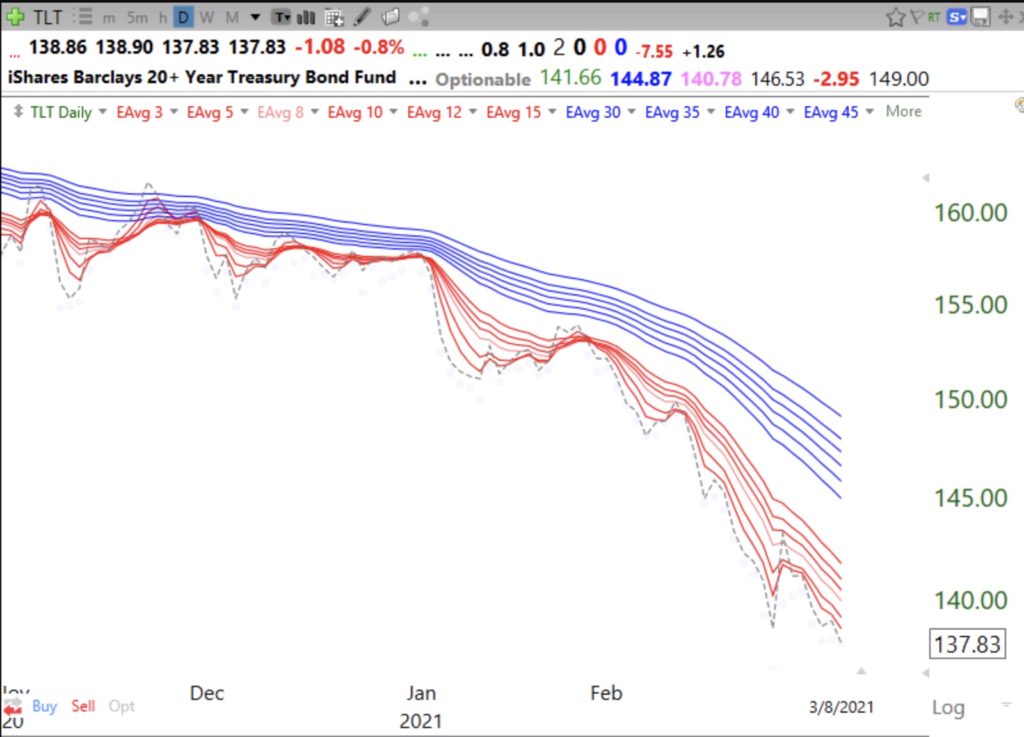

This week the GMI flashed a Red signal, when it had two consecutive daily readings below 3. The start of the QQQ short term down-trend on February 23rd had already alerted me to exit the long side in my IRA trading account. When the GMI turned Red, I also transferred some other pension money out of stocks. No one knows how the market will react to the COVID stimulus bill and the likely associated rise in interest rates. I do know if rates continue higher it will suck money out of riskier stocks and into less volatile interest bearing securities. One thing that seems for sure to me is expected upward pressure on commodity prices as the world economies recover and focus on rebuilding infrastructure. I therefore hold a small position in the commodity ETF, DBC, shown below. Note from this weekly chart that DBC has advanced each of the past six weeks. Note also the unusual trading volume last week as it had a weekly green bar (WGB) signal. I would sell if it traded below last week’s low of $16.51. Moving stops up to the low of each subsequent WGB can be a profitable strategy. DBC is in a Weinstein Stage II up-trend, above its rising 30 week average (solid red line) since October.

