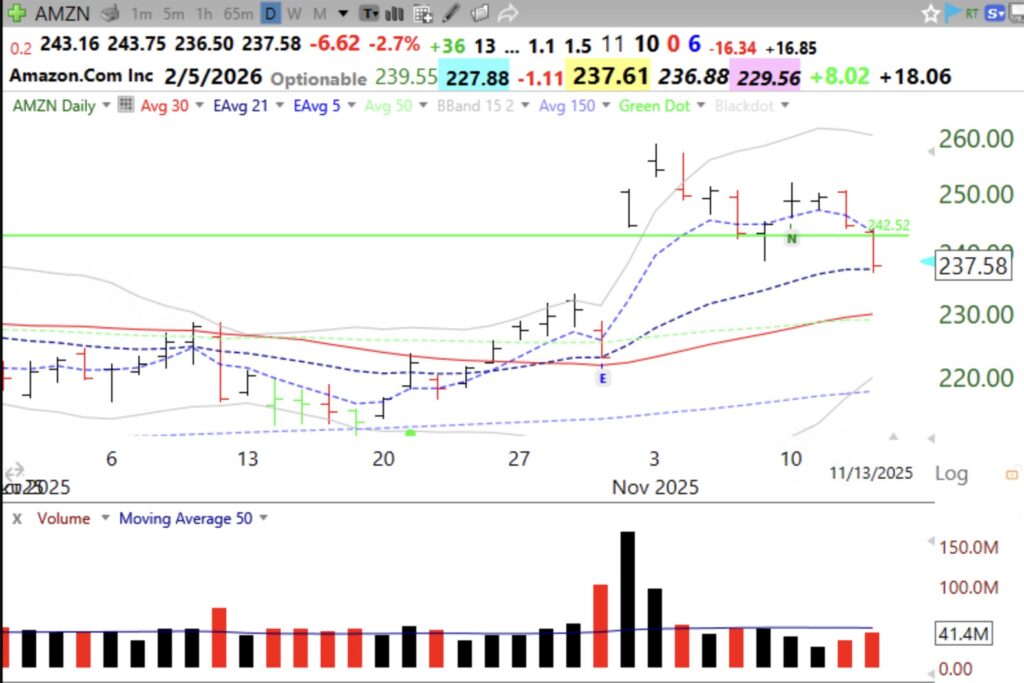

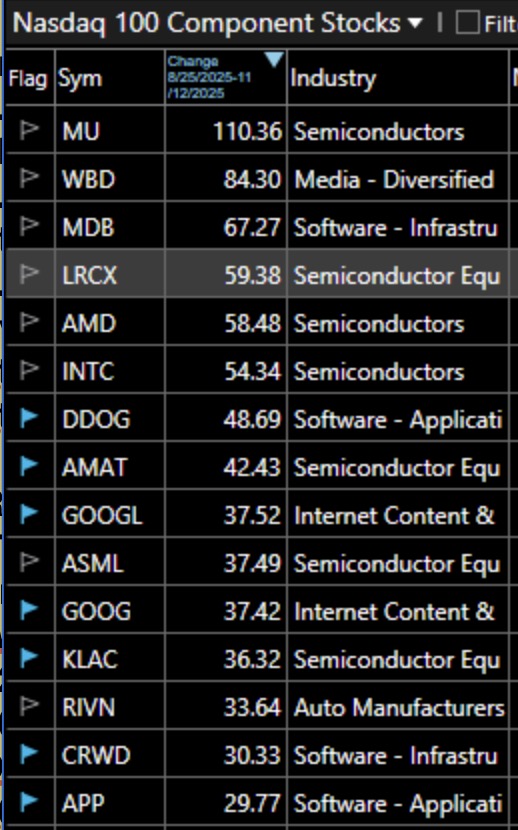

Many tech leaders are being slaughtered. Many breakouys are failing. Not just techs are weak. See this failed GLB by AMZN after its large volume earnings gap up on 10/31. To remain a successful GLB, the stock must not close back below the green line. I am mainly in cash in my trading accounts, while holding a little SQQQ. I will add more SQQQ with continued weakness in QQQ on Friday and the start of a short term down-trend. I will accumulate SQQQ very slowly. Many new QQQ short term down-trends have ended within 5 days. I will add more after 5 days or go back to TQQQ with the start of a new short term up-trend. GMI is down to 3 (of 6).