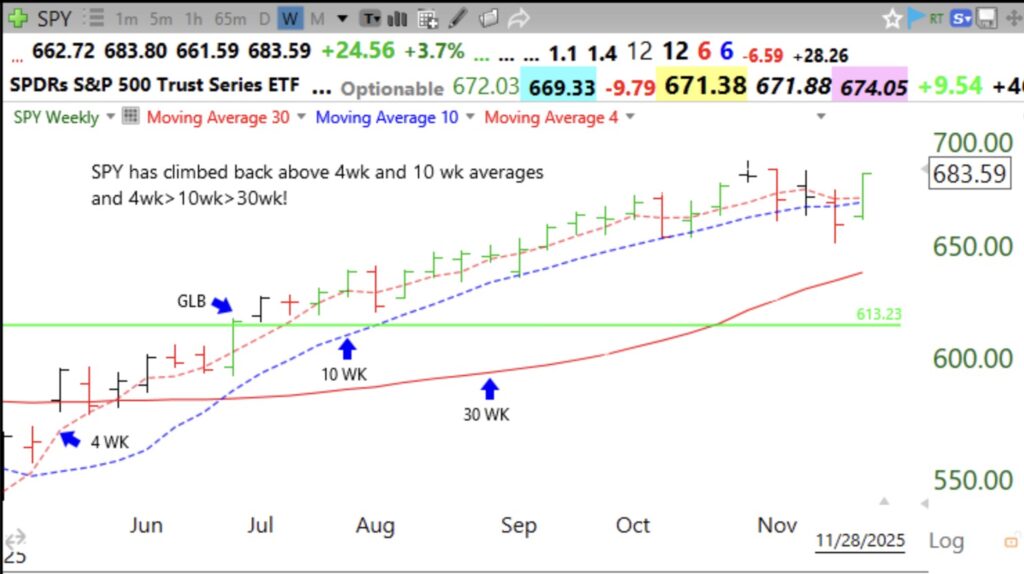

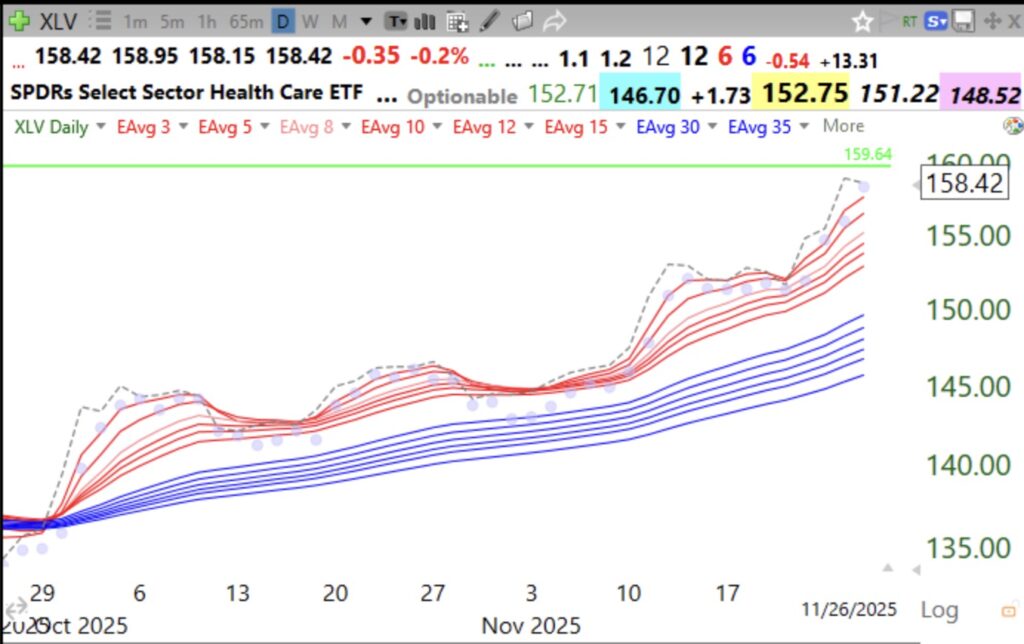

This morning AMAT crossed above its green line and TC2000 sent me an immediate alert. I bought a little and sent out a tweet containing a chart of AMAT. If you want to receive my intraday tweets, follow me on X, @WishingWealth. The green line was drawn at $255.89 and AMAT closed at $265.33 on above average volume. Remember, if a GLB (green line breakout) CLOSES back below its green line anytime it is a failed GLB and I immediately exit. I often repurchase it if it closes back above its green line. On TC2000, draw the green line on a monthly chart at the highest bar that has not been exceeded for at least 3 moths (bars). Then right click on it to set an alert if the stock crosses above it. I am slowly accumulating $TQQQ as the new QQQ short term up-trend matures. A discussion of the GLB appears at my recent TraderLion presentation here.