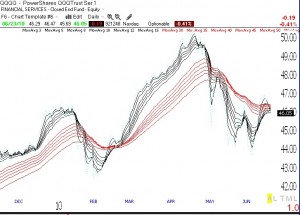

The QQQQ short term up-trend completed its 6th day on Wednesday. Still, the QQQQ is sitting right on support and the SPY and DIA are in down-trends. This is a good time to sit on the sidelines, in cash. The multiple moving average daily chart of the QQQQ below, a chart type made famous by Daryl Guppy (see his book to lower right), shows that all 12 moving averages are converging, indicating that the QQQQ has been flat over all of these periods. (For example, the average of the closes over the past 5 days is about the same as the average of the closes over the past 50 days). Click on chart to enlarge. In a market like this it is very difficult to ride a trend. The key is to trade only when one has an edge.

All Posts

GMI falls to 2; Up-trend in doubt; Remain very defensive

There is again a split in the market between the nonfinancial tech stocks in the QQQQ and the big cap industrial stocks, reflected in the Dow 30 and S&P500 indexes. A similar split occurred in the 2008 decline, when financial stocks tanked. These indexes are in down-trends, even as the QQQQ remains in a short term up-trend. But the QQQQ daily and weekly up-trends are now also in danger of ending. I am going largely to cash and setting stop losses very close to support. We might get that head and shoulders top I have been discussing. This is not the time to be brave. Better to conserve cash and wait on the sidelines for signs of a real up-trend.

GMI holds at 4; UNG breaks up-trend

In spite of the reversal on Monday the GMI remains at 4 and the GMI-R, at 7. UNG closed below its 30 week average and the Stage 2 up-trend is now in doubt. Monday was the 4th day of QQQQ short term up-trend (U-4).