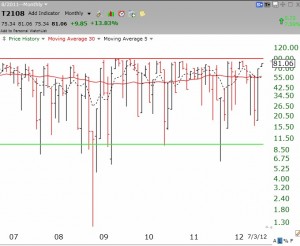

The monthly chart of the T2108 below shows it to be near overbought territory. While the T2108 can stay up there for a while, it is worth noting that this pendulum of the market is close to as high as it ever gets, signified by the horizontal red line. Click on chart to enlarge.

All Posts

11th day of QQQ short term up-trend; adding to longs

Stocks held up well on Monday. A lot of my stocks hit new highs, including ASPS, ALXN, DDD. AAPL is akso coming alive as we approach second quarter earnings. This market looks like it wants to go up. I bought some QLD and will average up slowly. There is an abbreviated trading day on Tuesday.

9th day of QQQ short term up-trend; strong end of 2nd quarter? Impact of AAPL wage increases

The GMI buy signal has been in place since June 19, and Thursday was the 9th day of the short term up-trend in the QQQ. This has been a very volatile period and I have struggled to follow these signals. I have been in and out of the market and remain mainly in cash in my trading accounts. I am fully invested in mutual funds in my university pension, however, because there are rules limiting my ability to go back and forth from mutual funds to a money market fund.

This morning the index futures are significantly above fair value so it looks like we will get a bounce as the market closes out the second quarter. We will then move into the period just prior to the release of second quarter earnings. Stocks will be driven according to individual earnings expectations, announced 2nd quarter results and company thoughts regarding their outlook for the future .

I am not trading AAPL right now. While the stock often does well near the release of earnings, I suspect the recent news about their raising wages of their sales force may limit future earnings growth. There could be a reduced forecast coming. We need to be careful.