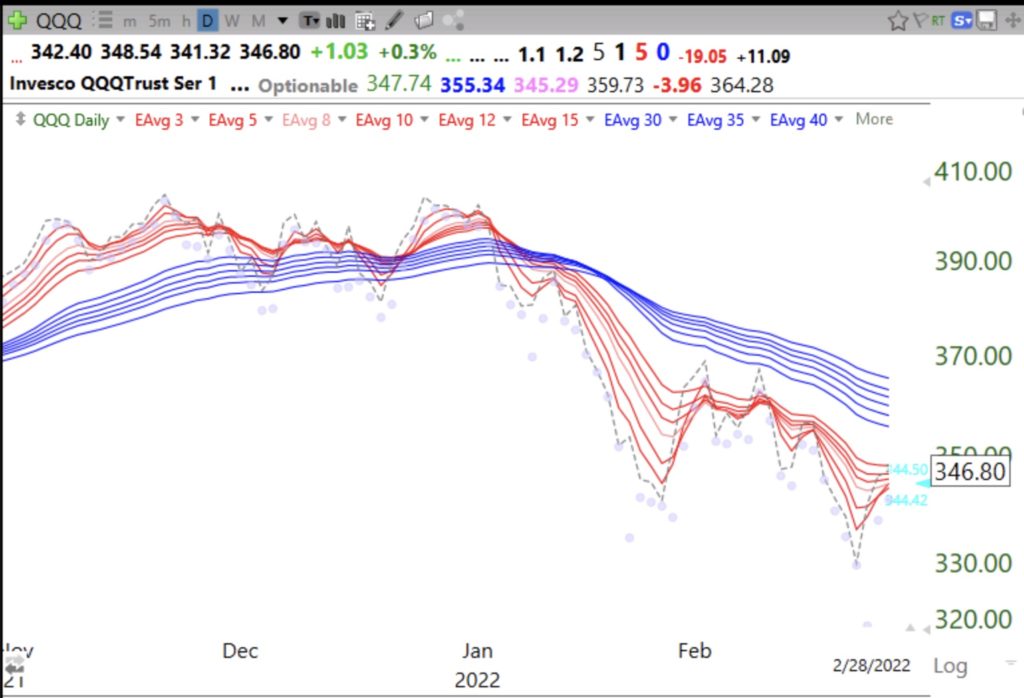

DIA and SPY also in daily BWR down-trends, not shown.

All Posts

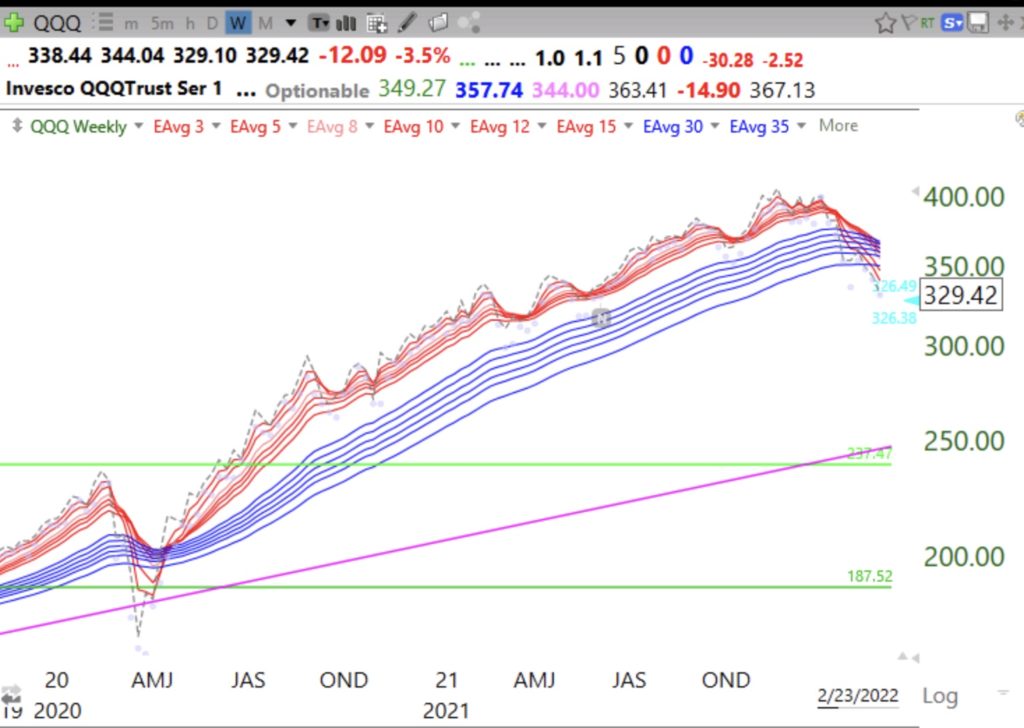

Blog post: Day 33 of $QQQ short term down-trend; Weekly RWB up-trend now over, see chart; IBD calls correction

This decline is just getting started. It is not even as steep as the 2020 decline. Let’s see if it turns into a BWR down-trend pattern. Thus far, T2108, now at 21%, is still too high for a bottom. If T2108 falls below 10%, I hope to have the courage to buy a little SPY. I never do and I miss the bottom. It is so nice to be in cash…….(I told you when I got scared in November)