Dr. Wish

Dr. Wish

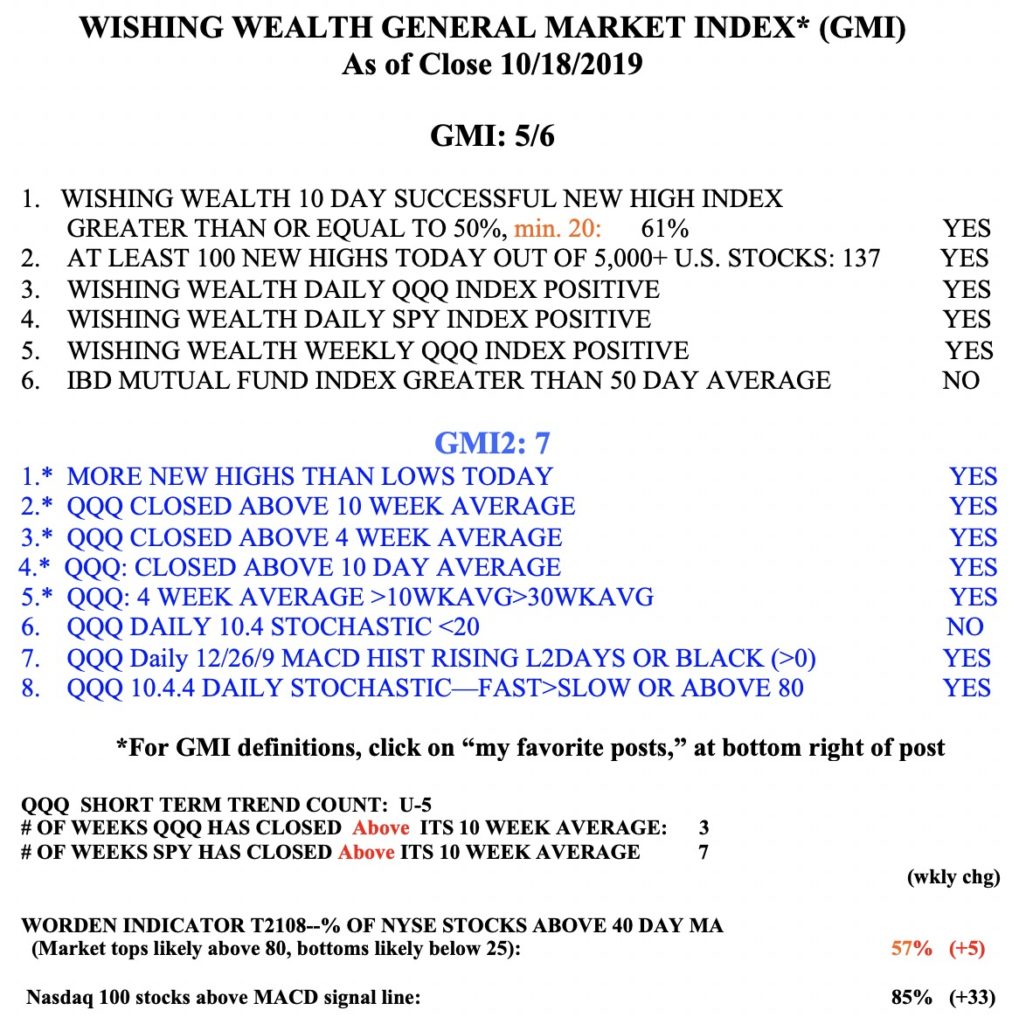

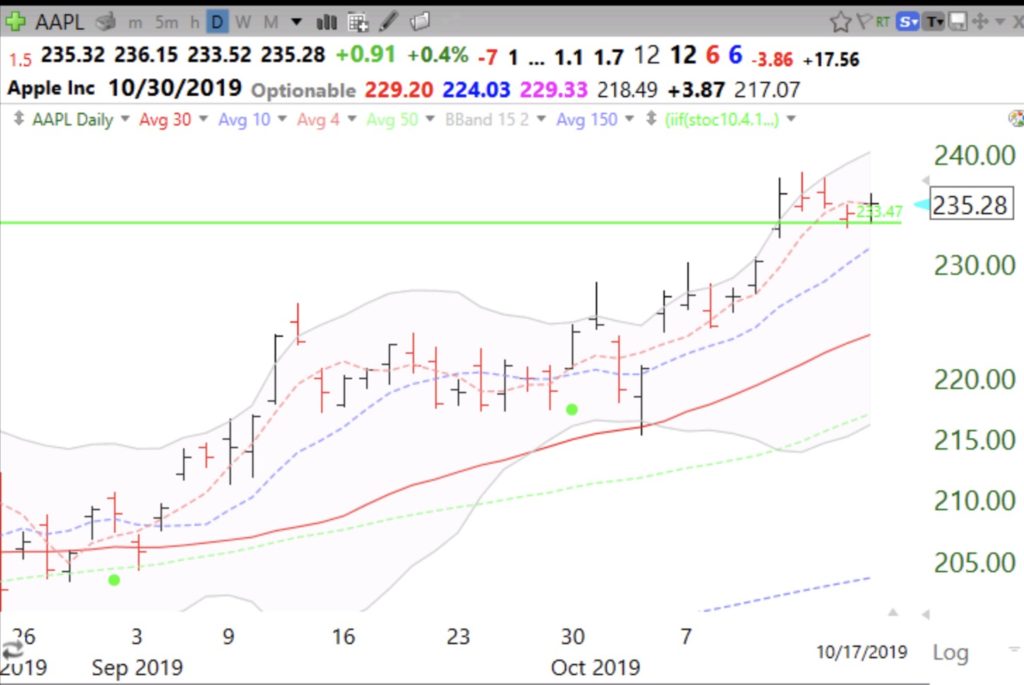

Catch my TASC magazine interview; 4th day of $QQQ short term up-trend; $AAPL finding support at green line

In a few days, the November issue of the magazine Technical Analysis of Stocks and Commodities will publish a long interview with me about my trading roots, strategies, and the college courses I teach. I hope you find it useful.

AAPL finds support at its green line break-out (GLB).