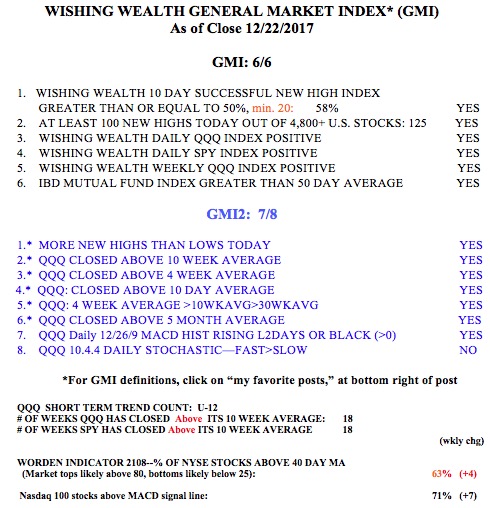

All three major index ETFs (QQQ, SPY, DIA) have their fast stochastic (10.4 daily) below their slow stochastic (10.4.4 daily). For me, this indicates short term weakness. The longer term technicals remain strong for these indexes with the GMI at 6 (of 6).

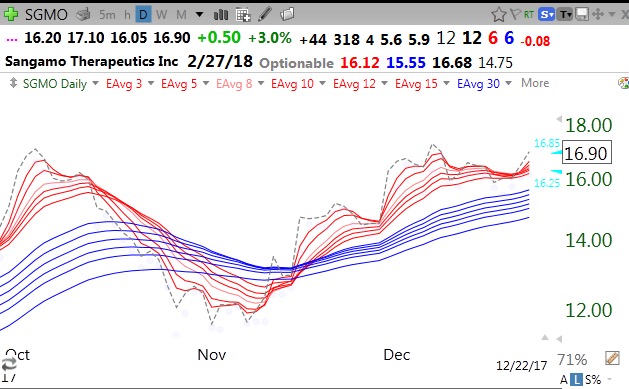

A stock that came up on my RWB scan is SGMO, a biotech. SGMO also looks like a possible cup with handle pattern.

Note that SGMO has now closed back above all 6 red lines and is in a RWB pattern.