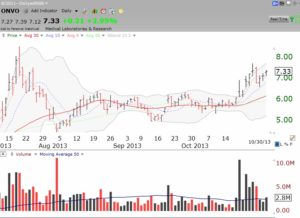

ONVO has risen 9 of the last 10 days. ONVO is in the exciting 3D bio-printing business. It broke out on high volume 8 days ago. ONVO is very speculative and I have a small position.

Dr. Wish

Dr. Wish

13th day of QQQ short term up-trend; JCI: green line break-out

All of my GMI and GMI-2 components are positive. JCI reported record earnings and had a large volume green line break-out on Tuesday. Check out its daily chart.

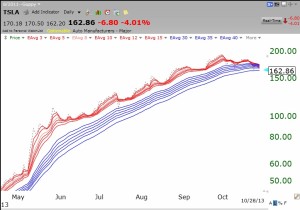

12rth day of QQQ short term up-trend; TSLA head and shoulders top?

Is TSLA forming a head and shoulders top? Check out this daily chart. TSLA may be on the neckline. A penetration could lead to a sharp sell-off.

This daily GMMA chart shows that the RWB pattern is gone, with the shorter averages (red) about to cross below the longer averages (blue).

This daily GMMA chart shows that the RWB pattern is gone, with the shorter averages (red) about to cross below the longer averages (blue).