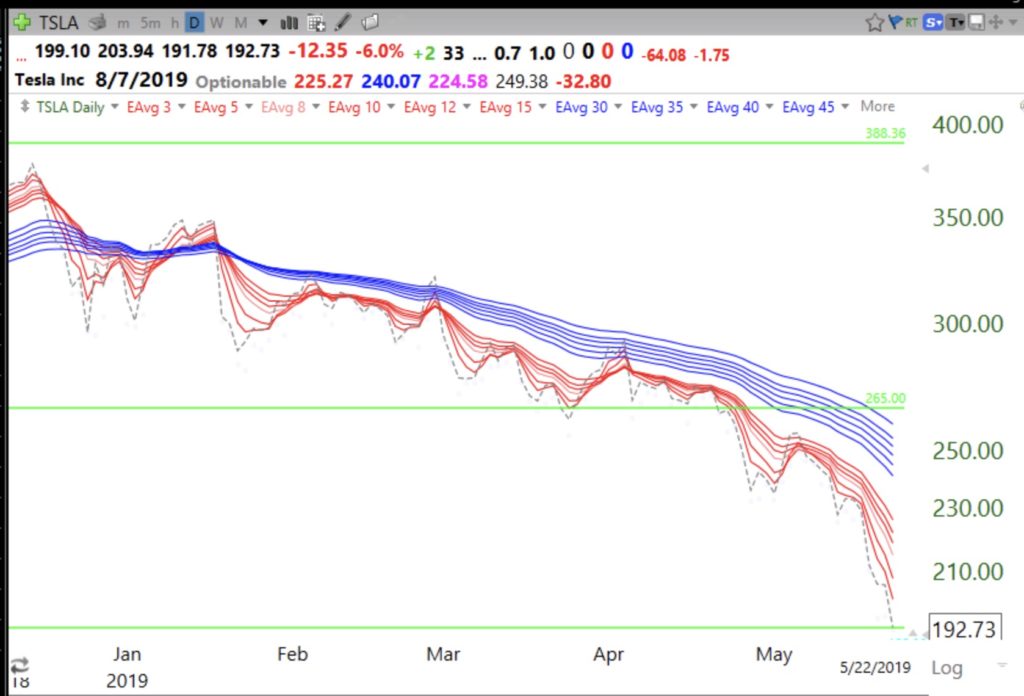

A good example of this is TSLA, which lost its RWB up-trend pattern early last December, around $347. It later entered a BWR down-trend that has continued through today, now around $192. I only buy/hold stocks in RWB up-trends (all red lines above the rising blue lines with a white space between them).

