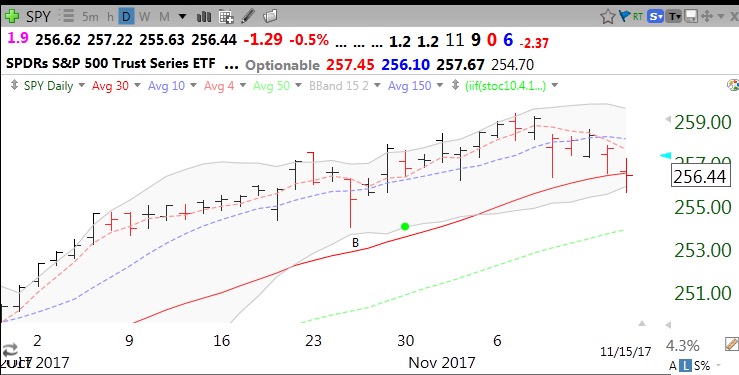

Among US stocks, more new lows than highs and only 105 new 52 week highs on Wednesday, lowest since late August. However, SPY and DIA are in short term support territory. This daily chart shows that the SPY just kissed its lower 15.2 daily Bollinger Band, an important area of support. If this bounce fails, I expect more weakness. But remember, we are near the period when the end of quarter mutual fund window dressing rally in the strongest stocks should begin.