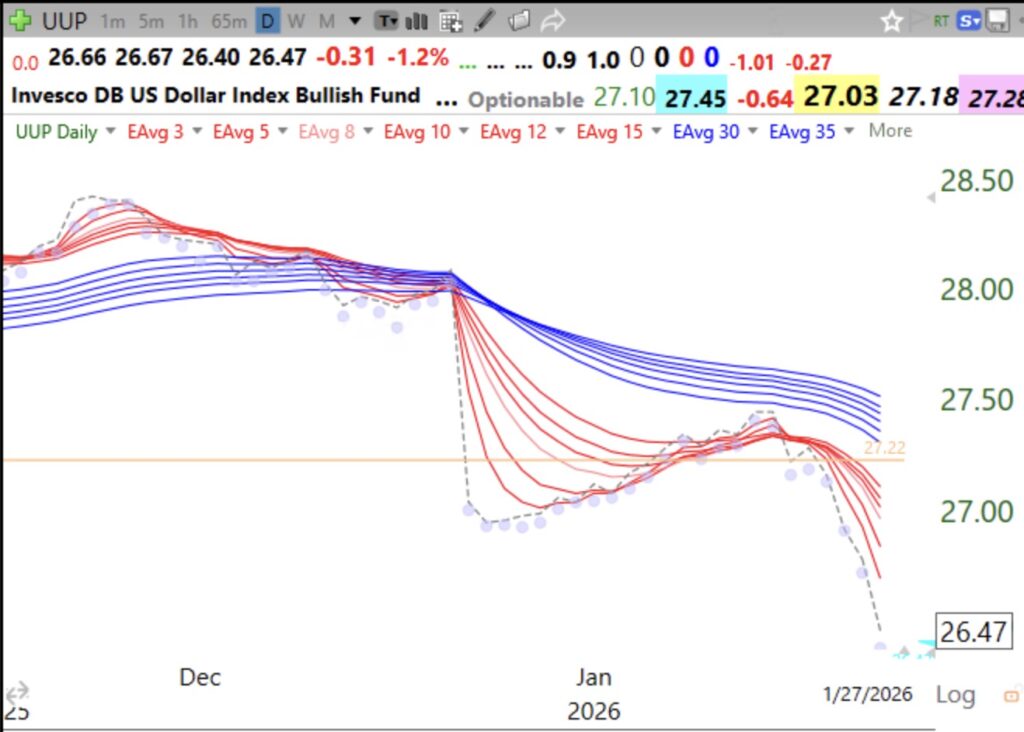

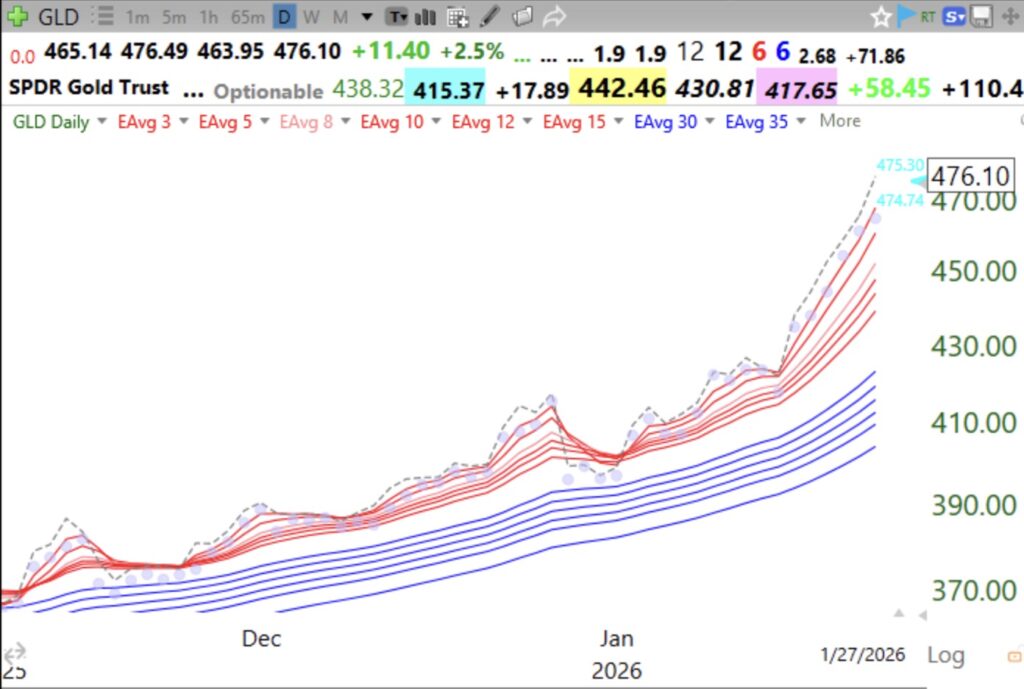

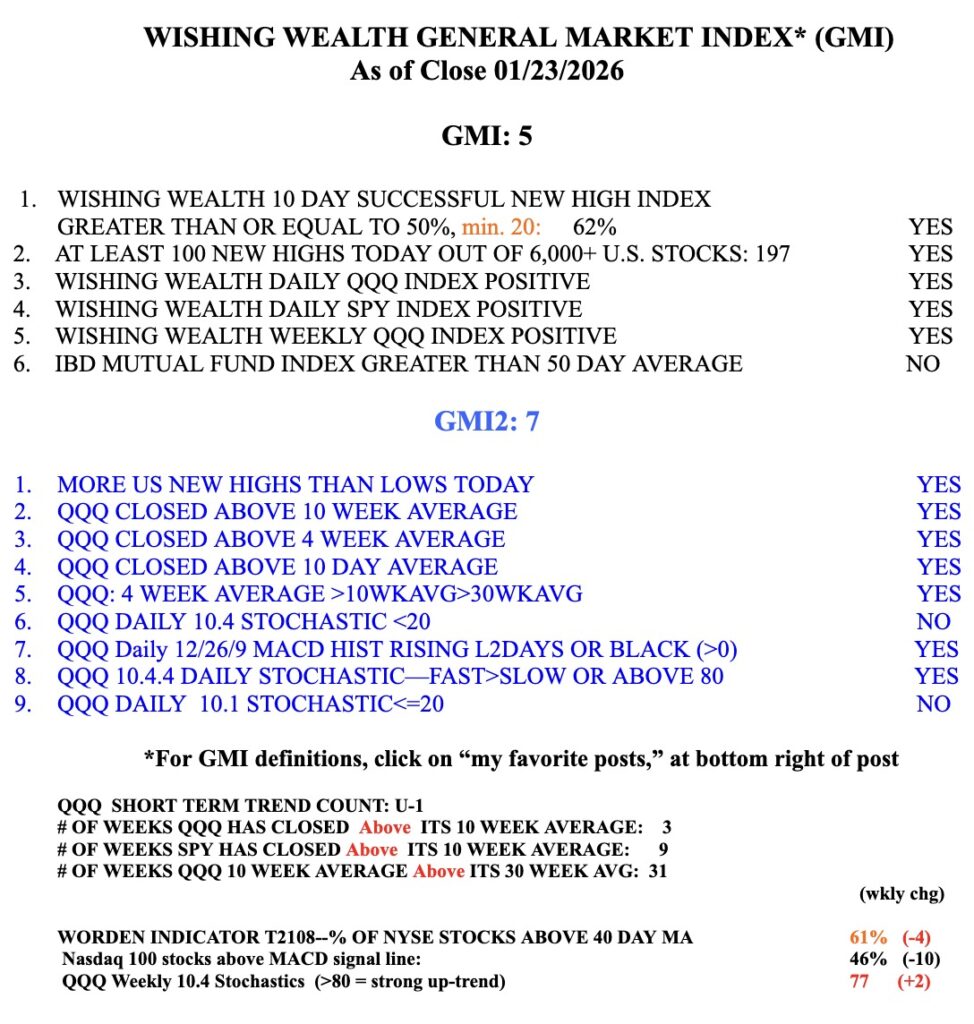

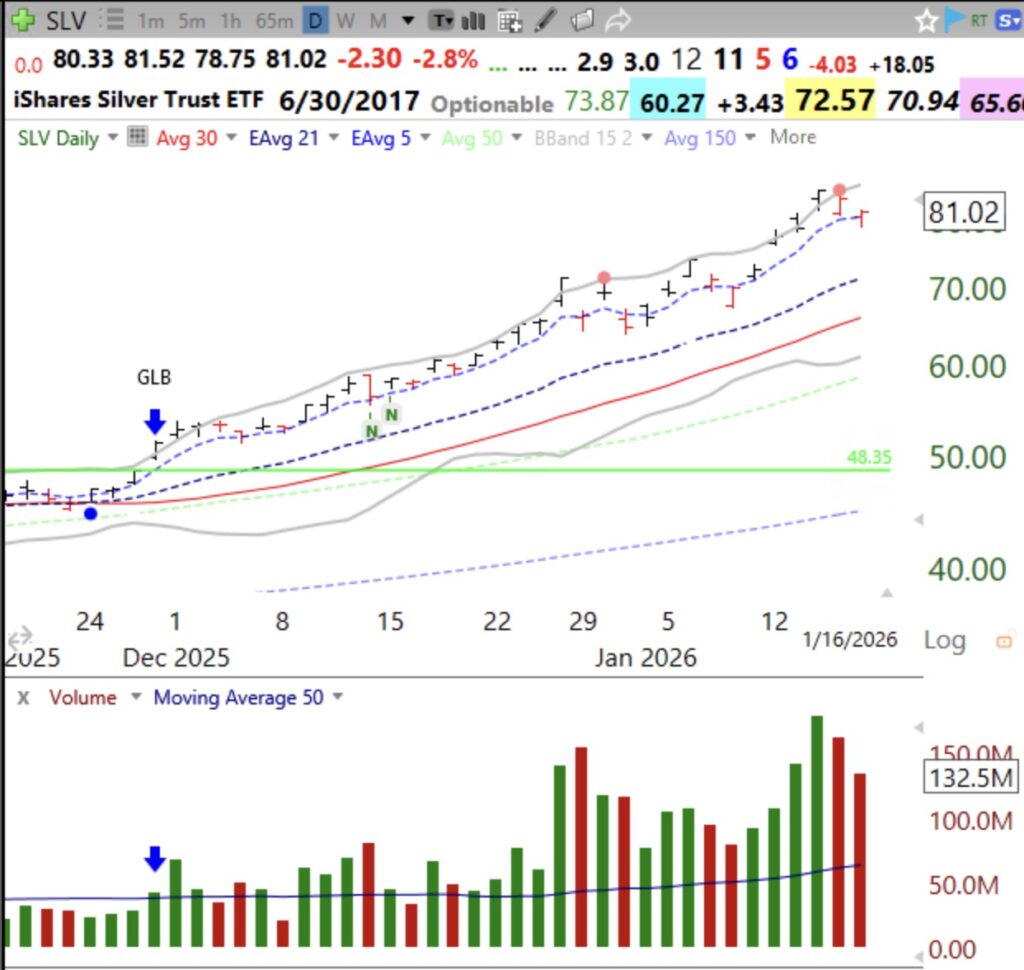

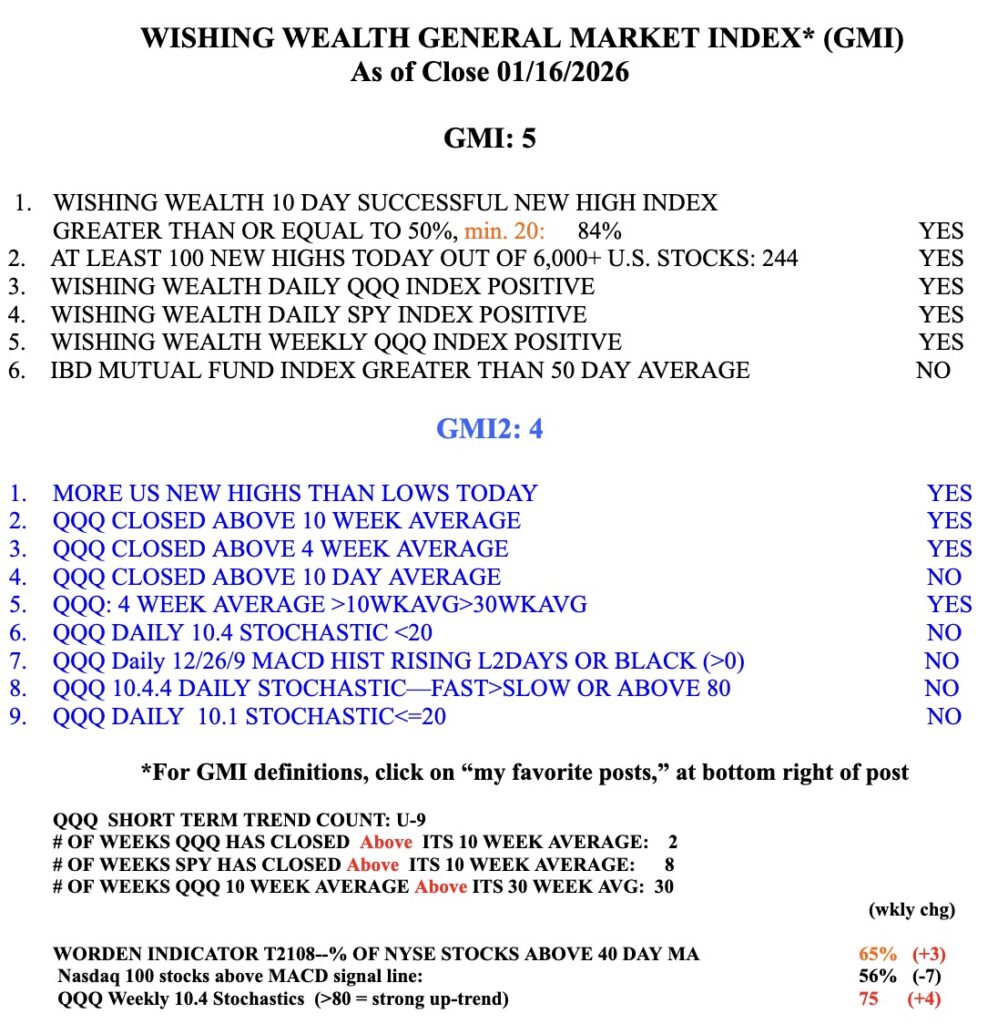

Perhaps the Fed is going to lower rates again. The dollar is acting like rates are coming down. When interest rates fall, people sell dollars and buy gold. I am slowly buying some TQQQ as the QQQ short term up-trend has now lasted 3 days. I am much more confident of a new up-trend, however, when it reaches Day 5. Buying TQQQ during a new short term up-trend is difficult because I question whether the recent down-trend is really over. So I buy a little and hold my breath, ever ready to exit or add more.