I wrote yesterday that the indexes were at oversold levels where they typically bounce. Let’s see if the Fed takes away the punch bowl……

All Posts

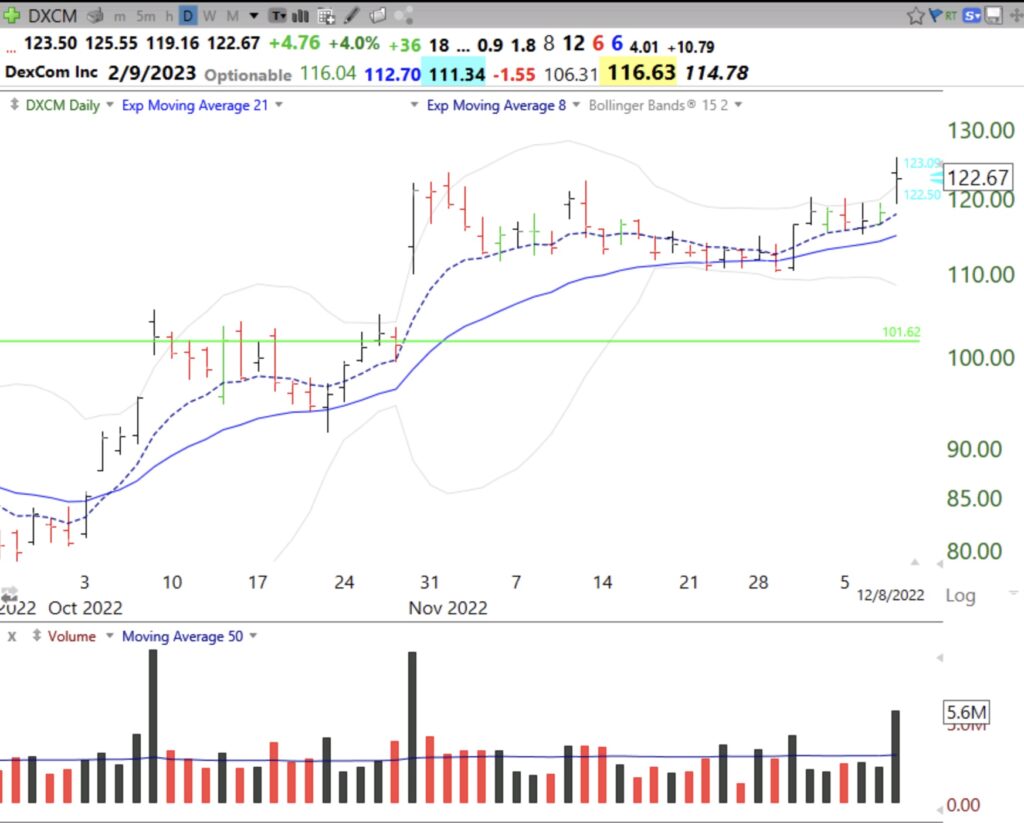

Blog Post: Day 17 of $QQQ short term up-trend; 81 new US highs, 326 lows; $QQQ and $SPY return to their key 30 day moving averages but are also very oversold–will they hold Wednesday?

SPY and QQQ have become very oversold and are right on their key rising 30 day averages. Wednesday’s action should tell me whether they will hold. If not, the QQQ short term up-trend could end Thursday.

This chart shows today’s price hitting the 30 day average (red solid line).

The same is true of SPY.

Both indexes have daily 10.1 stochastics well under 20, a level where they often bounce. If QQQ holds the 30 day I will buy a little TQQQ on a bounce. These indexes are also close to their bottom 15.2 daily Bollinger bands, another place where they tend to find support.