When the market has a weak day, it is important to find the stocks that resist the decline. For example, the recent green line break-out stock FOMX, which I have been following, rose on Tuesday. This is a significant sign of relative strength.

Dr. Wish

Dr. Wish

10th day of $QQQ short term up-trend; $AAPL leading market higher; 5 GLB stocks; GLB in IPOs

With AAPL showing strength, it looks like this market will move higher. Check out AAPL’s daily chart.

And its strong RWB pattern.

And its strong RWB pattern.

Stocks are breaking through their green line tops to all-time highs. Like SYNA

And IMAX

I like to hold stocks that break up through their green line tops (GLB) as long as they stay above their green lines.

I like to hold stocks that break up through their green line tops (GLB) as long as they stay above their green lines.

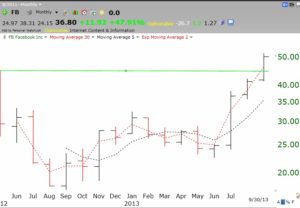

A green line top occurs when a stock reaches an all-time high that it does not exceed for at least 3 months. By definition, an IPO may not have existed long enough to rest for 3 months. I rediscovered what Jesse Livermore once wrote. If an IPO opens strong and then recedes from its peak for a few weeks, buy it when it breaks to a new high. As Jesse said, it means something has changed. FB did this quite a while ago, although it took it almost two years until 2013 (monthly chart) to hit a new high.

SHAK flashed the buy signal much more quickly, after 12 weeks (weekly chart). It pays to watch the IPOs for this truncated GLB pattern.

SHAK flashed the buy signal much more quickly, after 12 weeks (weekly chart). It pays to watch the IPOs for this truncated GLB pattern.

The GMI remains at 6 (of 6).

9th day of $QQQ short term up-trend; $NXPI breaking out?

I watch NXPI because my stock buddy, Judy, likes the concept. It could be breaking out of a cup and handle base if it holds Thursday’s lows. (I own it.)

NXPI is above its green line break-out (all-time high) and has a strong RWB pattern.