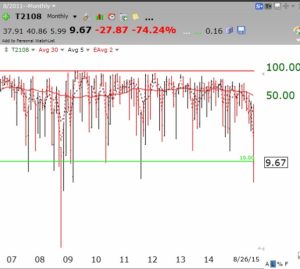

The Worden T2108 indicator measures the percentage of all NYSE stocks that closed above their simple 40 day moving average. When T2108 falls below 10% it is a sign that the market will bounce from a very oversold level. The T2108 was at 6 on Tuesday and at 10 at Wednesday’s close. There have only been a few times T2108 has gone to single digits in the pas 28 years since Worden started tracking it. Here is a monthly chart of T2108 since 2007. In 2008 T2108 got as low as 1.2. In the 2011 decline it reached 6.5. In the 1987 rout it reached its lowest ever, 0.5. One should not start selling when T2108 is below 10.