Keeping an eye on AAPL, which I continue to own. It is trading at the equivalent of around $92 if it were to split now. Once the split shares trade next Monday, how long will it take to reach $100 per share, equaling $700 on the unsplit shares? I would not be surprised to see AAPL zoom over $100, especially by the end of the 2nd quarter mutual fund window dressing period at the end of June. We shall see……

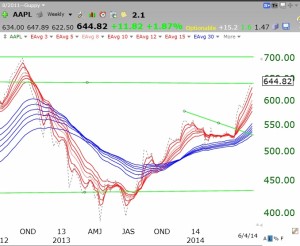

Below is the weekly GMMA chart of AAPL. It clearly continues in a RWB rocket pattern, which I first wrote about last November. Click on chart to enlarge.