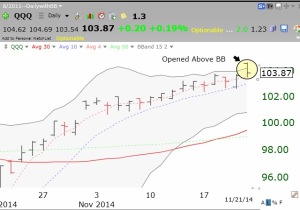

The three market index ETFs I follow (DIA, QQQ, SPY) all opened outside of their upper daily 15.2 Bollinger Bands and closed back below them. This may represent extremely over-bought conditions. A down day on Monday would likely indicate some retracement of the recent rally will take place. I am therefore very cautious about the immediate continuation of the rally. Check out this daily chart of the QQQ.

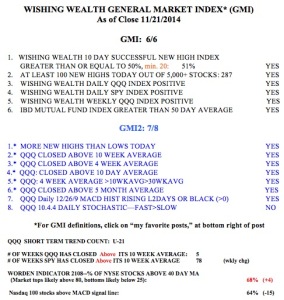

Nevertheless the GMI remains at 6 (of 6).