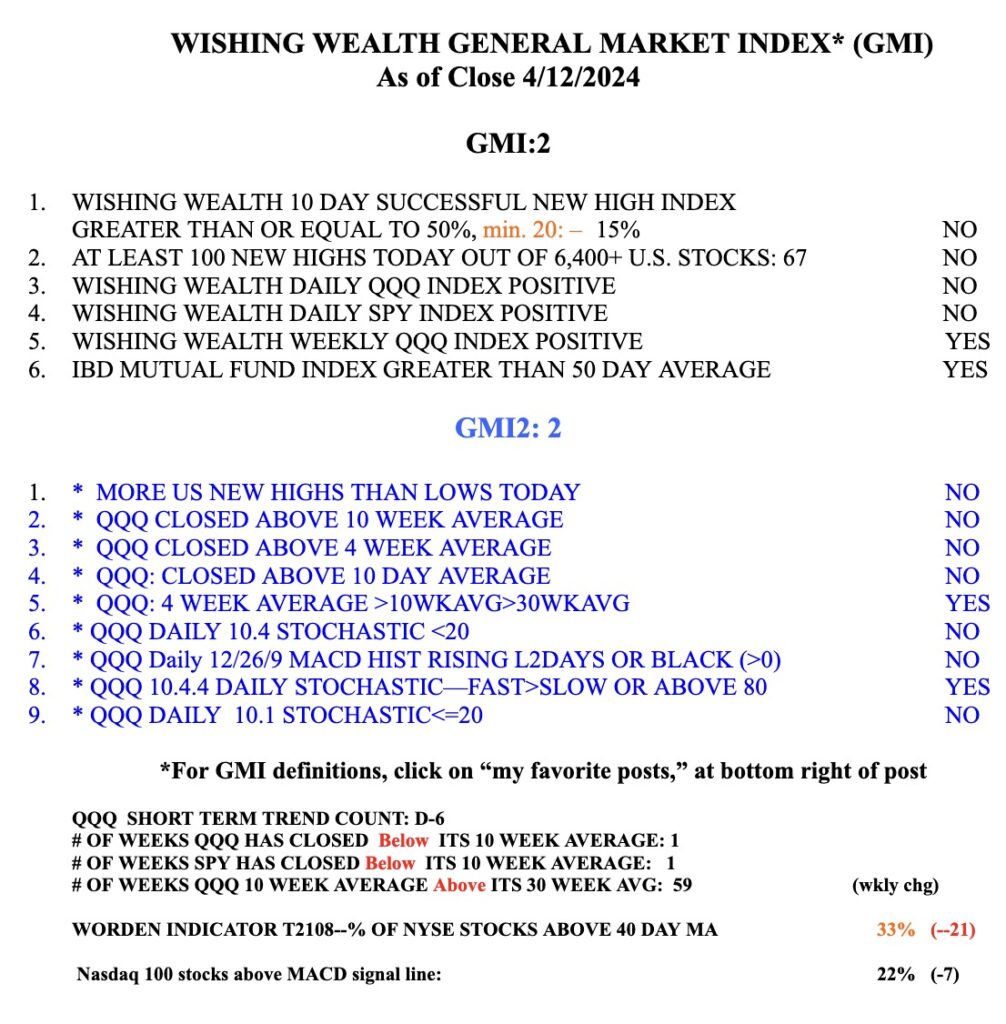

As I indicated in a tweet, @wishingwealth, intraday last Friday, I went to cash in my trading account. Too many breakouts have failed. GLD looked like it had experienced a high volume reversal. SPY and QQQ have now closed below their 10 week averages. Another weak day will turn the GMI to Red. I will wait to see if we get a strong earnings related bounce this week. This market is not acting well enough for me to take on long positions. Sell in May is almost upon us.