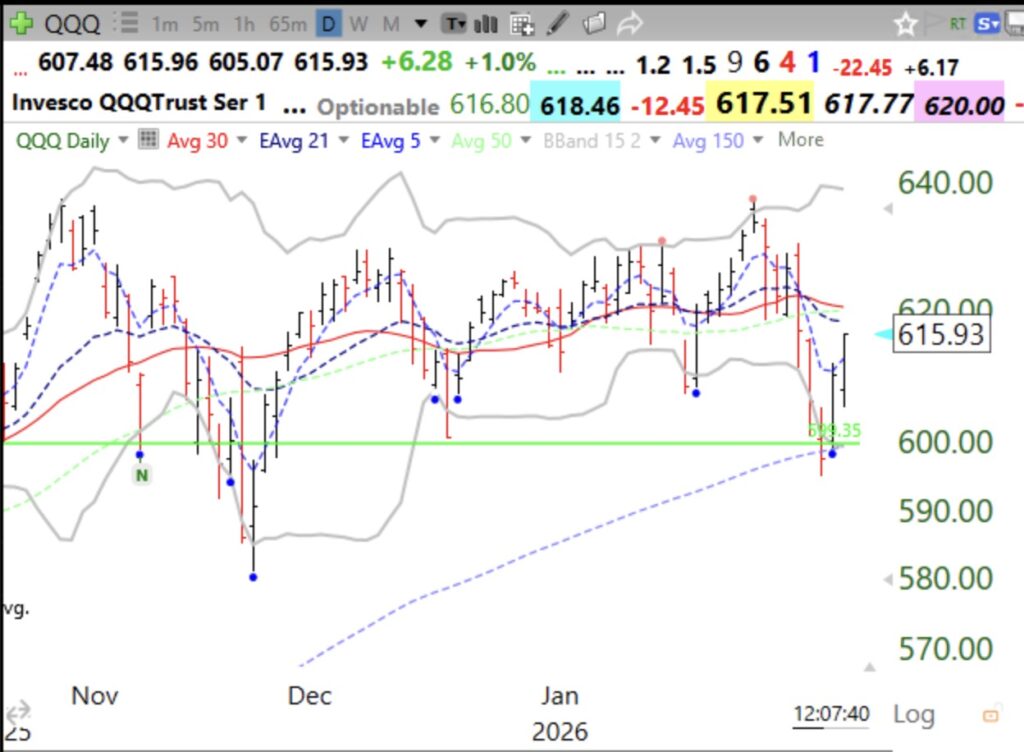

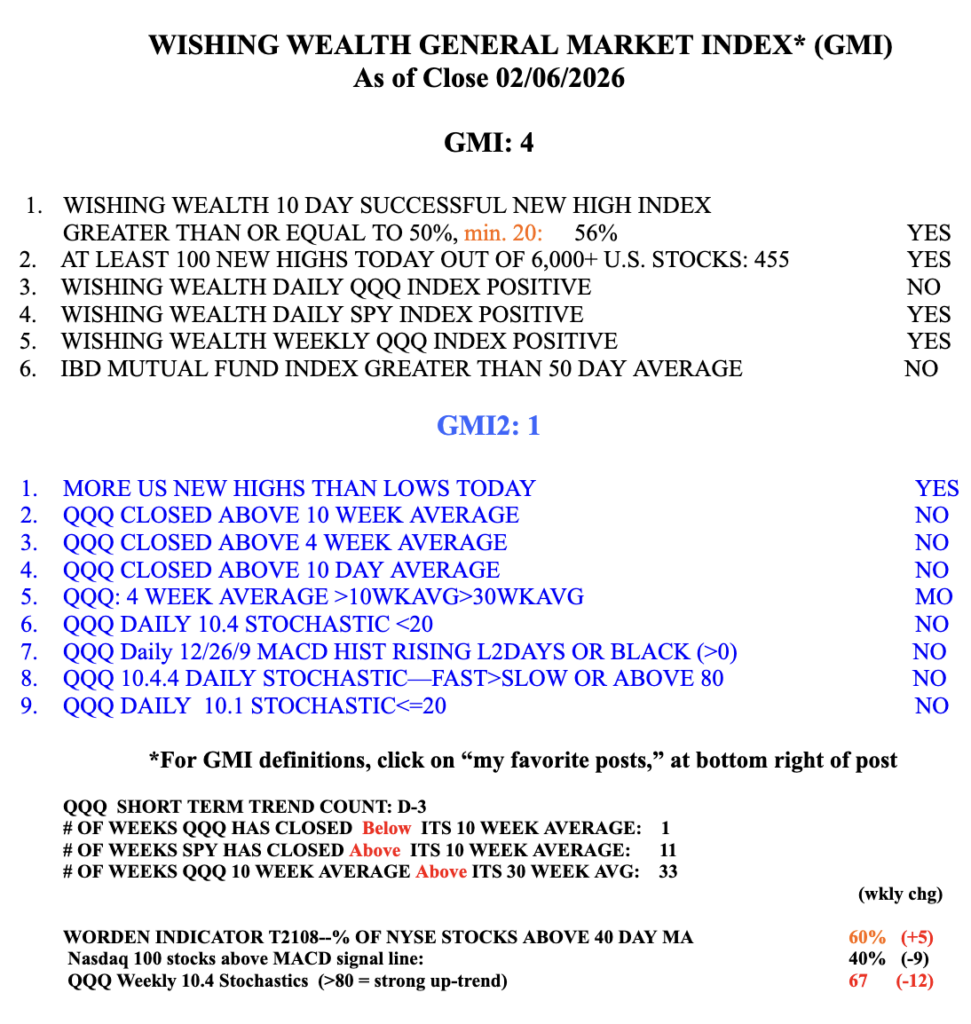

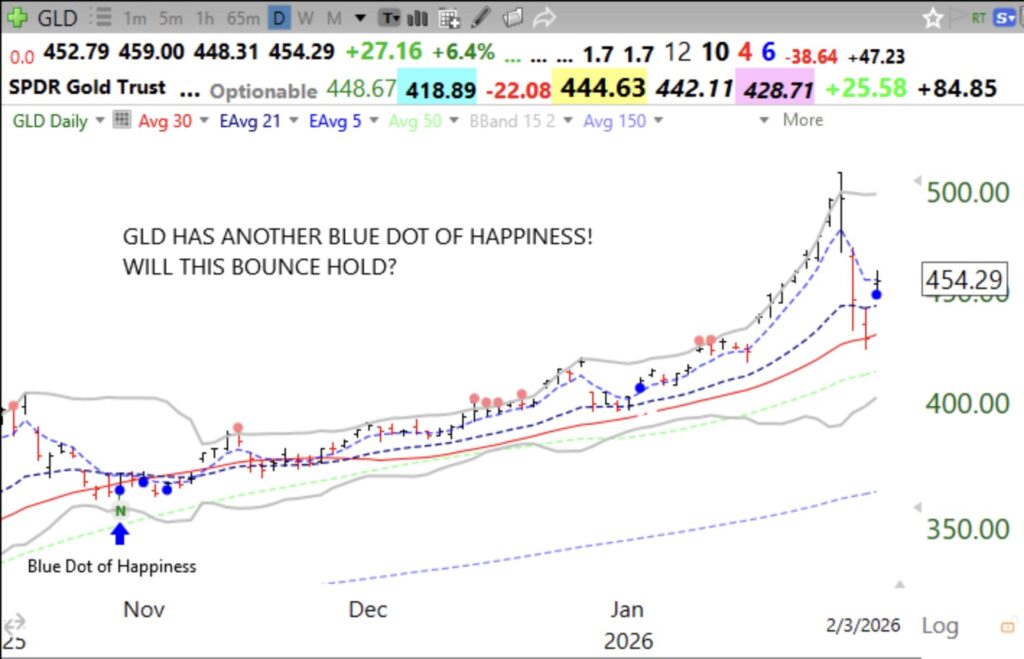

It is possible that the prior winners have gone to extremes and that other stocks are having their day before the entire market drops? Best for me to own little, have close stops and wait for Mr. Market to reveal his intentions. The gold and silver and mineral stocks are bouncing from oversold. Will they retake their ATHs? Note the Blue Dot of Happiness, oversold bounce, on Friday on QQQ. Resistance is at the 2.15 upper Bollinger Band.