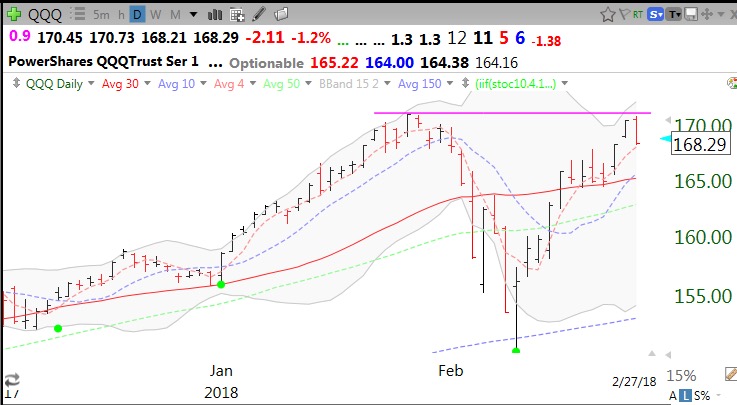

Note that QQQ stopped near prior top yesterday. When will it get through this ceiling? Wait for next green dot signal?

Dr. Wish

Dr. Wish

Rising interest rates suggest market to form top

I have been trading in the market since the 1960s. Over that time I have witnessed many market cycles. The late perspicacious Martin Zweig published a book that educated me about the force that the Federal Reserve’s actions exert on the markets. After the Fed raises interest rates several times the market eventually declines. I observed that when interest rates rise, there is typically a market decline and afterwards people, ever optimistic, believe that the market can survive rising rates or they won’t continue to rise. At some point, however, investors eventually surrender to the rising rates and the market enters a sustained decline. We are now in the period after the bull market euphoria has been dissipated and people are turning their attention to interest rates. Pundits want to believe that the short correction is over and the bull market will resume. Still, every move and utterance by the Fed members will be scrutinized for an indication of how much and how rapidly they will raise rates. The Fed has to raise rates because they had to lower them to historic levels to bring the economy back from the horrendous debacle of 2007-2008. As the economy recovers they want to normalize rates and get most of the bonds they purchased to bring down rates (quantitative easing) off of their balance sheets. The resulting increase in the supply of bonds will reduce bond prices and raise interest rates.

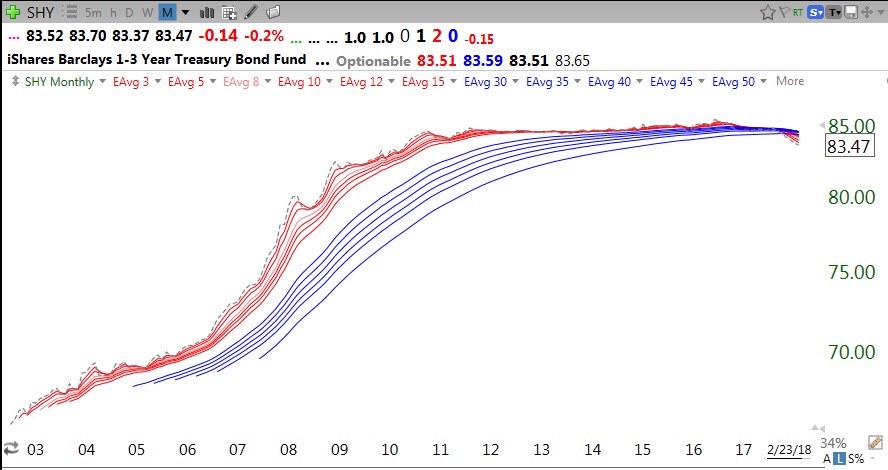

As a psychologist and a chartist, I have found that the best way to predict behavior is to study the behavior itself. I therefore monitor a number of treasury bond ETFs as a way of understanding what is happening. I usually provide daily or weekly RWB charts (see glossary for definitions) to show trends. However, with the bond ETFs, I look at long term monthly RWB charts to see the major long term trends. I do not want to scare you, but these charts tell me that the multi-year RWB rise in bonds and corresponding decline in interest rates is over and bonds may be entering a significant BWR down-trend pattern. Note the huge RWB pattern in SHY through about 2013.

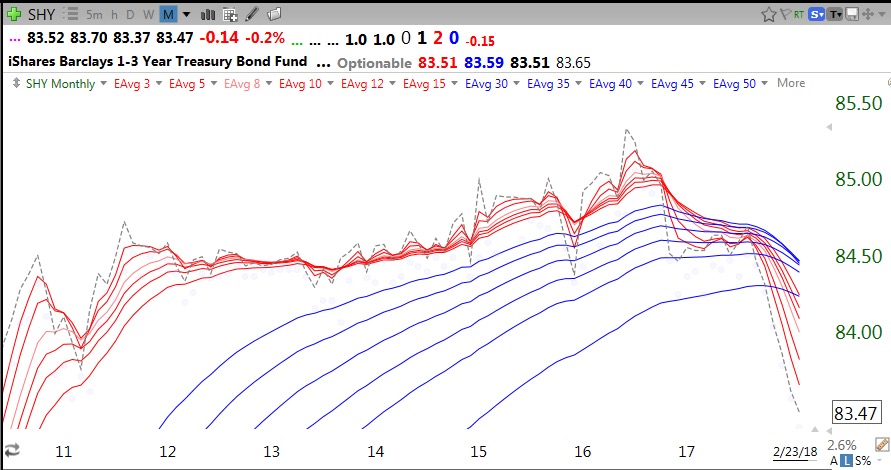

This chart zooms in on the recent past and shows the RWB pattern actually lasted until mid 2016 and now SHY is entering an ominous BWR decline (see glossary) for the first time since at least 2003 (as far back as I have data). Given that this is a monthly chart, it suggests to me that this trend could persist for months if not years.

