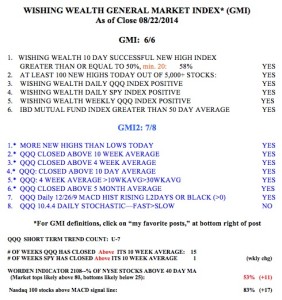

GMI remains at 6 (of 6).

Dr. Wish

Dr. Wish

7th day of $QQQ short term up-trend; Cramer gets, then loses religion!

I wrote in In 2009, after many of the stocks that he had advocated had fallen, that Jim Cramer had finally got religion and embraced technical analysis. For many prior shows he had called chartists “morons.” He learned the hard way that buying good companies during a bear market was foolish. Hence his new found respect for chart reading.

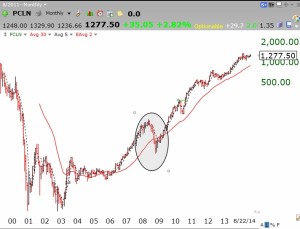

I think Cramer slipped back last week when he listed the performance of a number of stocks that beat GOOG (+799%) in the 10 years since it came public in 2004. Among the stocks that he mentioned were PCLN (+ 5662%), GMCR (+8448%), MNST (5619%) and ALXN (+3638%). The implication was that if one had just held these stocks over the past 10 years one would have done very well indeed. What could be easier! Just buy great companies and hold on through hell and high water. What he failed to mention was that each of these stocks experienced sizable declines in this ten year period. For example, GMCR hit a peak of 115.98 in September, 2011 and then fell to 17.11 by July 2012. Who in their right mind should have held onto their GMCR through that one year 85% decline from its peak? PCLN experienced a 69% decline from its peak in the 2008 bear market. And look what the bear did to it in 2000-2002. The person who bought PCLN at the peak in 1999 and held on during that decline would have waited until 2013 to BREAK EVEN!

In fact, all of these stocks experienced one or more large declines during this 10 year period. If anyone holds a stock through a large decline, there is no guarantee it will come back like these winners did. Remember Enron or Radio Shack (RSH)? In my opinion, I still need technical analysis to tell me when I should exit even a good company. Or maybe I am just a moron….

Meanwhile, the GMI remains at 6 (of 6). I am long some stocks in my trading accounts, but I also own puts on these stocks to protect myself against any sudden declines. In 2009, I wrote a tutorial on buying puts for insurance.

6th day of $QQQ short term up-trend

All of my market indicators remain positive.