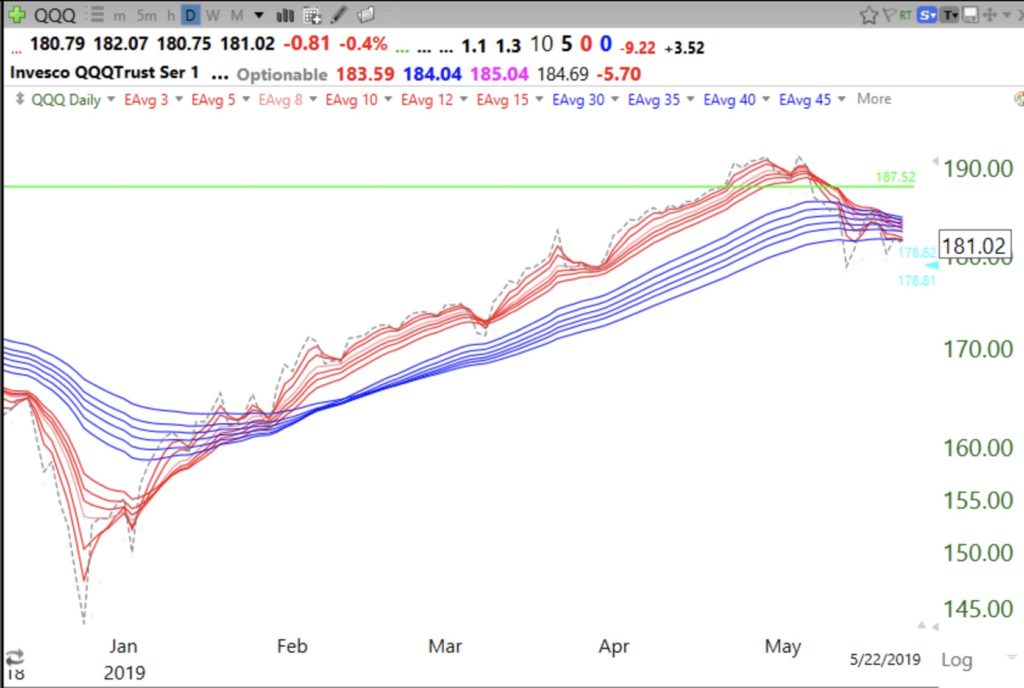

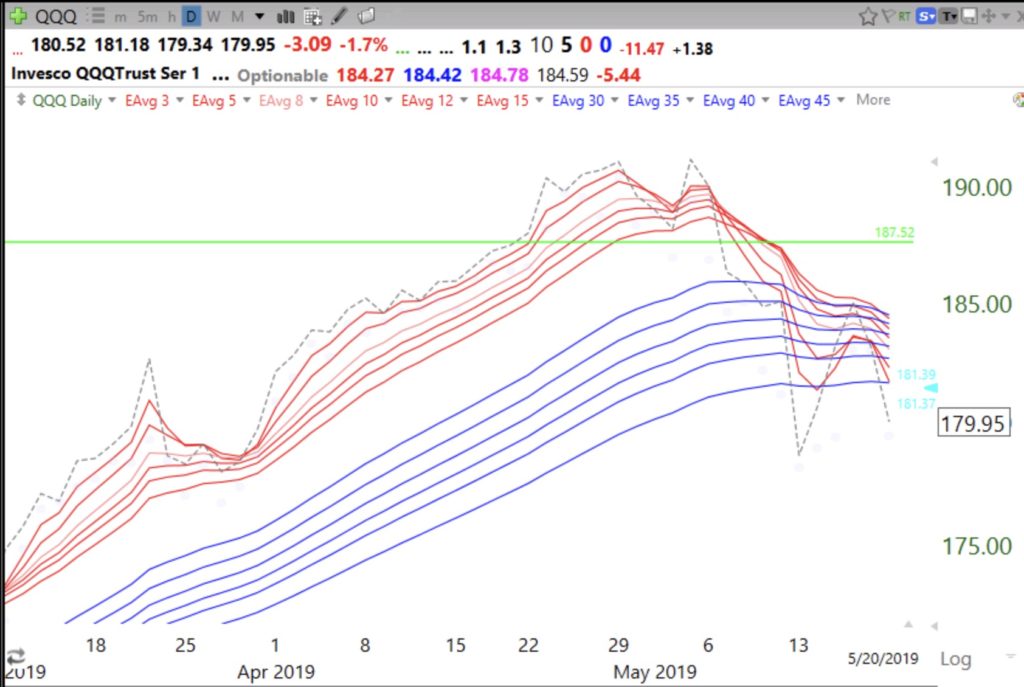

By the way, QQQ has lost its daily RWB up-trend. Will it enter a BWR down-trend?

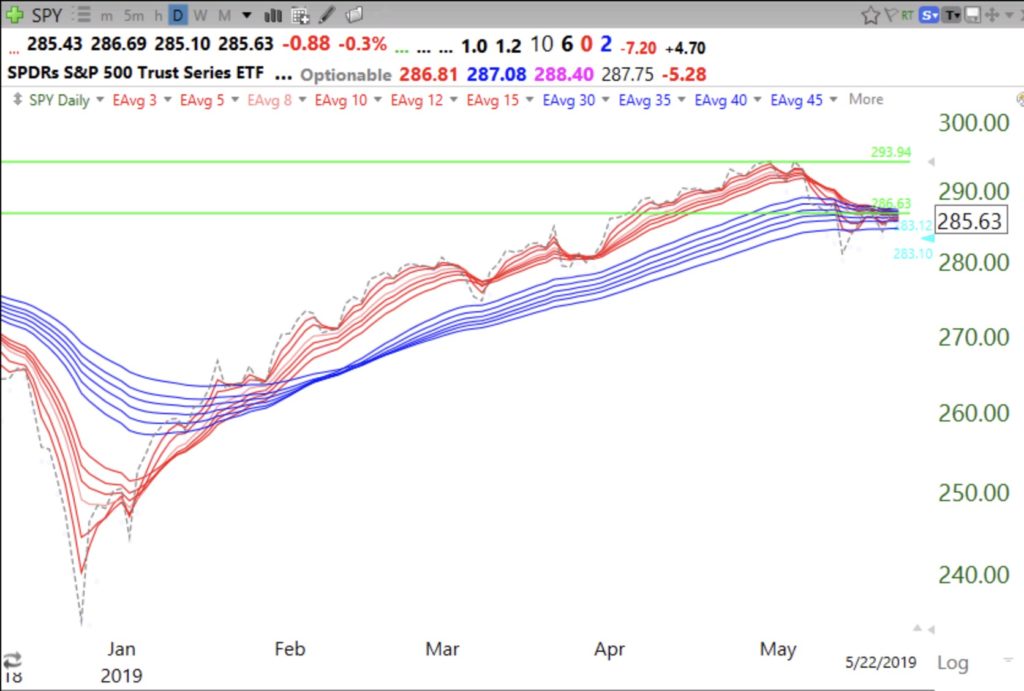

SPY has a similar pattern.