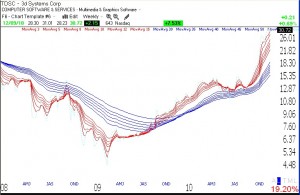

I thought I would mention a stock that my stock buddy, Judy, recently told me about. Judy, who trades on concept and technicals, likes TDSC. Judy is an avid reader and she thoroughly researches emerging technologies, looking for interesting stocks. She is patient and usually buys new technologies long before others discover them. So, I bought a little of TDSC to hold for a while. Note that TDSC also already has a weekly RWB rocket stock pattern. It recently broke out of a 14 year trading range, but is well below its all-time high of $51 reached in 1989. You may want to go ahead and research TDSC.

All Posts

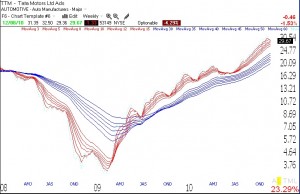

Retraction of my comments on TTM

This morning I spoke with my stock buddy, Judy, who is a shrewd concept trader. When I mentioned today’s post on buying TTM on a bounce, she cautioned me that the company’s story had turned terrible. She discovered that some of the economic actions of India’s government were hurting TTM’s sales of low cost autos. I therefore would not buy TTM even on a bounce.