TLT measures 20 year U.S. treasury bonds. The higher they go, the lower the long term interest rates. Does flight to bonds indicate fear of a market crash or fear of a recession?

Dr. Wish

Dr. Wish

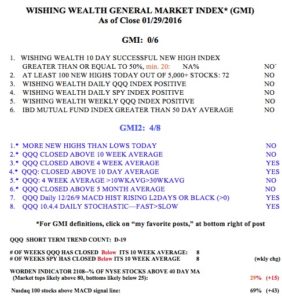

20th day of $QQQ short term down-trend

Bounce continues as earnings are being released. Then what…………..

I am still safely on sidelines.

19th day of $QQQ short term down-trend; $QQQ and $SPY look weak

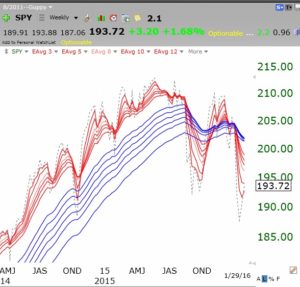

IBD sees renewed up-trend. MY GMI and QQQ short term trend indicators are still pointing to a down-trend. For me, this rise remains a “dead cat bounce” until more of my indicators turn positive. A lot of technical resistance is just above current levels. By the way, I drew the lower horizontal line in this chart months before QQQ found support there in January. We likely will see at least a re-test of January’s lows.

The SPY continues to look quite weak, in a BWR down-trend.

The GMI remains at 0 (of 6) and on a Sell signal since December 10th.

The GMI remains at 0 (of 6) and on a Sell signal since December 10th.