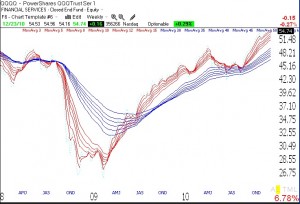

Chances are we might have some more strength in the leaders of the past year, as mutual funds close out their 4th quarter portfolios. The funds want to hold winners and shed the losers. Thursday was the 24th day of the current QQQQ short term up-trend. As this weekly GMMA chart of the QQQQ shows, the Nasdaq 100 index remains in a strong RWB up-trend.

All Posts

QQQQ completes 23rd day of short term up-trend; riding QLD

All of my GMI and GMI-R indicators remain positive. I have therefore been riding QLD for a long time. QLD strives to rise (or fall) twice the amount that QQQQ does. I typically accumulate my position in stages once the QQQQ short term up-trend turns positive. When it turns negative, I phase into QID, the inverse QQQQ ultra ETF, which aims to rise twice as much as the QQQQ declines. I accumulate my position in stages so as to reduce my risk if the market suddenly changes its trend. Since the start of the current QQQQ short term up-trend on November 19, the QQQQ has risen +4.6%, while the QLD has risen +9.7%. The more volatile 3X technology bull ETF, TYH, has risen +14.1% during the same period. It is often easier and more profitable to just ride these ultra index ETF’s than to attempt to find an individual stock that will beat them. It all depends on whether one is in the market to look smart or to make money–the two are often mutually exclusive endeavors.

ARMH cup-with-handle break-out

Well, I do not frequently talk about specific stocks that may break out. However, yesterday I wrote that ARMH looked like a possible cup-with-handle base. Go back to Monday’s post and look at the daily chart of ARMH. Then look at Tuesday’s chart below. ARMH lost no time breaking above the handle high (horizontal red line). Given the increased share volume on Monday, this may be the beginning of a nice rise.