I noticed that the QQQ short term trend was turning down on Monday and so I sold some positions and hedged others with put options. We are in the period when earnings are mainly out and we often see a decline until 2nd quarter is over and earnings begin to come out in early July. IBD still sees market in confirmed up-trend.

All Posts

18th day of $QQQ short term up-tend; waiting for July, $AMBA shines

While the longer term up-trend remains intact, I have reduced my long positions in my active trading accounts. My longer term university pension accounts remain invested long in mutual funds. I am still expecting some weakness in June while we wait for the release of second quarter earnings in July.

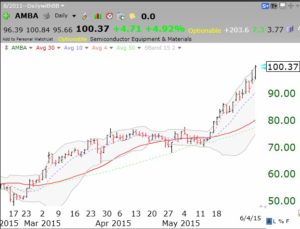

On the other hand, IBD says the put/call ratio reached over 1 on Thursday, indicating a lot of bearish option trades and a place where the averages tend to bounce up. Maybe Thursday’s decline was over-done. AMBA sure held up, showing that people are still following good earnings news.

17th day of $QQQ short term up-trend; interest rates spike

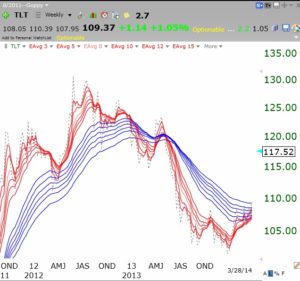

I do not like the weakening in the bonds. TLT is the ETF for the 20 yr Treasury bonds. The RWB up-trend is over and the shorter averages (red) are moving below the longer term averages. As TLT declines, interest rates rise.

The last time we got an interest rate hike scare was 2013.

The last time we got an interest rate hike scare was 2013.

The market did not tank, but it may this time. Since 2nd quarter earnings are now released, I suspect we will get a lull with a weak market until July and earnings come again. I have taken a lot of money off of the table….

The market did not tank, but it may this time. Since 2nd quarter earnings are now released, I suspect we will get a lull with a weak market until July and earnings come again. I have taken a lot of money off of the table….