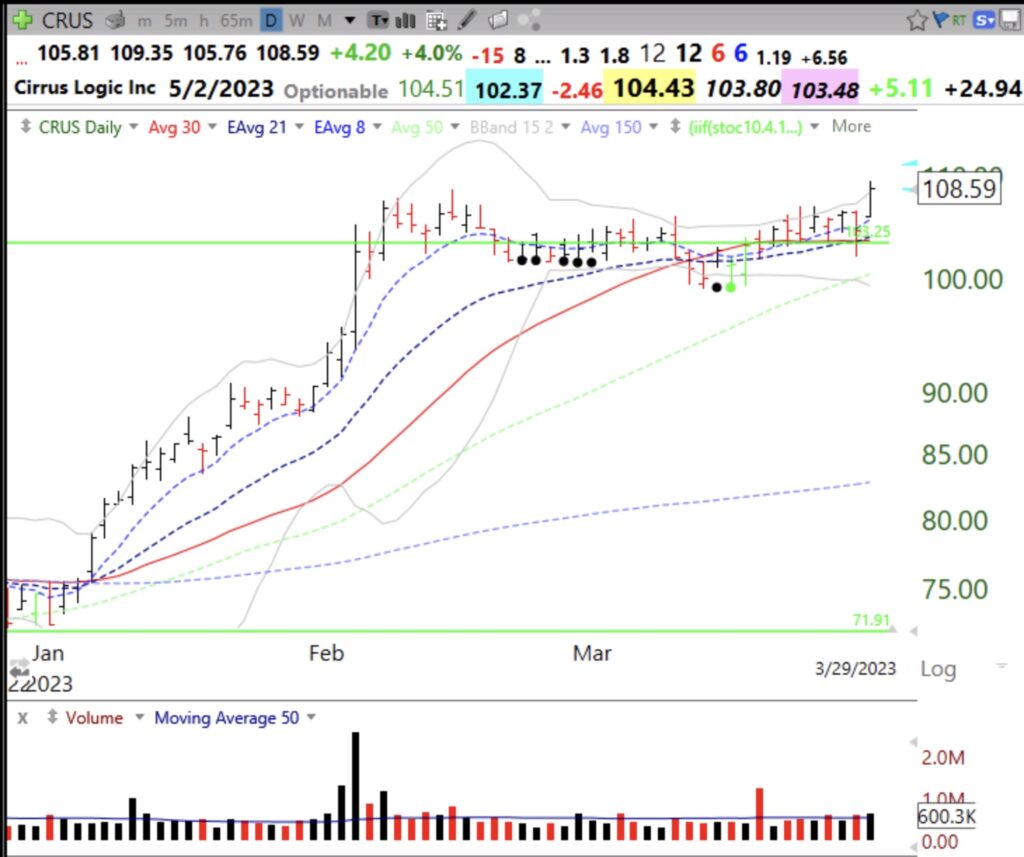

Stocks reaching ATHs at the beginning of a market up-trend may turn out to be new market leaders. After a GLB in early February, CRUS consolidated around its green line for 7 weeks and broke out to an ATH on Wednesday. See daily, weekly and monthly charts.