Dr. Wish

Dr. Wish

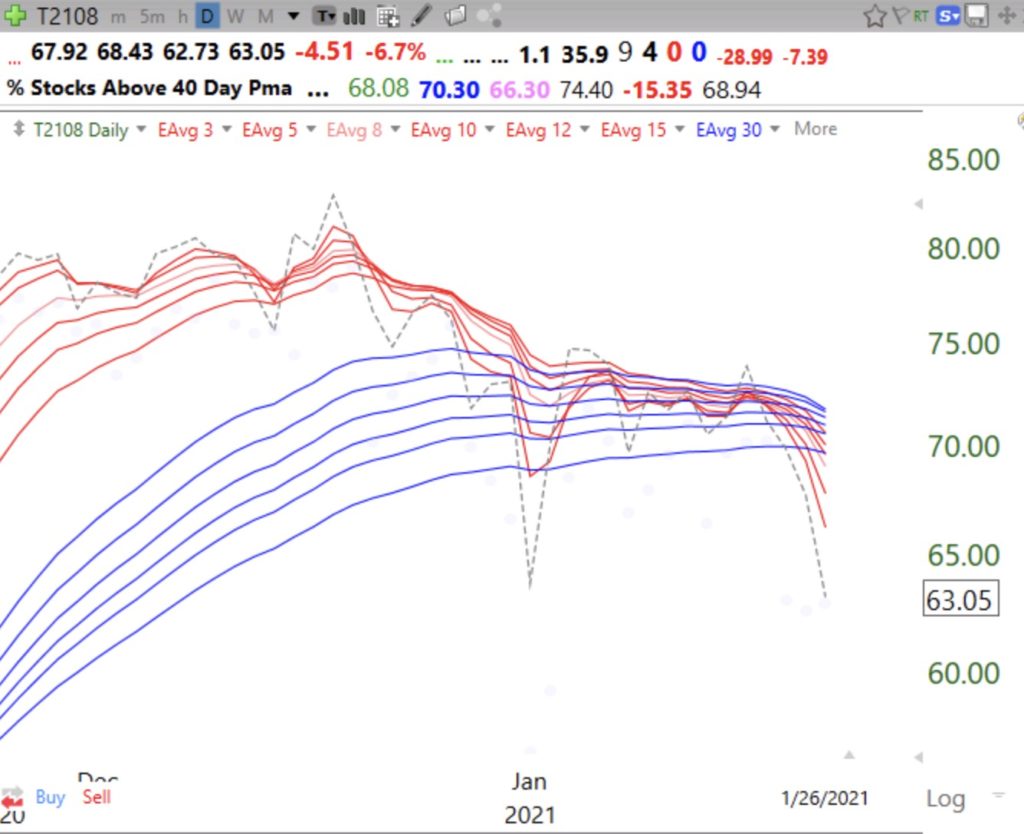

$GME had a high volume GLB last Friday and went on to skyrocket +434%, in 3 days–$T2108 falling, beware

No, I did not buy GME. I missed it. It was not on any of my growth stock watchlists that I monitor. But I think this crowd sourced manipulation will hurt the market. As the hedge funds have to buy back their shorts at much higher prices they will have to raise funds by selling their stronger long holdings, the types of growth stocks that most of us own and trade. Note that T2108, the % of NYSE stocks above their 40 day moving average has cratered to 46%. Beware….

When consummate traders David Ryan @dryan310 and Mark Minervini @markminervini see market weakness ahead I get very defensive

These men called the last market weakness. David Ryan is William O’Neil’s protege and all should know about Mark’s success trading. I follow their tweets closely. I moved to cash in my trading account yesterday after I saw their tweets and the many people boasting of their trading profits in social media, including my former students. Some of my holdings also broke critical support levels. Be careful. Making money in the market is usually a very difficult and tricky endeavor. Note the weakening T2108 too.