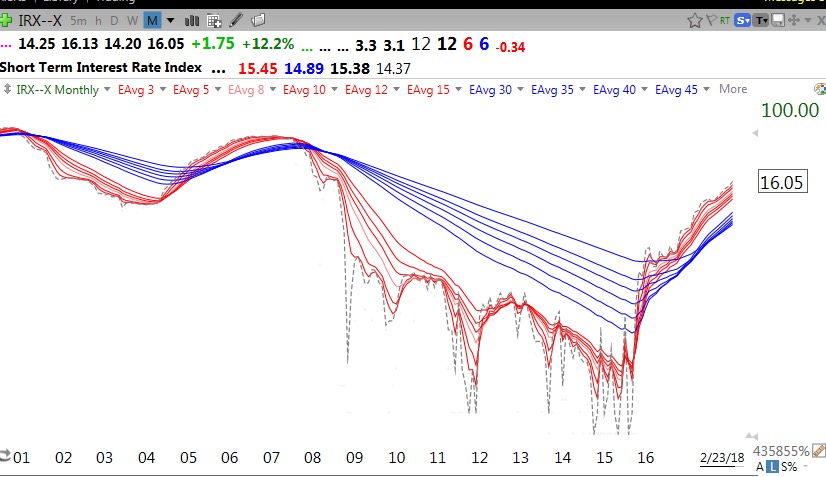

Rather than looking at bonds to discern rates, TC2000 also offers a chart of the short term interest rates themselves. This monthly RWB chart shows the Fed reducing rates after the collapse of the internet bubble in 2000, then raising them again until the 2007 housing related crisis when they lowered them tremendously through 2015. Now look at how rates have been rising so much that they now form a steep RWB up-trend.

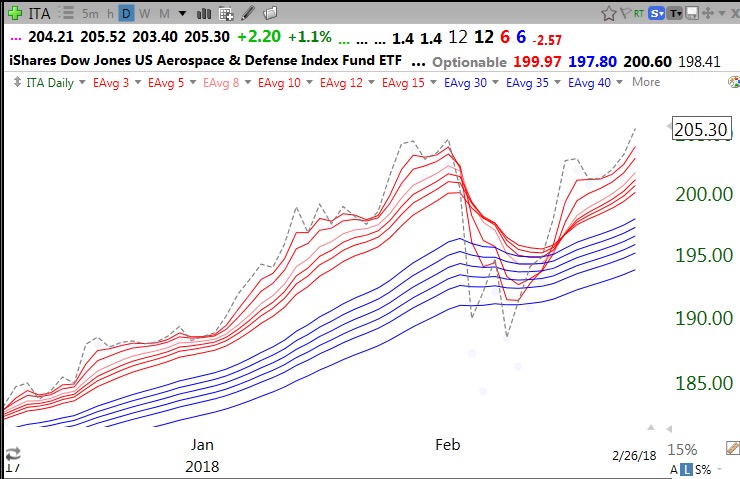

If we are indeed entering a period of a persistent decline in short term bonds and a rise in interest rates, the market may be forming a long term top. The lure of higher rates will eventually suck money out of relatively more risky stocks, especially by anxious boomers nearing retirement. With that in mind, I am willing to own some stocks but am keeping one foot out the door so that I will be ready to exit quickly if my market technical indicators should weaken…..

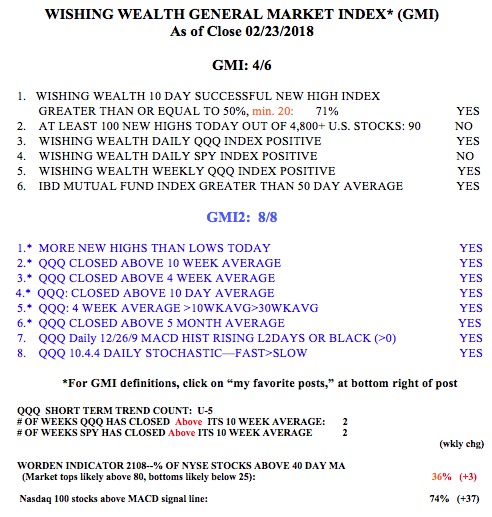

Meanwhile the market indexes are currently rebounding, as shown by the GMI being Green and the SPY and QQQ having closed above their 10 week averages for the 2nd week in a row. Note, however, the paucity of new highs among US stocks on Friday (90). Prior to January 29, there were more than 200 new highs each day.