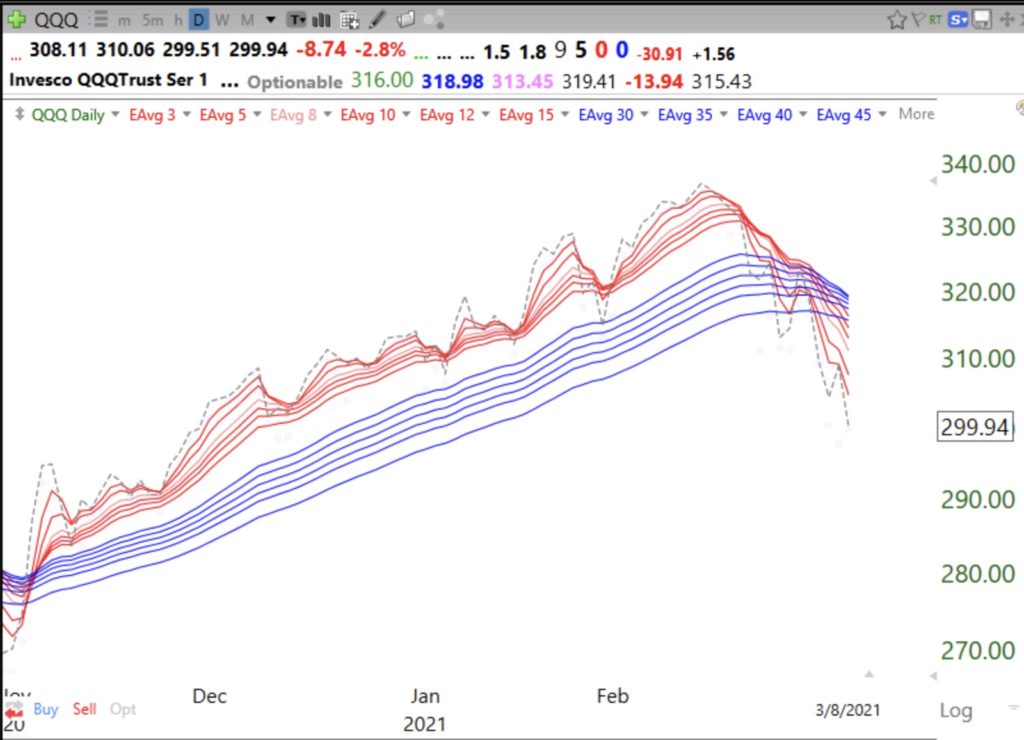

In contrast, the high volume break-down in QQQ is troubling. If QQQ does not hold its 30 week average, it could enter a major decline.

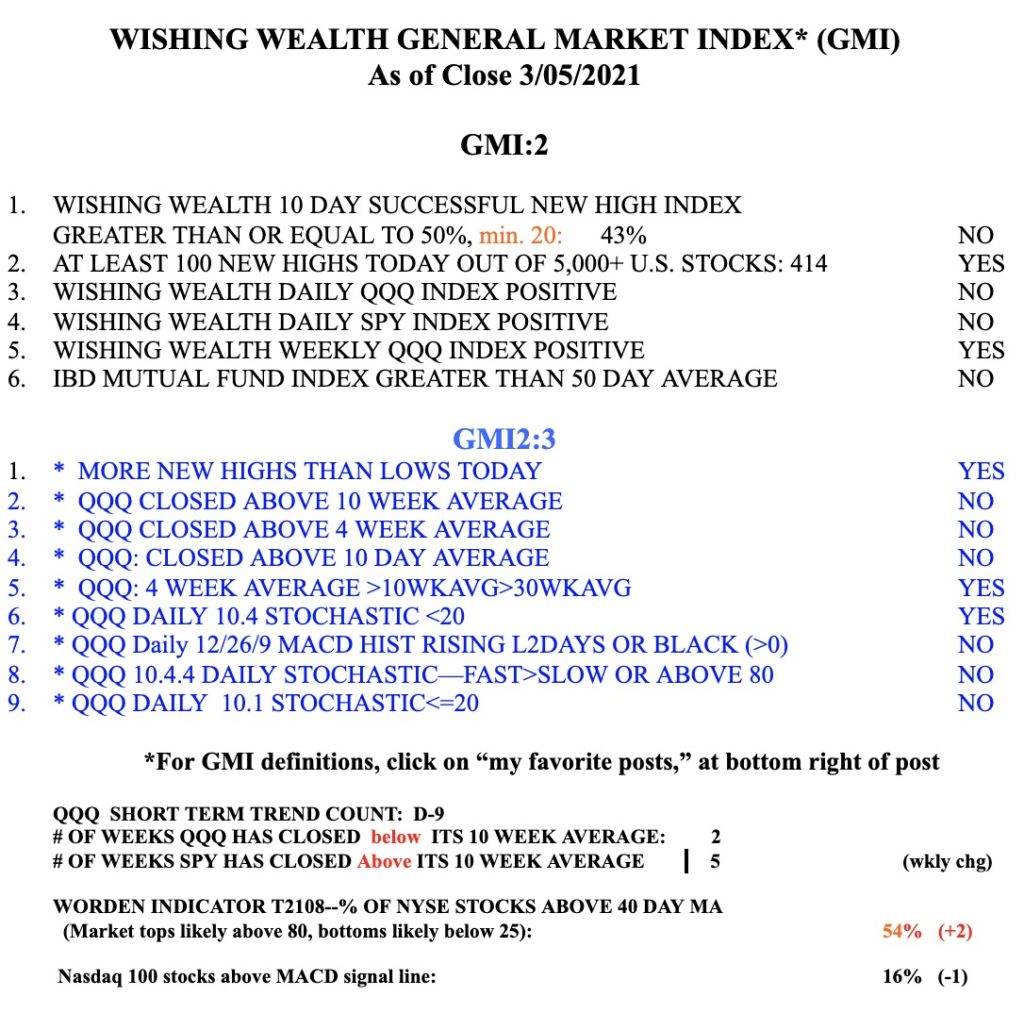

The GMI has kept me on the right side of the market for years. However, it is heavily focused on QQQ which is weak as other types of stocks remain strong. The question remains which index will prove to be the leader.